Selling insurance requires fast follow-ups, clear communication, and a smooth client experience – yet most insurance agents still juggle leads, quotes, renewals, and claims across multiple disconnected tools.

This slows you down, causes missed opportunities, and makes retention harder than it should be.

GoHighLevel for Insurance Agents helps you simplify everything.

You get one platform to:

- manage leads

- deliver quotes

- automate follow-ups

- book consultations

- send renewal reminders

- track policies

- and keep clients updated

……without switching between apps all day.

Whether you sell:

- life

- auto

- home

- health

- or commercial insurance

GoHighLevel gives you the systems you need to work faster, close more policies, and build stronger relationships with your clients.

This guide walks you step-by-step through how to use GoHighLevel as an insurance agent so you attract better leads, follow up consistently, and deliver a professional experience that earns trust.

TL;DR: How GoHighLevel Transforms Your Insurance Agent Business

- GoHighLevel helps you manage leads, quotes, policyholders, renewals, and claims in one organized CRM.

- You can automate follow-ups, appointment scheduling, and renewal reminders to boost conversions and retention.

- Funnels, email/SMS campaigns, and nurture sequences help you attract new clients and build trust quickly.

- This guide shows you exactly how to set up and use GoHighLevel to streamline your insurance workflow and improve client satisfaction.

How to Set Up GoHighLevel for Insurance Agents – (Step by Step Tutorial)

Let’s get straight to the point – first, we’ll set up your account, then I’ll walk you through all the strategies you can use.

This is how to set it up:

Step 1: Create HighLevel Account for 30 Days Free

Since you’re just starting with GoHighLevel, you would need to properly set up your account.

And you can do that for free through our exclusive 30-Day Free Trial link here.

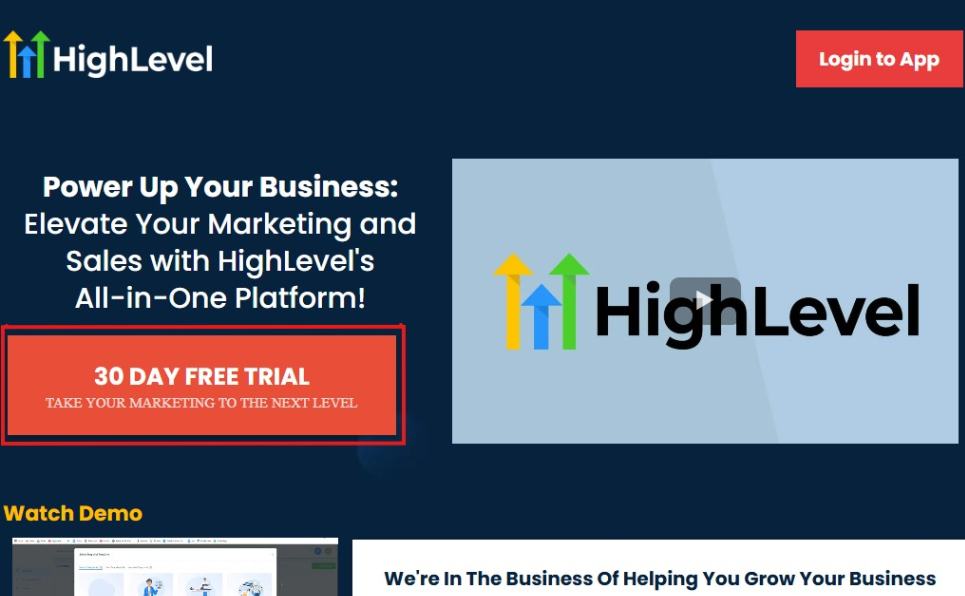

In order to start, head over to gohighlevel.com/30-day-free-tial free trial and click on “30 DAY FREE TRIAL” as you can see below.

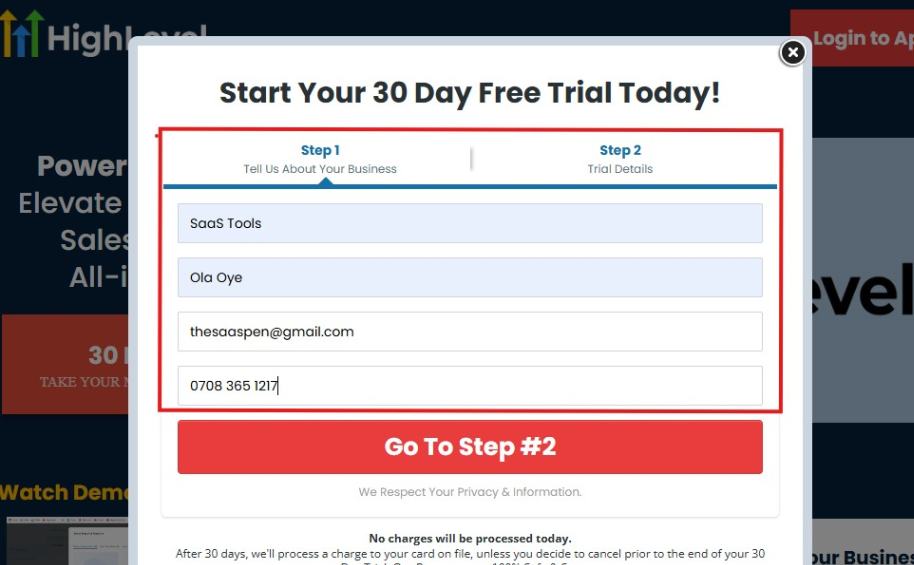

Upon clicking on “30 DAY FREE TRIAL“, a page will pop that looks exactly like the image below.

If you take a closer look at the image above, you will see that you need to supply your:

- Business name

- Company name

- Company email

- Phone number

Supply all the pieces of information and click on “Go To Step #2.”

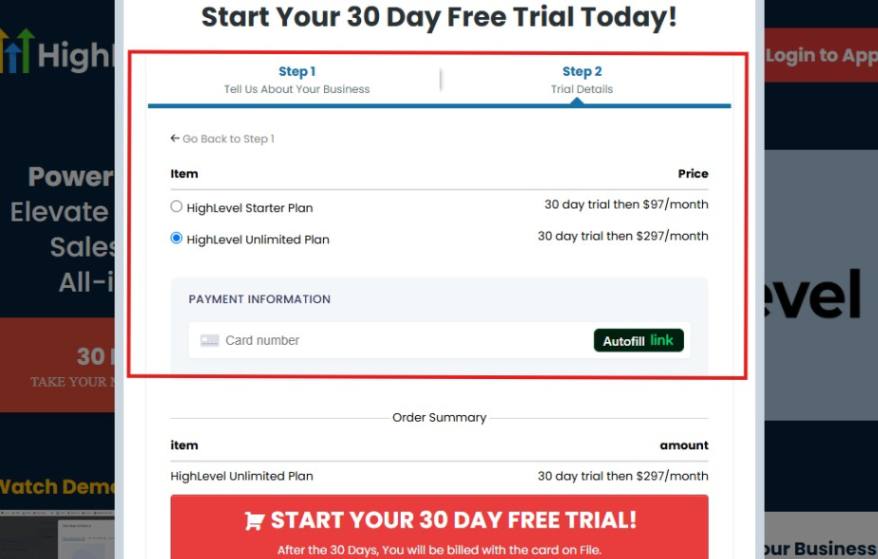

On the next page, you will be required to select the plan you want to opt in for.

As you can see from the image above, you can either choose from:

- HighLevel Starter Plan

- HighLevel Unlimited Plan

Select the HighLevel Unlimited Plan and continue – you can always upgrade to the SaaS Mode later if you want that or downgrade.

The next thing you want to do is supply your credit card information.

Note: You will not be debited anything today until the end of your trail that is if you don’t cancel. Keep in mind that $1 will be debited and refunded back instantly into your account just to test your card is working.

After you have supplied the information accordingly, click on “START YOUR 30 DAY FREE TRIAL” and you will be asked to confirm you’re not a robot.

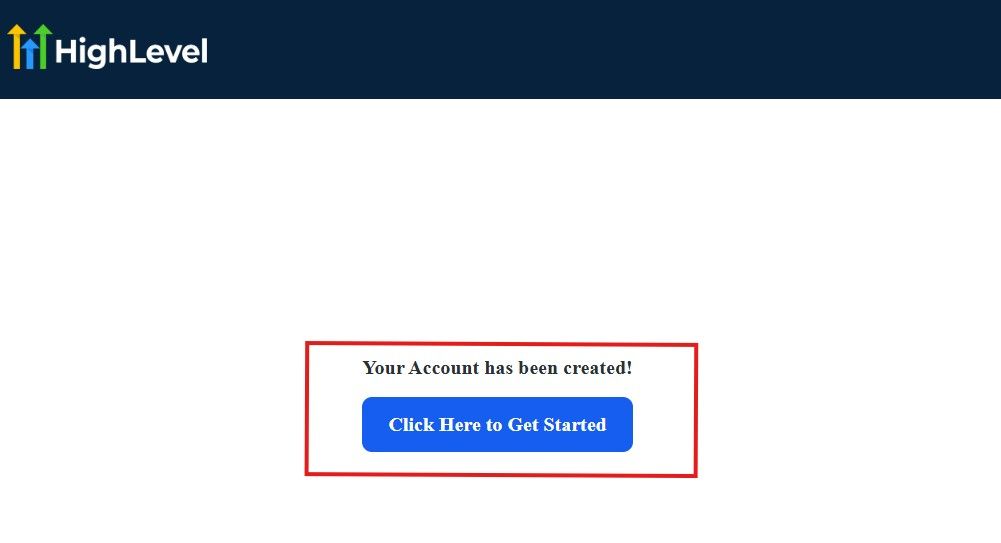

After that, the page below will pop up.

The image above says, “Your Account has been created!” Now, you need to click on the blue button that says “Click Here to Get Started.“

Click on the blue button to start your onboarding process.

Step 2: GoHighLevel Onboarding Process

The onboarding questions help GoHighLevel understand why you have signed up for the platform so that it can tailor your experience accordingly.

This is all you need to do:

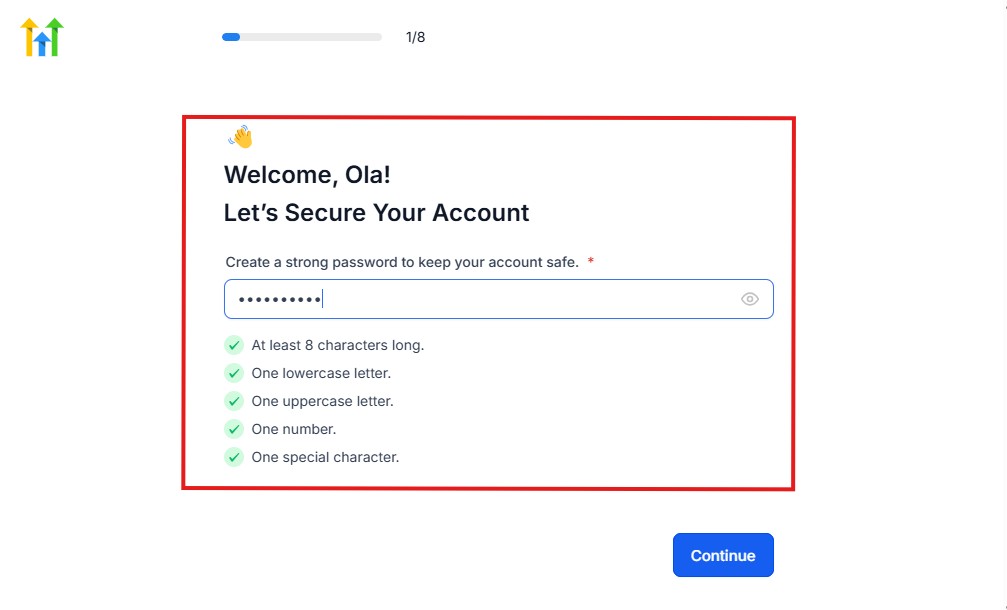

After you click on the blue button above, the page below will pop up.

As you can see above, you need to set up your password, and the password has to be:

- At least 8 characters long

- One lowercase letter

- One uppercase letter

- One number

- One special character

If you have input the password and it matches all the description above, everything will be green just the way it’s in the image.

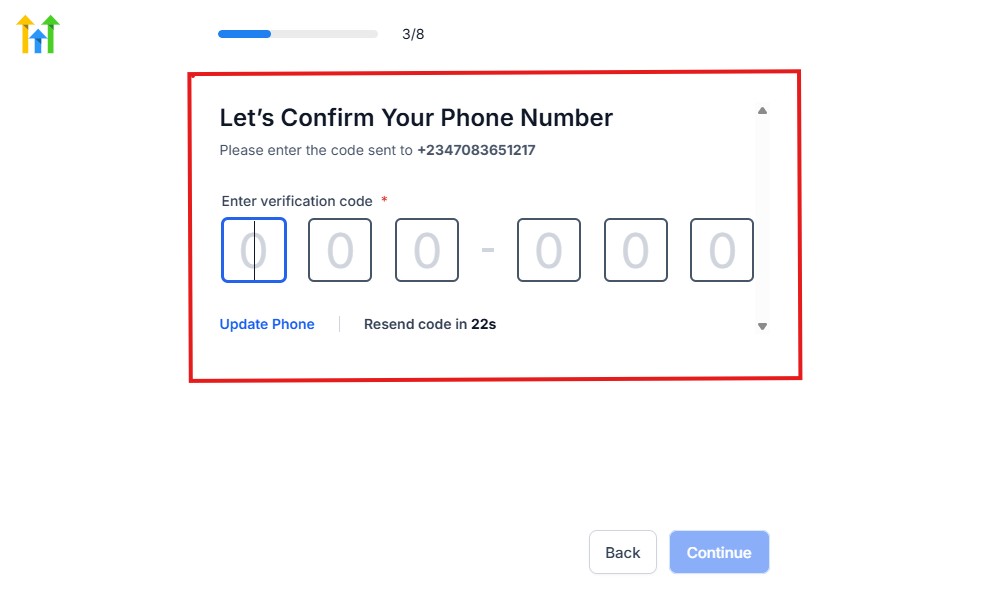

Click on “Continue” there after, and the image below will pop up.

As you can see, a code will be sent to you to confirm your email address and phone number. The process is the same for the 2.

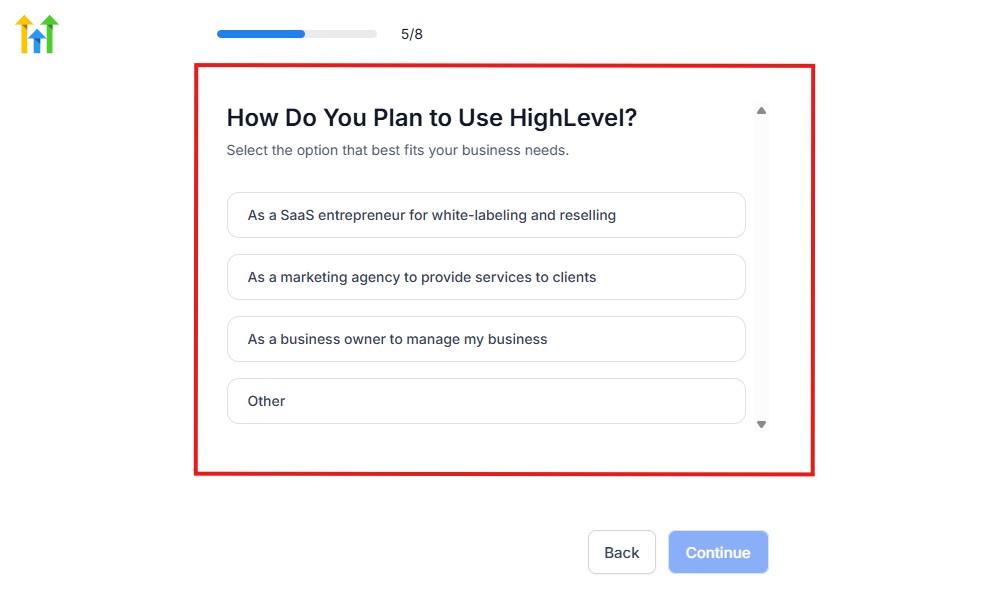

The next thing you need to do is to select how you plan to use GoHighLevel, as you can see below.

Select what best matches why you have signed up and click on Continue.

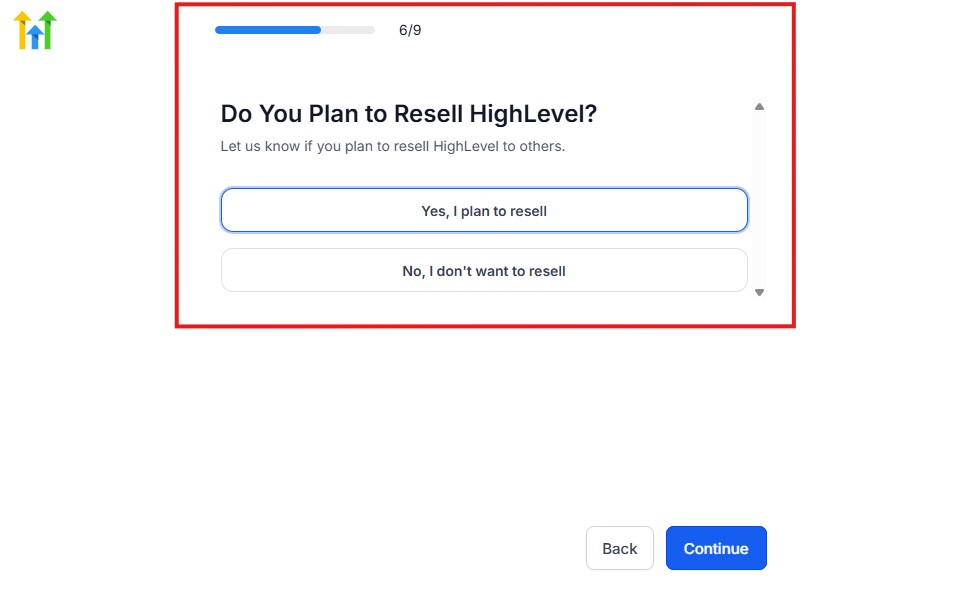

On the next page, you will be asked if you plan to resell GoHighLevel or not.

Select the answer based on the reason why you have signed up and click on “Continue”

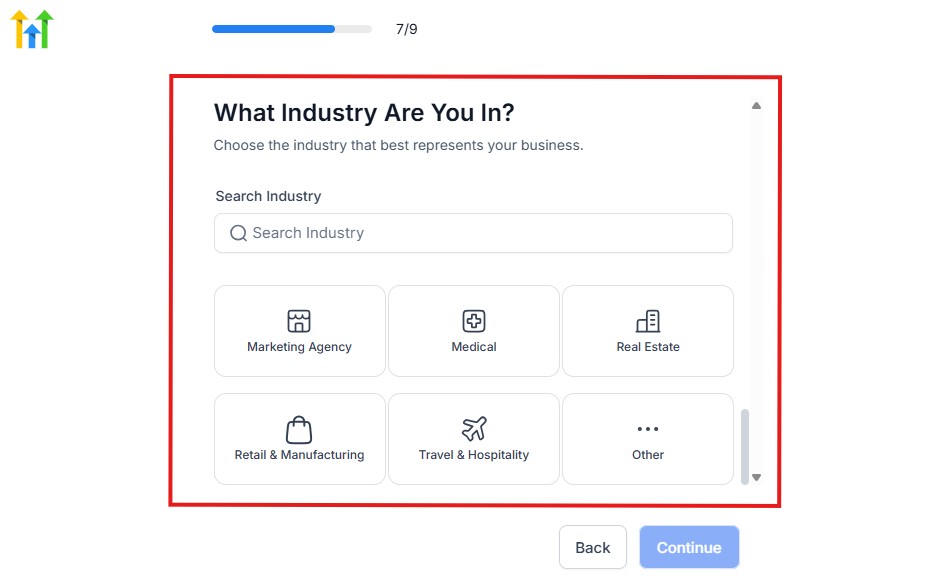

Then, the page below will pop up.

From the image above, you need to select the industry that you fall on. You can also make use of the search button if you can’t find it right away.

Then, click on continue after you select your industry.

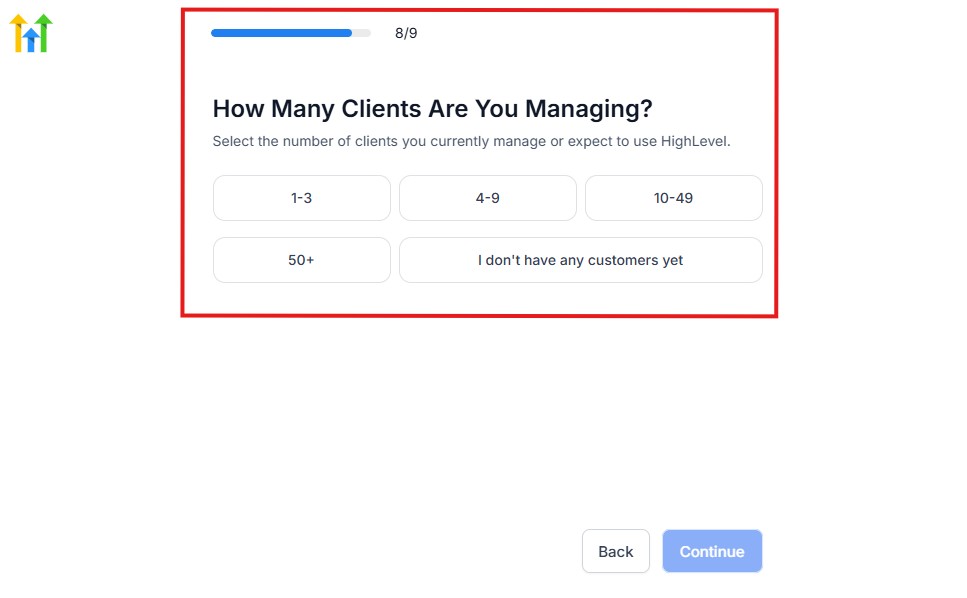

Then, the next thing you need to do is to select the number of clients that you currently have. Select “I don’t have any customers” yet if you currently don’t have one.

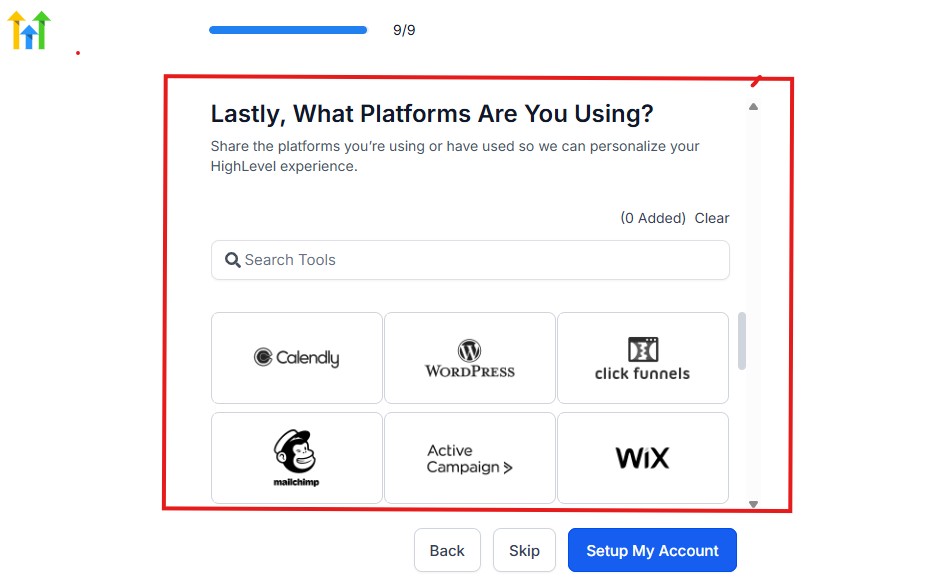

On the next page, you will be asked to select the platforms you currently use that you can integrate with GoHighLevel right away.

You can use the search button to search for any tools you want to add to your GoHighLevel account.

You can also skip this process and do it later if you want to.

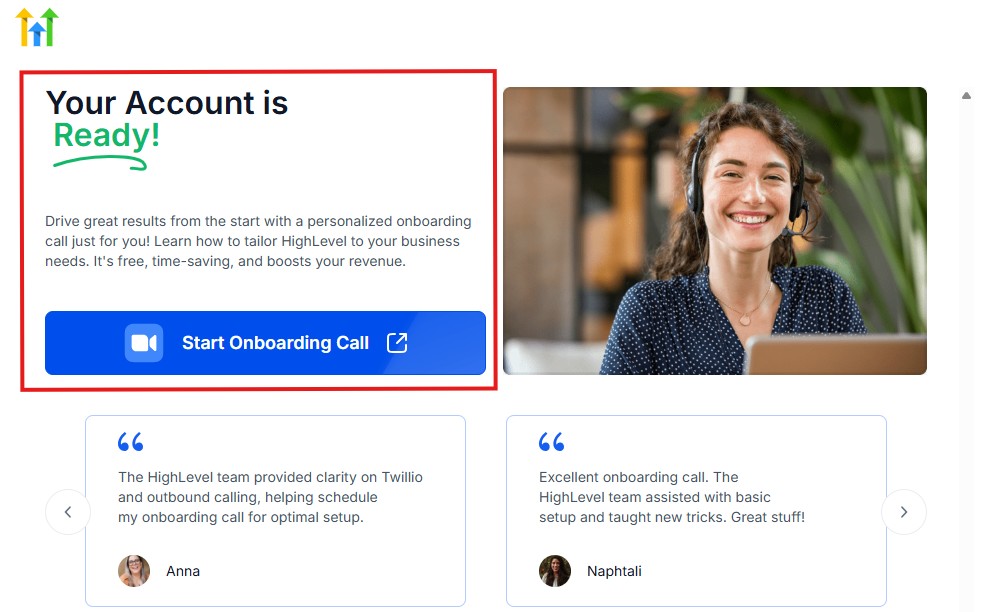

After that, the page below will pop up.

The page above says your account is ready and is asking you to “Start Onboarding Call.”

The “Onboarding Call” allows you to connect with the Go High Level team in order to discuss your account set-up process and everything regarding your plan in using HighLevel.

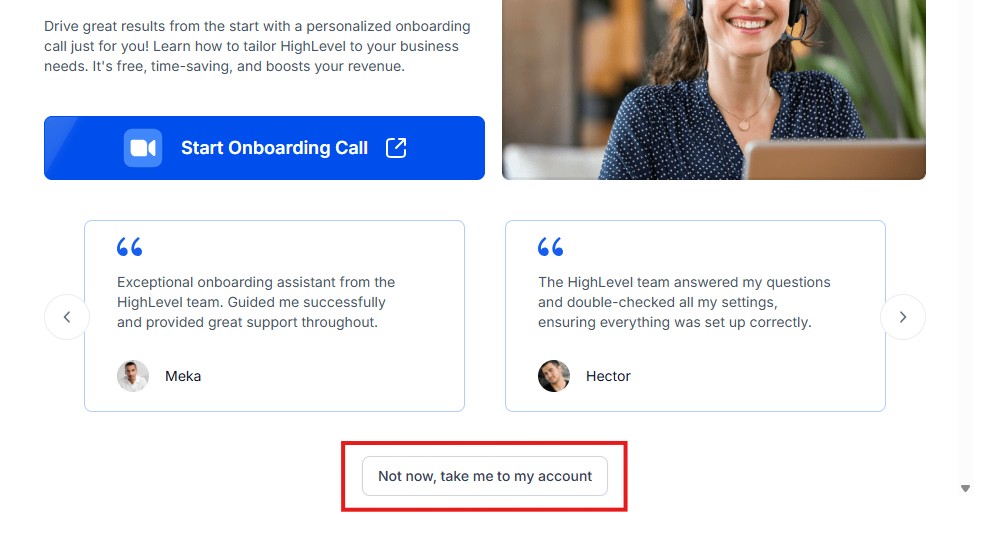

If you don’t want to start the “Onboarding Call” yet, just stroll down, and you will see the button in the image below.

Simply click on “Not now, take me to my account“, and you will have access to your dashboard.

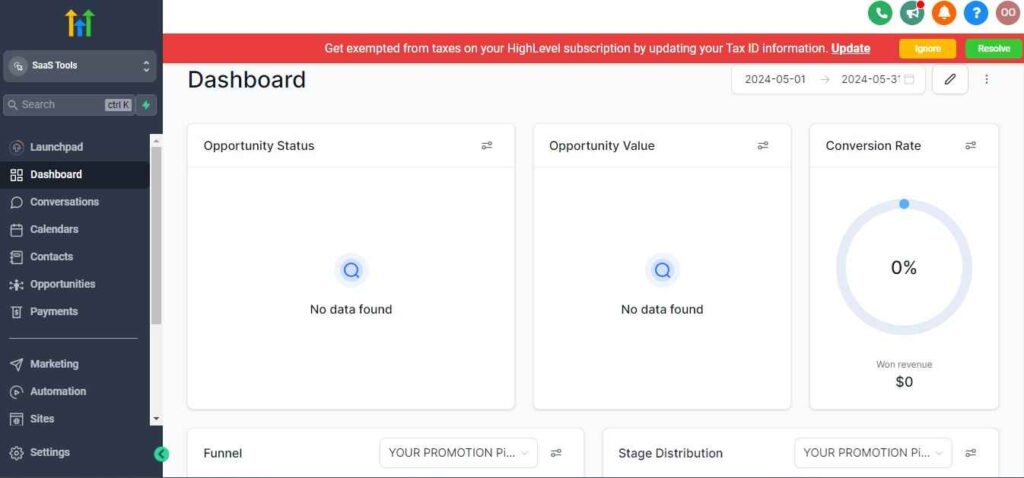

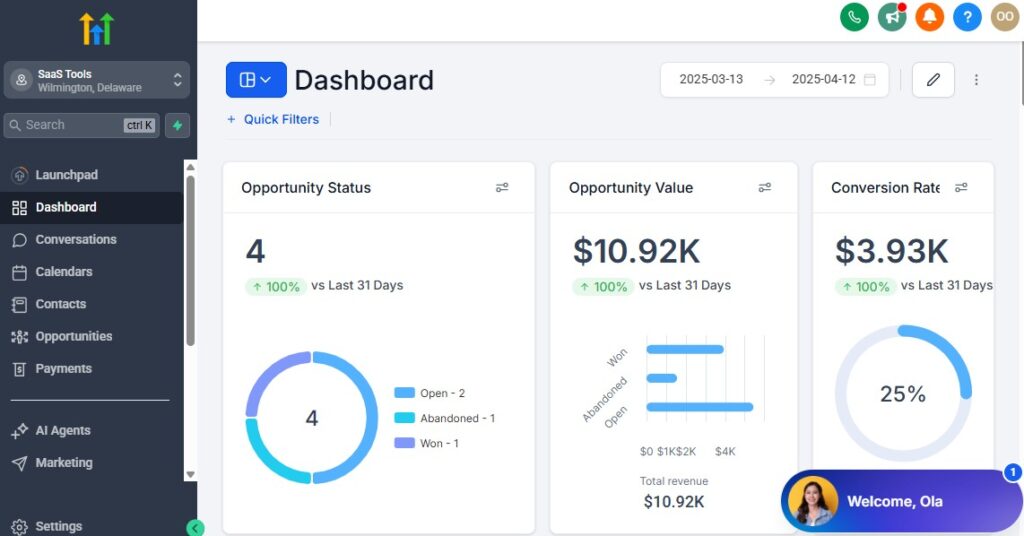

Note: If you have indicated that you want to resell HighLevel, you would have access to the agency dashboard by default, which looks like the image below.

But if you didn’t indicate interest in reselling GHL, your dashboard will look like the image below.

You can switch between these dashboards at any time.

The data you see on the dashboard above are not real data, they’re snapshots that you can use to kickstart your account setup process.

I want to say congratulations. You have successfully set up your Go High Level account.

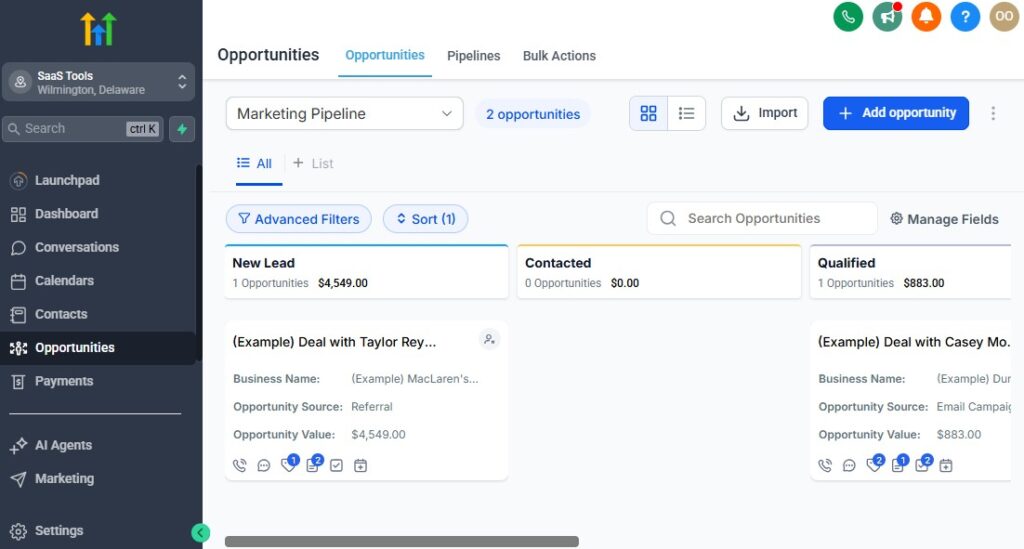

Step 3: Create Pipelines for Each Insurance Product You Sell

Different insurance lines have different sales cycles. Creating separate pipelines helps you stay organized, track quote statuses, and follow up consistently.

Recommended pipelines

- Auto Insurance Pipeline

- Home Insurance Pipeline

- Life Insurance Pipeline

- Health Insurance Pipeline

- Commercial/Business Insurance Pipeline

- Renewals & Retention Pipeline

How to set them up

Go to Opportunities → Pipelines → Create Pipeline

Add stages such as:

- New Lead

- Quote Requested

- Quote Sent

- Follow-Up Needed

- Pending Approval

- Policy Active

Save and assign each pipeline to the correct automation workflow

This keeps every lead and policy progress easy to track.

Step 4: Add Custom Fields for Insurance-Specific Data

Insurance requires detailed client information.

Use custom fields to keep everything organized and easily accessible.

Useful custom fields

- Policy Type (Auto, Life, Home, etc.)

- Coverage Amount

- Premium Amount

- Effective Date

- Renewal Date

- Carrier Name

- Claim Status

- Lead Source

How to create these

- Go to Settings → Custom Fields

- Choose field type (text, date, dropdown, etc.)

- Add fields like “Renewal Date” or “Policy Type”

- Assign them to forms, funnels, or workflows

These fields help you personalize communication and automate renewal reminders.

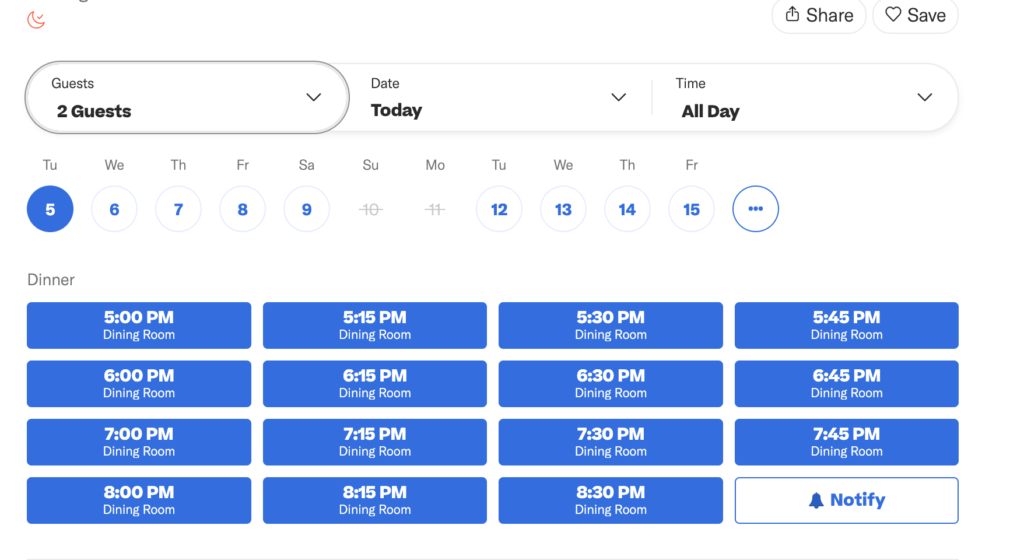

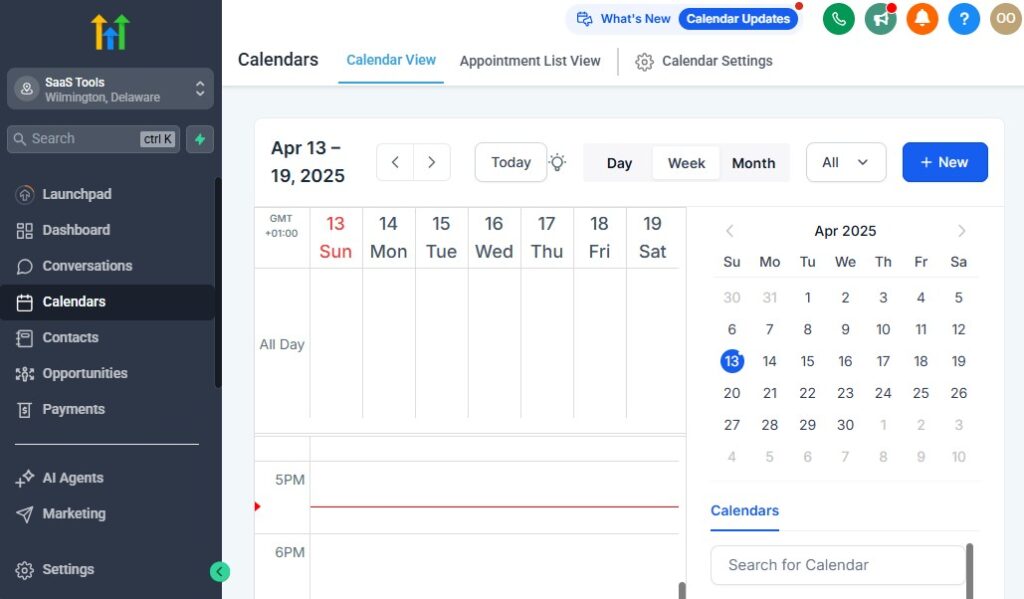

Step 5: Create Insurance-Specific Calendars

Insurance agents need different appointment types, so separate calendars help clients book exactly what they need.

Calendar examples

- Quote Consultation

- Policy Review Meeting

- Claims Support Call

- Renewal Consultation

- Multi-Policy Discount Consultation

How to set them up

- Go to Calendars → Create Calendar

- Choose Single User or Round Robin

- Set location (Zoom, office, phone call)

- Add availability and buffers

- Customize confirmation + reminder settings

This makes scheduling simple and ensures clients always know what to expect.

Step 6: Set Up User Roles & Team Permissions

If you have a team – agents, customer service reps, or admin staff – setting roles keeps everything secure and organized.

Best practice roles

- Admin: Full access

- Agent: Access to leads + pipelines

- CSR: Access to communication + renewals

- Sales Assistants: Access to tasks + follow-ups

How to configure

- Go to Settings → Team

- Add users

- Assign roles and permissions based on their responsibilities

This keeps client data secure while allowing your team to work efficiently.

Step 7: Build Your Lead Capture System

You need an automated way to capture leads from:

- Facebook Ads

- Google Ads

- Website forms

- Lead vendors

- Referral partners

- Landing pages

How to set it up

Connect forms to GoHighLevel funnels

Add automation triggers:

- “Form Submitted → Create Opportunity”

- Auto-tag based on insurance type

- Add to correct pipeline

Send instant SMS + email follow-ups

This ensures no lead slips through the cracks.

Step 8: Connect Communication Channels

All client communication should flow into GoHighLevel for tracking and compliance.

Channels to connect

- Email (Gmail/Outlook)

- Phone/SMS

- Facebook Messenger

- WhatsApp (optional, depending on your region)

How to do it

- Go to Conversations → Settings → Channels

- Connect each platform

- Test inbound/outbound messages

This gives you one centralized inbox where every conversation stays organized.

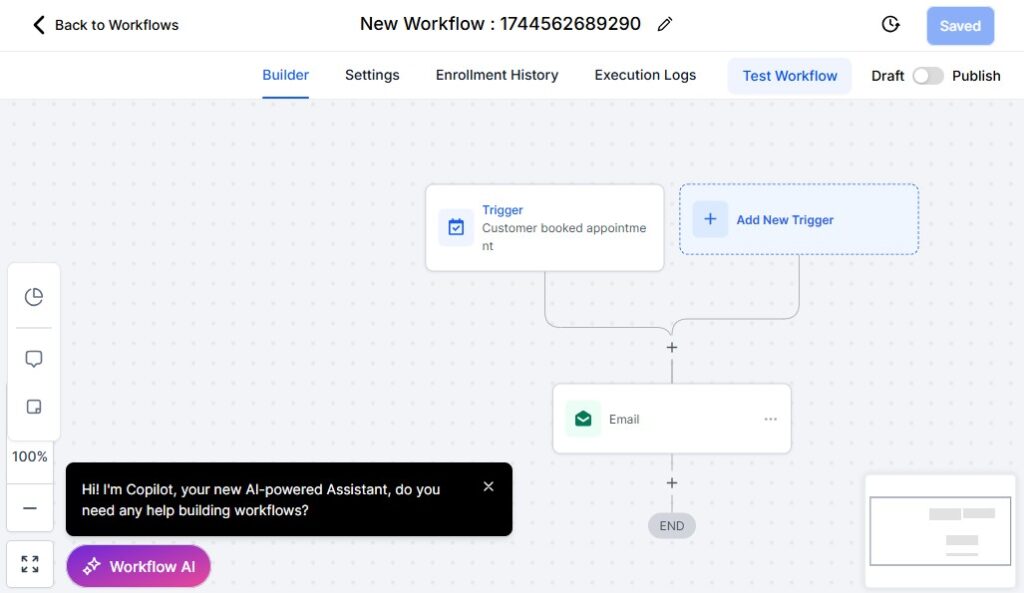

Step 9: Prepare Your Core Automations

Before selling or following up, set up key automations that keep your workflow running smoothly:

Must-have automations

- New lead welcome sequence

- Quote follow-up sequence

- Missed call text back

- Appointment reminders

- Renewal reminders

- Claims update notifications

How to set one up

Go to Workflows → Create Workflow

Add trigger (example: Form Submitted: Auto Insurance Lead)

Add steps:

- Send SMS

- Send Email

- Add to pipeline

- Assign task

- Wait → follow-up

- Update custom field

Publish

This builds the backbone of your automated insurance system.

Final Result: A Clean, Professional Insurance CRM Setup

Once your pipelines, calendars, custom fields, communication channels, and automations are ready, you’ll have a system that:

- Captures leads automatically

- Organizes every quote and policy

- Follows up consistently

- Handles renewals on autopilot

- Keeps clients informed at every step

- Supports compliance and documentation

- Saves you hours every week

You’re now ready to move into the next section.

Managing Leads, Quotes & Clients Using the CRM

Managing insurance leads, quotes, and active policyholders becomes a lot easier when everything lives inside one CRM.

GoHighLevel gives you the structure to track conversations, follow-ups, quotes, renewals, claims, and policy status in a clean and organized workflow – without spreadsheets or scattered messaging apps.

This section walks you through how to manage every type of client relationship, plus how to set it up inside GoHighLevel so you stay on top of every opportunity.

Organize Leads by Insurance Type Using Tags & Pipelines

Insurance leads come in all shapes – auto, home, life, health, commercial.

Segmenting them correctly helps you follow up with precision.

Use tags to identify each lead

- Auto Lead

- Home Lead

- Life Lead

- Health Insurance Lead

- Commercial Lead

- Bundle Lead (Auto + Home, etc.)

How to automate tagging – GoHighLevel for Insurace Agents

- Go to Workflows → Create Workflow

- Trigger: Form Submitted or Funnel Step

- Add action: Add Tag: Auto Lead

- Assign them to the correct pipeline

This ensures every lead enters the right follow-up sequence instantly.

Use Pipelines to Track Lead Progress From Inquiry → Policy Active

Pipelines show you exactly where each lead is, what they need, and what action to take next.

Suggested stages

- New Lead

- Contacted

- Quote Requested

- Quote Sent

- Follow-Up Required

- Pending Approval

- Policy Active

How to manage opportunities

- Go to Opportunities → Pipeline

- Drag-and-drop leads based on progress

- Add notes, tasks, or reminders

- Trigger automations when leads move stages

This gives you a clear picture of your entire sales funnel.

Store Every Client Detail With Custom Fields – GoHighLevel for Insurace Agents

Insurance requires accurate client data. Custom fields keep everything organized and easy to reference.

Useful fields

- Policy Type

- Policy Number

- Carrier

- Premium Amount

- Effective Date

- Renewal Date

- Quote Amount

- Claim Status

How to add/update fields

- Open a client record → Custom Fields

- Fill out policy details

- Use workflows to auto-fill fields from forms

This helps you personalize communication and automate renewals.

Track Quotes Easily – From Requested to Sent to Closed

Quotes are the heart of your insurance workflow. GoHighLevel helps you track and follow them up without forgetting any lead.

How to track quotes

- Create a “Quote Sent” stage in your pipeline

- Add quote details inside custom fields

- Use tasks for follow-up reminders

- Add workflows to send automated quote follow-ups

Optional enhancement

Integrate quote tools through Zapier so quote creation updates the client record automatically.

This improves your conversion rate and keeps every lead moving.

Use the Unified Inbox to Manage All Communication

Your email, SMS, calls, WhatsApp, and social messages should all live in one place.

Why this helps

- No lost conversations

- Faster responses

- Complete communication history

- Better compliance documentation

How to use it

- Go to Conversations → All

- Filter by channel

- Reply directly inside the inbox

- Attach files, quotes, or policy docs

- Add internal notes for team members

This keeps your communication structured and easy to reference.

Assign Tasks to Stay Organized and Follow Up Consistently

Tasks help you stay on top of important actions like:

- Sending quotes

- Reviewing documents

- Following up on claims

- Reminding clients about forms

- Scheduling policy reviews

How to add a task

- Open the client record

- Click Tasks → Add Task

- Set due dates + assign to yourself or a team member

- Trigger tasks through workflows

This ensures nothing gets missed, especially during busy seasons.

Use Smart Lists to Separate Clients Based on Status

Smart Lists help you filter and target groups of clients instantly.

Useful Smart Lists

- Leads waiting for quotes

- Clients with upcoming renewal dates

- Claims in progress

- High-value policyholders

- Cold leads

- Unsold quotes

- Multi-policy prospects

How to create them

- Go to Contacts → Smart Lists

- Add filters (tags, fields, pipeline stages)

- Save the list for future use

This helps you stay proactive and strategic with follow-ups.

Keep Every Policyholder Organized in Client Records

For active clients, you can keep all policy details in one clean profile.

What to store

- Policy documents

- Renewal date

- Premium amount

- Claims history

- Carrier details

- Past conversations

- Notes + internal comments

- Attached files (ID, proof, forms, etc.)

How to maintain records

- Update custom fields after every change

- Upload new documents

- Add notes after calls

- Tag based on status (Active, Renewal Due, Lapsed)

This builds a complete client story – critical for retention.

Automate CRM Updates Based on Client Behavior

Save time by letting GoHighLevel update client records automatically.

Examples

- When a quote request form is submitted → add tag + move to pipeline

- When an appointment is booked → update the lead stage

- When the renewal date is close → add “Renewal Due” tag

- When a policy becomes active → move to “Policy Active” stage

- When SMS is replied → notify the agent

How to set it up

Go to Workflows

Choose trigger (form, tag, stage, date, etc.)

Add steps:

- Update field

- Add tag

- Move pipeline stage

- Send internal notification

This keeps your CRM updated without manual work.

The Result: A Clean, Organized CRM for Insurance Agents

With GoHighLevel running your CRM, you get:

- Clear visibility over every lead

- Faster follow-ups

- More accurate quotes

- Organized policyholder records

- Better client communication

- Higher conversion + retention

Everything stays in one place, nothing gets lost, and your workflow becomes more predictable.

Automating Lead Follow-Up, Quotes & Policy Nurturing

In insurance, speed + consistency determine how many quotes turn into policies. Most prospects don’t buy immediately – they compare rates, think about it, get busy, or simply forget to reply.

This is why automation matters. GoHighLevel helps you follow up instantly, nurture unresponsive leads, and keep every potential client moving toward a quote or policy decision.

This section shows you what to automate, why it works, and how to set it up inside GoHighLevel so your follow-up system runs 24/7 and converts more leads into real paying policyholders.

Automate Instant Follow-Up When a Lead Inquires

Speed is everything in insurance. If you contact a lead within 5 minutes, your chance of closing skyrockets.

What to automate immediately

- Welcome SMS

- Welcome email

- Notification to the agent

- Add to pipeline

- Assign lead source tag

- Book-a-call link

How to set it up

Go to Workflows → Create Workflow

Trigger: Form Submitted or Facebook Lead Form Submitted

Add actions:

- “Send SMS: Thanks for your inquiry…”

- “Send Email: Here’s what happens next…”

- “Create Opportunity in Auto/Home/Life Pipeline”

- “Add Tag: Auto Lead (or relevant)”

- “Notify User (Agent)”

This ensures every lead gets contacted instantly – even when you’re not online.

Create a 5–10 Step Follow-Up Sequence for Unresponsive Leads

Most insurance leads require multiple follow-ups before they respond or request a quote.

What to include in your follow-up sequence

- Quick introduction message

- Questions to understand their needs

- A link to book a consultation

- A summary of benefits/policy explanations

- Testimonials and success stories

- Soft deadlines or reminders

- A final “Still interested?” message

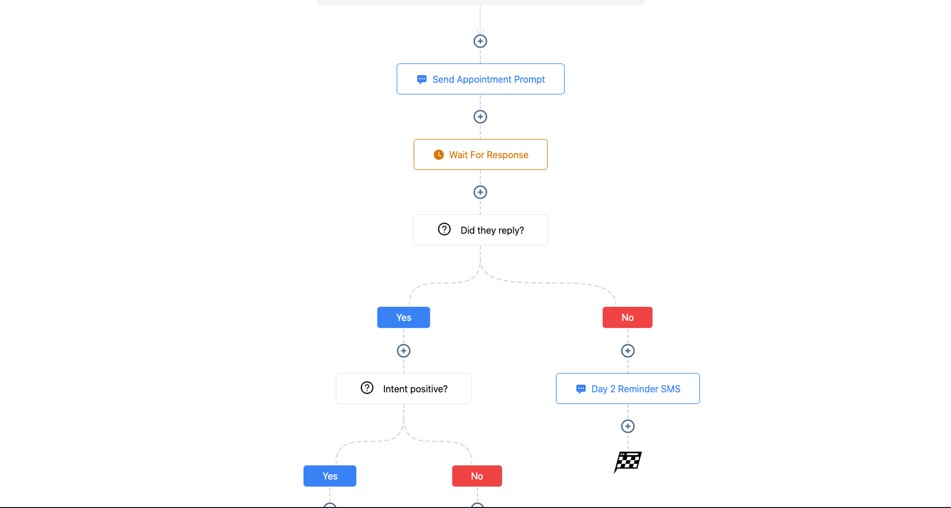

How to automate it

- Add Wait steps (1–3 days between messages)

- Add Email + SMS combos

- Use conditional logic:

- If they reply or book → stop workflow

- If they don’t respond:

- Add them to a nurture campaign

This keeps leads warm and engaged until they’re ready.

Automate Quote Delivery & Follow-Up

Once you send a quote, the real selling begins.

Most agents send a quote and wait – which leads to lost sales.

Automate the full quote process

- Tag added: “Quote Sent”

- Move lead to Quote Sent stage

- Send follow-up reminders

- Answer common objections

- Offer alternatives (bundles, lower deductibles, etc.)

- Send urgency messages before quote expiration

How to set it up

Add a tag Quote Sent to the client

Trigger: Tag Added – Quote Sent

Add steps:

- Email: “Here’s your quote…”

- Wait 24 hours → SMS: “Any questions about your quote?”

- Wait 48 hours → Email: benefits breakdown

- Wait 72 hours → Offer call link

This raises your quote-to-policy conversion rate dramatically.

Automate Policy Nurturing for Each Insurance Line

Different policies need different messaging.

GoHighLevel lets you build tailored nurture sequences.

Examples of insurance-specific nurturing

Auto Insurance:

- Reminders about discounts

- Importance of proper coverage

- Benefits of switching carriers

Home Insurance:

- Home protection tips

- Add-on coverage education

- Mortgage + insurance bundling opportunities

Life Insurance:

- Why coverage matters

- Term vs whole life explanations

- Stories that build urgency

Health Insurance:

- Enrollment deadlines

- Benefits explanation

- Prescription coverage info

How to automate it

Create a workflow for each insurance type

Trigger:

- Tag = “Auto Lead”

- Tag = “Home Lead”

- Tag = “Life Lead”

Add:

- Educational emails

- Call-to-action for quote requests

- SMS reminders

- Trust-building content

This allows your messaging to feel personalized and relevant.

Use Missed Call Text-Back to Boost Engagement

Insurance leads often call when you’re busy or with another client.

What happens automatically

- When you miss a call → send instant SMS

- “Sorry I missed you – how can I help?”

- Ask if they want a quote or call-back

How to enable it

- Go to Phone → Missed Call Text Back

- Turn it ON

- Customize your message

This alone can recover a large number of lost inquiries.

Use Behavioral Automation for Smart Follow-Up

Automation should adapt to how the client behaves.

Examples of smart triggers

- If they open your quote email → send reminder

- If they click the booking link → trigger a faster sequence

- If they don’t open → send an SMS instead

- If they reply → stop follow-up automatically

How to implement

Add If/Else branches in workflows

Choose triggers like:

- Email open

- Link click

- No reply after 2–3 messages

You get more conversions because the system responds intelligently.

Automate Policy Review Requests

Every insurance agent should schedule annual or semi-annual policy reviews.

What to automate

- Annual review email reminder

- Follow-up SMS

- Booking link with your calendar

- “Let’s update your coverage” sequence

How to implement

Create a custom field: Policy Renewal Date

Trigger: 30–60 days before renewal

Send:

- Review invitation email

- SMS reminder

- Follow-up offer

This increases renewals and cross-selling opportunities.

Automate Cross-Selling & Upselling Campaigns

Insurance cross-selling is extremely profitable – and easy to automate.

Cross-sell examples

- Auto → Home

- Home → Life

- Life → Health

- Business → Commercial Auto

- Anyone → Umbrella policy

How to automate

- Use segment tags (e.g., “Auto Only Client”)

- Trigger a workflow:

- “If client only has Auto → send Home Insurance offer”

- Add a call-to-action for a quote

- Follow-up if no response

This helps you grow your book of business with minimal effort.

Automate Lapsed Policy Follow-Up

Never lose a client just because they forgot to renew.

Automate reminders like

- “Your policy is past due…”

- “We can reinstate your coverage today”

- “Here’s what happens if your policy remains inactive”

How to implement

Create a tag: Lapsed

Trigger: Tag Added → Lapsed

Add:

- Email sequence

- SMS reminders

- Phone call tasks

This reactivates lost clients and protects your renewal rate.

The Result: A Follow-Up System That Works 24/7

When your follow-up and nurturing runs automatically, you get:

- Faster responses

- Higher quote request rates

- Better conversions

- More consistent follow-up

- Higher retention

- More cross-sells

- A cleaner, more reliable sales system

You focus on closing deals – while GoHighLevel handles the chasing, reminding, nurturing, and organizing.

Appointment Scheduling for Calls, Consultations & Policy Reviews

Scheduling is one of the most important parts of your insurance workflow. Prospects need consultations.

Clients need policy reviews. Some need help with claims. Others want to compare quotes or explore bundled policies.

If you try to handle scheduling manually, you’ll waste time going back and forth – and you’ll risk losing leads who prefer instant online booking.

GoHighLevel gives you a clean, automated scheduling system that keeps your calendar full and your clients informed at every step.

Below is what to set up, why it matters, and how to implement each part so your insurance agency stays organized and responsive.

Create Dedicated Calendars for Different Types of Insurance Appointments

Different appointment types require different prep.

Creating separate calendars makes your workflow cleaner and helps clients book the right call instantly.

Recommended calendars

- Quote Consultation Call

- Policy Review Meeting

- Claims Support Call

- Renewal Consultation

- New Client Strategy Call

- Multi-Policy Discount Consultation

How to set them up

- Go to Calendars → Create Calendar

- Choose Single User (or Round Robin if you have multiple agents)

- Set appointment duration

- Add location (Zoom, phone call, in-person)

- Add buffers (10–20 minutes)

- Customize the confirmation message

- Enable reminders (SMS + email)

This gives clients a simple, friction-free booking experience.

Use Smart Booking Links for Faster Conversions

You want prospects to book instantly the moment they show interest.

Where to use booking links

- Funnels

- Quote pages

- Email signatures

- SMS follow-ups

- Missed call text-back

- Facebook ads

- Website contact pages

How to add booking links

- Go to Calendars → Share Link

- Paste the link into emails, SMS, or funnel buttons

This removes the back-and-forth and speeds up your sales cycle.

Add Buffers to Keep Your Day Organized

Insurance calls often take longer than expected. Buffers give you breathing room.

Why buffers matter

- Prevent back-to-back stress

- Give you time to take notes

- Let you prepare documents

- Increase client satisfaction

How to set buffers

- In calendar settings, enable:

- Buffer Before (10–15 minutes)

- Buffer After (10–20 minutes)

This keeps your schedule smooth and predictable.

Automate Appointment Confirmations

Clients should receive all the call details instantly – without you manually messaging them.

What confirmations include

- Date & time

- Location or call link

- Required documents

- What to expect

- Rescheduling link

How to automate

- Open your calendar settings

- Toggle Send Confirmation Email/SMS

- Customize templates under Marketing → Templates

This reduces confusion and prepares clients before the call.

Automate Reminders to Reduce No-Shows

Insurance appointments are often forgotten – especially reviews and consultations. Reminders fix this.

Best reminder schedule

- 24 hours before

- 2 hours before

- 15 minutes before

How to implement

- Enable reminders inside the calendar

- Add SMS + email reminders

- Optional: Create workflow with custom reminders

Fewer no-shows = more policies sold.

Allow Rescheduling to Keep Clients in the Pipeline

Life happens. Giving clients an easy reschedule option keeps them engaged instead of losing the appointment completely.

How to enable

Inside calendar settings, toggle “Allow Rescheduling”

Set:

- Minimum notice (2–12 hours)

- Rules for last-minute changes

This creates flexibility without losing control of your schedule.

Use Intake Forms to Prepare for the Call

When clients provide information upfront, your calls become faster and more productive.

What to ask

- Policy type needed

- Coverage expectations

- Current carrier

- Renewal date

- Claims history

- Discounts they might qualify for

How to implement

- Create a form under Sites → Forms

- Attach it to your confirmation email

- Trigger form reminders inside a workflow

Better information = better quotes = better conversions.

Automate Post-Appointment Follow-Up

Every completed call should trigger a next step.

Follow-up automation examples

- Send quote

- Request documents

- Send pricing breakdown

- Offer bundled policy options

- Move client to the correct pipeline stage

- Assign a task for follow-up

- Add them to a nurture sequence

How to set it up

Go to Workflows → Create Workflow

Trigger: Appointment Status = Completed

Add:

- Email + SMS

- Task assignments

- Pipeline movement

This ensures no prospect falls through the cracks.

Use Round Robin Scheduling for Multi-Agent Teams

If several agents handle consultations, round robin scheduling distributes appointments evenly.

How to set it up

- Create a Round Robin Calendar

- Add team members

- Adjust weights (equal or priority-based)

- Each agent receives auto-notifications

Great for fast-growing agencies.

Keep All Appointments Synced Across Your Calendars

Connecting your external calendars helps prevent double booking.

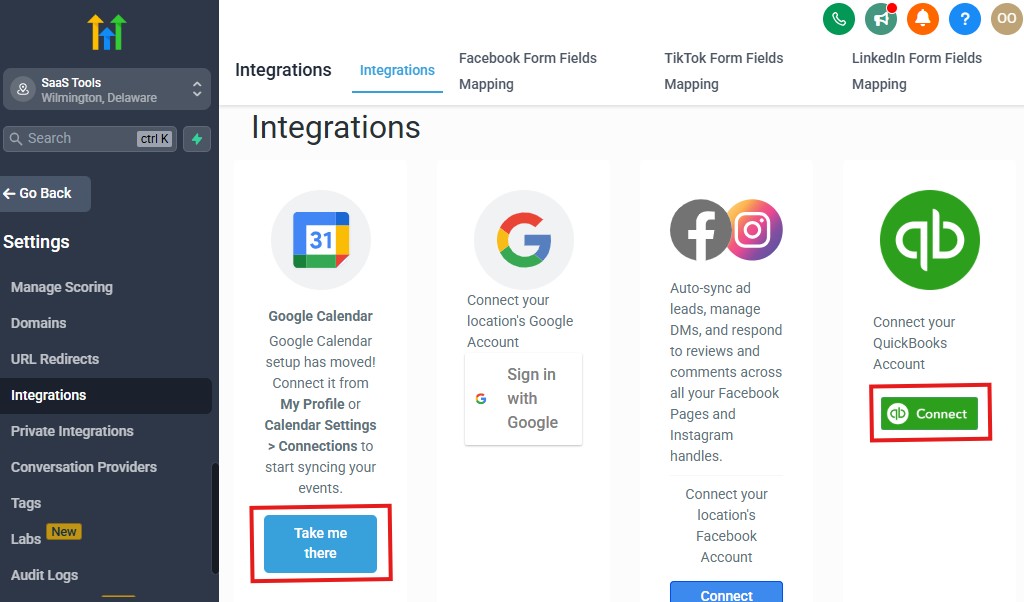

How to integrate

- Go to Settings → Profile → Calendar Sync

- Connect Google or Outlook

- Enable two-way sync

Your GHL calendar updates automatically across all devices.

The Result: A Clean, Automated Scheduling System That Boosts Conversions

With GoHighLevel scheduling:

- Clients book without friction

- You reduce no-shows

- You stay more organized

- You close more policies

- You deliver a smooth, professional experience

- Your follow-up flows stay consistent

A strong scheduling system helps you convert more leads and keep clients engaged throughout their policy lifecycle.

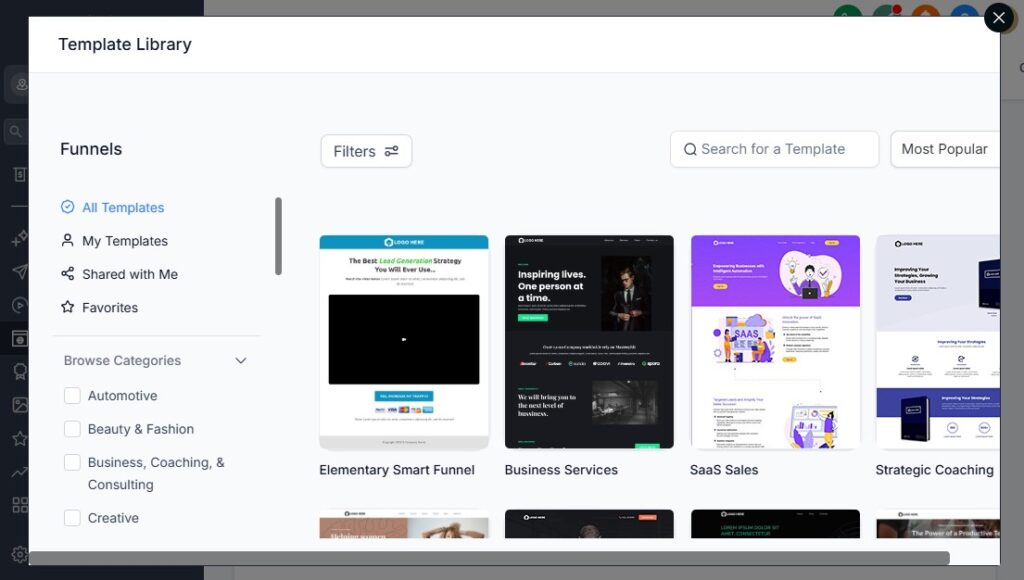

Building High-Converting Funnels for Insurance Products

Your funnel is often the first real touchpoint between you and a potential client.

If it’s clean, clear, and compelling, prospects feel confident enough to request a quote, book a call, or submit their information.

If it’s confusing or cluttered, they leave immediately – and you lose the sale.

GoHighLevel makes it easy to build simple, high-converting funnels tailored to different insurance products.

This section shows you what funnels to create, what each page should include, and how to build them step-by-step so you turn more visitors into leads and more leads into policyholders.

Create Separate Funnels for Each Insurance Product

Different policy types attract different audiences.

Creating one funnel for all will weaken your message, reduce trust, and lower conversions.

Recommended funnels

- Auto Insurance Funnel

- Home Insurance Funnel

- Life Insurance Funnel

- Health Insurance Funnel

- Commercial Insurance Funnel

- Bundled Policy Funnel (Auto + Home, etc.)

Each funnel should have its own message, benefits, form, and call to action.

Build Simple, Focused Landing Pages That Speak to Pain Points

Insurance buyers are usually dealing with worry, confusion, or a specific need.

Your landing page should speak directly to that.

What every landing page should include

- A clear headline

- “Get Fast, Affordable Auto Insurance Quotes in Minutes”

- A short section explaining what you offer

- Benefits in quick bullet points

- Trust elements (reviews, badges, “licensed agent”)

- A strong call-to-action button

- A short form or direct calendar link

How to build this in GoHighLevel

- Go to Sites → Funnels → Create Funnel

- Add a landing page

- Use the drag-and-drop builder

- Add sections for:

- Headline

- Benefits

- Testimonials

- Form / Call booking

- Keep it simple and visually clean

A clean page converts better than a long, messy one.

Use Lead Magnets to Encourage More Quotes

Sometimes prospects aren’t ready to book or request a quote.

A lead magnet captures their info early and warms them up.

Lead magnet ideas for insurance

- “Top 10 Ways to Lower Your Auto Insurance Premium”

- “Homeowner Insurance Checklist”

- “Term vs Whole Life Explained Simply”

- “Small Business Insurance Essentials”

- “Health Insurance Enrollment Guide”

How to implement this

- Create the PDF and upload it to Sites → Media

- Build a two-step funnel:

- Step 1: Lead magnet opt-in

- Step 2: Thank-you + booking button

- Automate delivery using a workflow

This grows your pipeline even if leads aren’t ready to buy immediately.

Add High-Converting Forms to Capture Essential Info

Forms should collect just enough data to start the conversation without scaring prospects away.

Recommended fields

- Name

- Phone

- Policy type

- Zip code

- Current carrier (optional)

- Renewal date (optional)

How to build forms

- Go to Sites → Forms → Create Form

- Add essential fields

- Add hidden tags (Auto Lead, Home Lead, etc.)

- Embed the form on your landing page

Short forms = higher conversions.

Use Booking Funnels for Ready-to-Talk Prospects

Some visitors want to speak to you immediately.

A booking funnel gets them on your calendar fast.

Structure

- Page 1: Short description + calendar

- Page 2: Thank-you page

- Page 3: Optional prep form

How to set it up

- Add a Calendar Element inside your funnel

- Connect it to your Quote Consult calendar

- Add confirmation + reminder automations

This works especially well with warm leads from ads.

Use Trust Elements to Boost Conversion Rates

Insurance is trust-heavy.

Adding social proof makes prospects feel safe.

Trust elements to include

- Reviews

- Testimonials

- “Licensed Agent” badge

- Years of experience

- Carrier logos (only if permitted)

- Security and compliance badges

How to add them

- Use the funnel builder Testimonials element

- Upload screenshots of real reviews

- Add a “Why Choose Us?” section

Trust increases conversions instantly.

Create Thank-You Pages That Guide Next Steps

Most agents waste their thank-you page.

Instead, use it to push the lead further down the funnel.

What to include

- Confirmation message

- Clear instructions on what happens next

- A short video (“Here’s what to expect”)

- A button to book a meeting

- A link to upload documents (optional)

How to build it

- Create a new funnel step

- Add text, a button, or video

- Add next-step instructions

This keeps prospects engaged and reduces drop-offs.

Connect Every Funnel to an Automation Workflow

Your funnel collects leads – your workflow nurtures them.

What the workflow should handle

- Welcome message

- Tagging

- Pipeline movement

- Quote request instructions

- Appointment reminders

- Follow-up sequences

How to connect

- Open your funnel

- Click the form

- Select Add to Workflow

- Choose the correct workflow

This ensures no lead slips through the cracks.

Test Your Funnel Before Going Live

Testing prevents lost leads and broken journeys.

How to test

- Submit a test form

- Check CRM record

- Confirm emails/SMS arrive

- Verify pipeline updates

- Check confirmation page

- Test on mobile

Do this before running ads or sending traffic.

The Result: Funnels That Convert Insurance Leads at Scale

With the right funnels in place, you get:

- More qualified leads

- Higher quote requests

- More consultation bookings

- Accurate segmentation

- Faster follow-ups

- A predictable, automated lead-generation system

Your funnels become your 24/7 sales engine – warming leads, capturing info, and guiding prospects straight into your CRM.

Running Email & SMS Marketing Campaigns for Insurance Clients

Insurance is a relationship-driven industry. People don’t always buy immediately – they compare rates, ask questions, wait for renewal dates, or get distracted.

This is why consistent, automated communication matters. GoHighLevel helps you stay top-of-mind, answer questions quickly, educate prospects, and increase conversions without manual follow-ups.

This section shows you what campaigns to run, why they matter, and *how to build them step-by-step so your insurance agency stays visible, relevant, and trustworthy.

Use Email for Education & Value – Use SMS for Urgency

Email and SMS each play different roles in your marketing.

Email works best for:

- Policy education

- Coverage explanations

- Claims guidance

- Renewal preparation

- Cross-selling opportunities

- Newsletters

- Trust-building content

SMS works best for:

- Quick reminders

- Quote follow-ups

- Renewal alerts

- Appointment reminders

- Missing document requests

- Urgent updates

How to set both up

- Verify your email domain under Settings → Email Services

- Purchase a phone number under Settings → Phone Numbers

- Connect your email account (Gmail/Outlook)

- Use email + SMS together inside your workflows

This keeps your communication balanced and effective.

Create a Lead Nurture Sequence That Warms Prospects Automatically

Most leads don’t buy on the first message.

A nurturing sequence helps build trust and keep them engaged.

What to include in your nurture sequence

- Welcome message

- Introduction to your agency

- Benefits of working with a licensed agent

- Educational content (auto, home, life, health, or business insurance)

- Coverage explanations in simple language

- Testimonials or reviews

- Soft call-to-action for a quote or call

How to build it

Go to Workflows → Create Workflow

Trigger: Form Submitted, Tag Added, or Added to Funnel

Add steps:

- Day 0 → Welcome email

- Day 1 → SMS

- Day 3 → Educational email

- Day 5 → Story-based email

- Day 7 → Quote or booking CTA

- Day 10 → Final reminder

This sequence alone can boost conversions dramatically.

Run Quote Follow-Up Campaigns for Hot Leads

Once a lead receives a quote, they need guidance and reassurance – not silence.

Your quote follow-up should include

- A confirmation email with the quote

- A breakdown of what the quote includes

- Why the coverage level matters

- Payment or activation instructions

- A reminder after 24–48 hours

- A follow-up SMS

- A soft urgency message (if quote expires soon)

How to automate it

Trigger: Tag = Quote Sent

Add steps:

- Email: “Your quote is ready”

- Wait 1 day

- SMS reminder

- Wait 2 days

- Email with benefits explanation

- Wait 2 more days

- Final CTA

This creates a smooth experience that increases close rates.

Build Renewal Reminder Campaigns (Your Highest-Value Automation)

Renewals are the backbone of your insurance business.

Missing a renewal follow-up = losing long-term revenue.

What to automate

- 60-day renewal reminder

- 30-day renewal reminder

- 14-day countdown

- 3-day final notice

- “Your policy has renewed” confirmation

How to set it up

Create a custom field: Renewal Date

Use Date-Based Trigger → Before Renewal Date

Add:

- Email reminders

- SMS reminders

- A link to book a policy review

- Follow-up tasks for your team

This protects your retention rate and keeps clients insured.

Create Cross-Sell Campaigns to Increase Lifetime Value

Cross-selling is how insurance agents multiply their revenue.

Cross-sell opportunities

- Auto → Home

- Home → Auto

- Auto/Home → Life

- Life → Health

- Business owner → Commercial Auto

- Any policyholder → Umbrella insurance

How to automate

Create Smart Lists for single-policy clients

Trigger: Client has Auto but NOT Home

Send:

- Educational email

- Case study or testimonial

- Savings offer

- CTA to request a quote

Your book of business becomes more profitable with zero extra effort.

Build Claims Communication Campaigns

Clients want reassurance during a claim. Automated updates help keep them calm and informed.

What to automate

- Claim received

- Claim under review

- Documents missing

- Adjuster assigned

- Claim resolved

- Next steps

How to implement

- Add a custom field: Claim Status

- Create workflows triggered by status updates

- Send SMS + email to notify clients

This creates a premium customer experience.

Run Reactivation Campaigns for Old or Lost Leads

Old leads who never converted can still become clients later.

What to include

- “Are you still comparing insurance quotes?”

- “We can help you save on your renewal.”

- “Want updated rates? Markets have changed.”

- “Quick question – still looking for coverage?”

How to implement

- Create a Smart List: Inactive Leads

- Add a short 3–5 message workflow

- Include a strong call-to-action to re-engage them

This can instantly revive 5–20% of your old pipeline.

Use Seasonal or Event-Based Campaigns

Insurance demand spikes during certain situations.

Seasonal opportunities

- Moving season

- New-year coverage reviews

- Open enrollment (health)

- Hurricane or storm season (home insurance)

- Back-to-school (health/life)

How to set it up

- Use Date-Based Trigger

- Send 2–3 emails + SMS reminders

- Always include a booking link or quote CTA

This keeps your agency relevant throughout the year.

Enhance Campaigns With Personalization

Personalization = higher conversions.

What to personalize

- Name

- Policy type

- Renewal date

- Quote amount

- Coverage options

- Client-specific benefits

How to implement

Use dynamic variables like:

- {{contact.name}}

- {{custom_value.policy_type}}

- {{custom_value.renewal_date}}

Campaigns that feel personal perform significantly better.

Track Campaign Performance & Optimize Regularly

Monitoring results helps you improve over time.

Track metrics like

- Open rates

- Click-through rates

- Replies

- Booked appointments

- Policies sold

- Renewal conversions

How to monitor

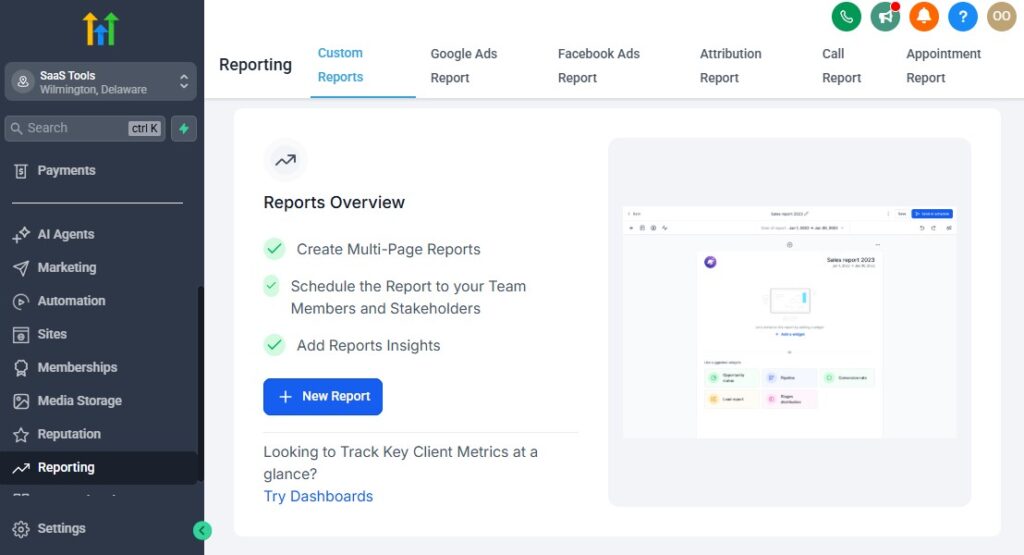

- Go to Reports → Email Stats

- Use Funnels → Analytics

- Check Automation → Workflow Stats

This helps you refine your campaigns for maximum impact.

The Result: Marketing That Grows Your Insurance Business Predictably

When your marketing campaigns run smoothly, you’ll see:

- More booked calls

- Better quote conversion

- Higher renewal retention

- Stronger relationships

- More cross-sells

- A full pipeline – all year long

Your agency becomes a consistent, automated sales and retention machine – powered by simple, smart messaging.

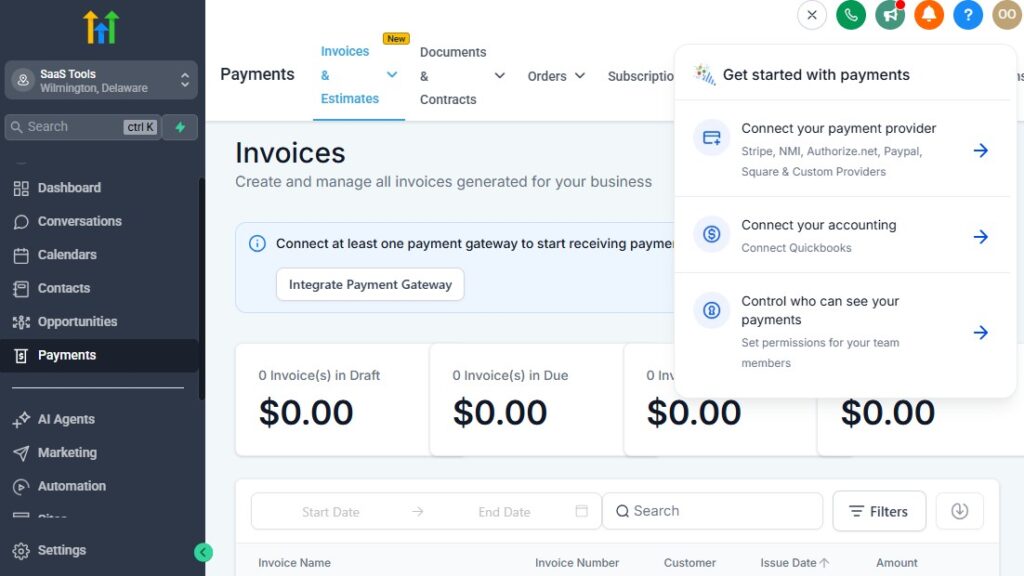

Managing Quotes, Premium Payments & Renewal Reminders

If you get quotes out fast, make it easy to pay, and never miss a renewal, your insurance book grows smoothly.

GoHighLevel helps you manage all three in one system so you’re not chasing people manually or relying on memory and spreadsheets.

Below, you’ll see what to set up and how to do it inside GoHighLevel so quotes, payments, and renewals run on autopilot as much as possible.

Organizing & Tracking Quotes in GoHighLevel

You don’t want quotes buried in email threads. Every quote should be tied to a contact and stage in your pipeline.

What you should track for each quote

- Policy type (auto, home, life, health, commercial)

- Carrier

- Quote amount

- Quote date

- Expiry date (if any)

- Status: Requested, Sent, Accepted, Declined

How to set this up

Create custom fields like:

- Quote Amount

- Quote Date

- Quote Expiry Date

- Quote Status

Add a “Quote Sent” stage in your pipeline.

When you send a quote (from your carrier or rating tool), update:

- The pipeline stage → Quote Sent

- The quote fields on the contact

This gives you a quick visual overview of where every quote stands.

Automating Quote Follow-Up

Most people won’t respond to a quote the first time. Your follow-up system should do the heavy lifting.

What your quote follow-up should do

- Confirm the quote was sent

- Explain what’s included in simple terms

- Handle common objections (price, coverage, carrier)

- Remind them before the quote expires

- Push them to a call/DM to finalize

How to automate it

Create a tag: Quote Sent.

In Workflows → Create Workflow:

- Trigger: Tag Added → Quote Sent.

Add steps like:

- Immediately:

- Email: “Here’s your quote and what it covers.”

- Optional SMS: “I’ve emailed your quote, check your inbox 😊.”

- After 1 day:

- SMS: “Any questions about your quote?”

- After 3 days:

- Email: “Quick breakdown of your coverage and options.”

- Before expiry (e.g. 7 days or 48 hours before):

- Email/SMS with mild urgency and a link to book a call.

Once this is in place, every quote gets proper follow-up without you chasing people manually.

Using GoHighLevel for Premium Payments (Links & Pages)

GoHighLevel won’t replace your carrier’s billing system, but it can still help you manage agency fees, consultation fees, or fixed service charges – and make it easier for clients to pay.

What you can collect through GoHighLevel

- Policy setup fees

- Broker/agency service fees

- Consultation fees

- Policy review fees

- Administrative charges

How to set up payments

- Go to Settings → Payments.

- Connect Stripe (or other supported processor).

- Create products (e.g. Policy Setup Fee, Consultation Fee).

- Create a payment link or checkout page in GoHighLevel.

- Add these links:

- In emails

- In SMS messages

- On your funnels (thank-you or booking pages).

Now, when you need a client to pay a fee, you just drop the link in your automation instead of typing out instructions every time.

Automating Payment Reminders (For Fees You Control)

If you’re collecting recurring fees or one-off charges through GoHighLevel, don’t chase people manually.

What to automate

- “Invoice created” → send payment link

- “Payment due today” reminders

- “Overdue” reminders

- Confirmation once paid

How to do it

Use a trigger like Tag Added: Payment Required or Form Submitted (fee agreement).

In your workflow:

- Step 1: Send email with payment link.

- Step 2: Wait 1–3 days.

- Step 3: If unpaid → send reminder email/SMS.

- Step 4: When payment is completed (using Stripe/Zapier, or manual tag):

- Add tag Payment Completed

- Send “Thank you, payment received” message.

This keeps your cashflow tidy and reduces awkward payment chasing.

Setting Up Renewal Fields to Power Automation

Renewals are where your real long-term money is. You must never rely on memory for dates.

Key fields you need

- Policy Effective Date

- Policy Renewal Date

- Policy Type

- Carrier

- Status (Active, Lapsed, Pending Renewal)

How to add them

- Go to Settings → Custom Fields and create date fields for:

- Effective Date

- Renewal Date

- Add them to your forms or fill them manually when a policy goes active.

These fields become the backbone of your renewal workflows.

Automating Renewal Reminder Campaigns

Your goal is simple: contact your client well before renewal, review their needs, and keep or upgrade the policy.

Suggested renewal reminder timeline

- 60 days before renewal – “Let’s review your policy.”

- 30 days before – “Time to renew / adjust your cover.”

- 14 days before – “We’re close to your renewal date.”

- 7 days before – Soft urgency.

- 1–3 days before – Final reminder.

- After renewal – Confirmation + thanks.

How to build this in GoHighLevel

Use a Date-Based Workflow.

Trigger: Based on Renewal Date field (e.g. 60 days before).

Add steps:

- Email: invite to a review or confirm details.

- SMS reminder: with a booking/link.

- Wait, then send the next reminder at 30/14/7 days.

After renewal:

- Tag: Renewed.

- Send a “Policy renewed” confirmation email/SMS.

- Optionally, add them to a cross-sell campaign (life, health, umbrella, etc.).

Now renewals happen proactively instead of reactively.

Handling Lapsed Policies With Automation

When a policy lapses, you shouldn’t just accept the loss. Automate a short win-back sequence.

What to do when a policy lapses

- Mark the policy as Lapsed (tag or custom field).

- Move the opportunity to a Lapsed / Inactive pipeline stage.

- Trigger a re-engagement workflow.

What the workflow should include

- Email: “Your policy appears to be inactive – here are your options.”

- SMS: quick check-in.

- Second email: explain risks of staying uninsured.

- Call-to-action: “Let’s talk about reinstating or updating your coverage.”

Even recovering a small percentage of these can significantly grow your book over time.

Linking Renewals & Quotes Together

A powerful move is to link renewal workflows to new quote flows.

Example

- 60 days before renewal → send review/quote offer.

- Client clicks link → goes to a “Renewal Review” funnel.

- They submit updated info → automatically:

- Updates fields in CRM.

- Adds tag Renewal Quote Requested.

- Triggers a quote follow-up workflow (like in Section 5).

You’re not just renewing blindly – you’re proactively remarketing and potentially improving coverage or pricing.

The Result: A System That Protects Revenue & Grows Your Book

When you manage quotes, premium-related payments, and renewals in GoHighLevel like this, you get:

- Faster quote responses

- Clean tracking of quote status

- Less manual payment chasing

- Far fewer missed renewals

- More policy retention

- More chances to cross-sell or upsell at renewal time

You’re no longer “hoping” people get back to you – your system makes sure they’re reminded, nudged, and guided at every key step.

Delivering Policies, Documents & Claims Communication

Once a client agrees to a policy, the next steps matter just as much as the sale. Clients expect smooth document delivery, clear instructions, fast claims communication, and reassurance at every stage. GoHighLevel helps you create a seamless post-sale experience that builds trust, reduces confusion, and boosts long-term retention.

This section breaks down how to deliver policies, how to organize client files, and how to automate claims communication so clients always feel supported and informed.

Deliver Policy Documents Quickly & Professionally

Insurance clients want their policy papers as soon as possible. GoHighLevel helps you organize and deliver everything in one place.

Documents you may deliver

- Policy declaration pages

- Coverage summary

- Digital ID cards

- Billing schedule

- Terms & conditions

- Claim instructions

- Carrier-specific documents

How to deliver documents

Upload files to Contacts → Files.

Send an email with:

- A secure download link

- A summary of the policy

- Important next steps

Add a confirmation SMS:

- “Your policy documents have been emailed 🎉 Let me know if you need help.”

This makes the delivery look polished and professional.

Organize Important Files Inside Each Client Profile

Your client’s entire policy history should live inside GoHighLevel.

What to store

- Quote files

- Signed applications

- ID cards

- Claim documents

- Renewal notices

- Policy changes

- Payment confirmations

How to set this up

Use the Files tab in the contact profile.

Create custom fields for:

- Policy Number

- Carrier

- Effective Date

- Renewal Date

Add tags for easy sorting (e.g., Auto Policy Active, Home Policy Active).

This keeps everything in one place for compliance and customer service.

Create a “New Policy Delivery” Automation

Every new policy should trigger a clean onboarding experience.

What your automation should include

- Welcome email + policy summary

- Attach/download policy documents

- ID card delivery (if auto insurance)

- Claims instructions

- Renewal date confirmation

- A link to schedule a “Policy Review Call”

- Tag the client as “Policy Active”

- Move them into the Active Clients pipeline

How to build it

Trigger: Tag Added → Policy Active OR Pipeline Stage: Policy Active.

Add:

- Email: “Welcome! Your policy is now active.”

- SMS: “Your policy documents have been sent to your email.”

- Task for your team: confirm everything is uploaded.

- Optional: add to a long-term nurture sequence.

This gives every client a polished onboarding journey.

Deliver Updates or Policy Changes Automatically

When clients request changes (address update, coverage changes, adding a driver), you should send them updated documents automatically.

How to handle policy updates

- Update custom fields

- Upload new documents

- Trigger a “Policy Updated” workflow

What the workflow should do

- Send policy update confirmation

- Attach updated documents

- Provide next steps

- Notify your team

Clients appreciate fast, clear updates.

Build a Claims Communication System Clients Can Rely On

Claims are emotional. Clients want reassurance and fast updates.

What to automate

- Claim received

- Claim assigned

- Documents required

- Under review

- Approved/Denied

- Payout details

- “What happens next” messages

How to implement

Create a custom field: Claim Status.

Each time status changes, update the field.

Trigger a workflow:

- If Claim Status = Received → send confirmation.

- If Claim Status = Missing Documents → send checklist + upload link.

- If Claim Status = Approved → send payout timeline.

This reduces calls, confusion, and stress on both sides.

Use SMS for High-Priority Claim Communication

SMS feels more personal and is read much faster.

What to send via SMS

- “We’ve received your claim.”

- “Your adjuster has been assigned.”

- “We need one more document.”

- “Your claim is under review.”

- “Your claim has been approved.”

How to activate

- Add “Send SMS” steps in your Claim workflows.

- Keep messages short and reassuring.

Clients stay informed without wondering “What’s happening with my claim?”

Create a Document Upload Funnel for Claims

Make it easy for clients to submit claim documents.

How to build it

Go to Sites → Funnels.

Create a simple page with:

- A brief instruction

- A file upload form

- A thank-you page

Connect the form to a workflow:

- Tag “Documents Submitted”

- Notify your team

- Move client to “Claim Under Review”

This keeps claims organized and reduces back-and-forth emails.

Automate Follow-Up for Missing Claim Documents

Clients often forget to send required documents.

Automation closes the loop for you.

How to do it

Trigger: Tag Added → Documents Required.

Add steps:

- Email: list missing documents

- SMS reminder

- Wait 2–3 days

- Follow-up message

If documents still missing:

- Notify your team

- Move client to “Waiting on Client”

This keeps claim timelines predictable.

Create a Centralized Claims Pipeline

Tracking claims in your head or on paper is risky.

Use a dedicated claims pipeline.

Suggested stages

- Claim Submitted

- Documents Needed

- Under Review

- Adjuster Assigned

- Decision Pending

- Approved

- Denied

- Closed

How to build it

- Go to Opportunities → Pipelines → Create Pipeline

- Add stages above

- Move clients automatically using workflows

This gives you a clear view of your claims workload.

The Result: Smooth, Professional Delivery & Claims Experience

When you deliver policies and manage claims through GoHighLevel:

- Clients feel supported

- Communication is consistent

- Documents stay organized

- Claims progress stays transparent

- You look more professional and reliable

- You save hours every week on follow-ups

A strong delivery + claims system sets your agency apart and increases retention naturally.

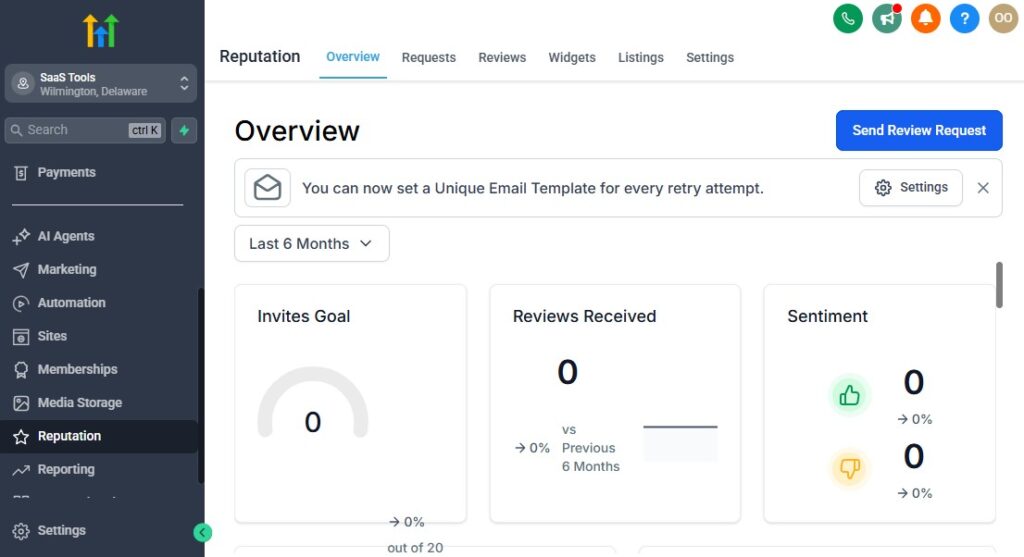

Collecting Reviews, Testimonials & Building Trust Online

In the insurance industry, trust is everything. People want to know they’re working with someone dependable, responsive, and knowledgeable.

Reviews and testimonials play a huge role in proving credibility – especially when prospects are comparing agents or deciding whether to switch providers.

GoHighLevel helps you create a simple, automated system that collects real reviews, showcases them beautifully, and builds a strong online reputation that fuels more leads and conversions.

Let’s break down how to collect reviews, where to showcase them, and how to automate everything using GoHighLevel.

Use Automated Review Requests After Policy Activation

The best time to ask for a review is right after a positive moment, such as:

- When a policy becomes active

- When a claim is resolved

- After a consultation goes well

- After you help a client save money

- After a renewal is completed

How to automate the request

Trigger: Tag Added → Policy Active or Pipeline Stage = Completed.

Add steps:

- Email: “Thank you for choosing us – would you mind leaving a quick review?”

- SMS with review link

- A short follow-up reminder after 2–3 days

Where to send them

- Google Reviews (highest impact)

- Facebook Page

- Yelp

- Better Business Bureau (optional)

This builds social proof passively, every week.

Make It Easy With a Single Review Link

Clients won’t leave a review if the process feels complicated.

How to simplify

Use a single Google Review link

Add it to:

- SMS

- Thank-you pages

- Footer of funnels

Make it one click – no searching, no confusion

This boosts your review volume significantly.

Create a Testimonial Collection Funnel

Testimonials help with conversion on your landing pages and funnels.

How to build it

Go to Sites → Funnels → Create Funnel.

Add:

- A simple form asking:

- “What did you love about working with us?”

- “What problem did we help you solve?”

- Permission to showcase the testimonial

- Add a “Thank You” step.

- Tag the contact (e.g., Testimonial Submitted).

- Add them to a workflow that saves the testimonial to a custom field or notifies you.

Use this funnel link

- After renewals

- After positive feedback

- After policy savings

You’ll build a growing library of social proof on autopilot.

Display Testimonials on Your Funnels & Website

Your landing pages convert better when they show real client results.

What to showcase

- Star ratings ⭐⭐⭐⭐⭐

- Short testimonial quotes

- Client first name + city (keeps privacy)

- Screenshots of real Google reviews

- Before/after savings examples (if appropriate)

Where to place testimonials

- Above the call-to-action button

- Near pricing or coverage explanation

- On quote request pages

- On policy-specific funnels

These small placements dramatically improve trust and conversion.

Use Video Testimonials for Higher Impact

Video builds deeper trust and engagement.

You can collect video testimonials through GoHighLevel forms.

How to do it

- Create a form with a file upload field

- Ask clients to record a short video on their phone

- Add simple prompts:

- “How did we help you?”

- “What made you choose us?”

- “Would you recommend us?”

Video testimonials are powerful for ads, landing pages, and social media.

Build a “Proof & Reviews” Page on Your Agency Website

A dedicated review page helps prospects feel confident before requesting a quote.

What the page should include

- Google review widget

- Top testimonials

- Video testimonials

- Review submission link

- Trust badges (licensed agent, years of experience, carriers you work with, etc.)

How to build it

- Go to Sites → Websites → Create Page

- Add:

- Review block

- Star ratings

- “Why people trust us” section

- Call-to-action button

This page becomes an asset you can use in ads, follow-ups, and emails.

Automate Follow-Up for Review Requests

Most clients don’t leave a review on the first ask – but they will on the second or third.

How to automate a gentle reminder

- Wait 2–3 days from initial request.

- Send a short reminder email:

- “Just checking in – your review would mean a lot to us!”

- Add an SMS reminder as well

People appreciate being reminded politely.

Celebrate Clients for Leaving Reviews

A small thank-you goes a long way.

How to automate appreciation

- Send a “thank you” email

- Send a personalized SMS

- Add a tag: Brand Advocate

- Add them to a referral workflow (optional)

This builds loyalty and encourages word-of-mouth referrals.

Protect Your Reputation With Feedback Forms

Not every client is thrilled – that’s okay. What matters is catching negative feedback privately.

How to handle it

- Create a “Private Feedback Form”

- Ask:

- “What could we have done better?”

- “How can we improve your experience?”

- Route negative submissions to you or your team

- Avoid sending unhappy clients to Google Reviews

This helps you fix issues before they become public.

Use Social Proof in Your CRM Workflow

Whenever you nurture prospects or send quote follow-ups, drop in a little trust.

How to use social proof in automations

- Add review snippets to quote follow-up emails

- Include testimonial screenshots in booking reminders

- Use “Real story from a client like you…” in nurturing messages

- Add star ratings in SMS messages (simple but effective ⭐⭐⭐⭐⭐)

This improves conversions through psychological reassurance.

The Result: A Trust-Driven Insurance Brand That Converts More Leads

When you collect and showcase reviews consistently, you get:

- Stronger credibility

- Higher quote-to-policy conversion

- Increased trust from new leads

- More referrals

- Better retention

- A reputation that sells for you automatically

GoHighLevel helps you build a brand people feel safe with – one that stands out in a competitive insurance market.

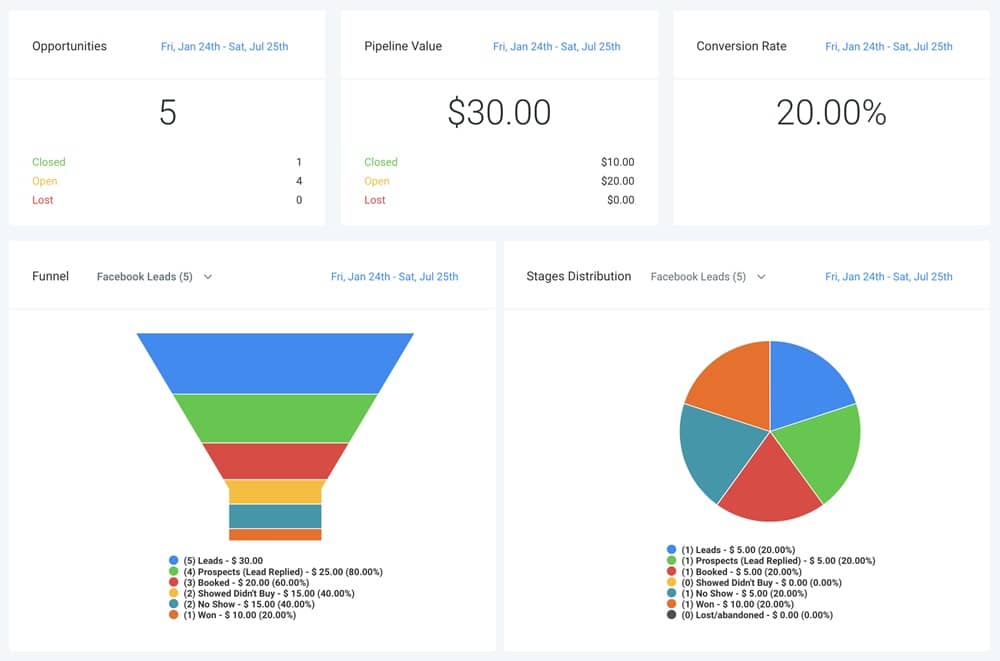

Reporting & Analytics for Insurance Agencies

To grow your insurance agency predictably, you need clear visibility into your numbers – where leads come from, how they convert, how long quotes take to close, which policies generate the most revenue, and where your follow-up system is leaking.

GoHighLevel gives you the analytics you need to make smarter decisions, tighten your operations, and scale intentionally.

This section shows you what to track, why it matters, and how to set it up so you always know exactly what’s working and what needs improvement.

Track Lead Sources to See What Marketing Channels Work Best

You shouldn’t guess where your best leads come from.

Tracking sources shows you which campaigns bring high-quality prospects.

What to track

- Facebook/Instagram ads

- Google Search ads

- Website traffic

- Referral partners

- Organic content

- Lead magnet downloads

- Email campaigns

How to track it

- Create hidden fields in your forms:

- Source

- Campaign

- Add UTM parameters to ads.

- Use the Attribution Report under Analytics.

This helps you stop wasting money on channels that underperform.

Use Pipeline Reports to Monitor Sales Performance

Pipelines show you how leads move from inquiry → quote → policy.

Metrics to monitor

- Number of new leads

- Quote request rate

- Quote sent rate

- Quote follow-up rate

- Conversion rate

- Time spent in each stage

- Policies closed

How to view it

- Go to Opportunities → Pipeline View

- Use Pipeline Stats to compare performance

This helps you spot bottlenecks, such as:

- Leads not being contacted fast enough

- Quotes being sent late

- Poor follow-up on “Quote Sent” stage

Fix the bottleneck → increase sales instantly.

Track Appointment Metrics to Improve Booking Rates

Appointments drive sales in insurance.

You need to know how many are being booked, completed, or no-showed.

Track these metrics

- Booking rate

- Show-up rate

- Cancellations

- Completed consultations

- Average consultation-to-policy conversion

How to track it

- Go to Calendars → Appointments Report

- Check “Completed,” “Cancelled,” “No Show,” etc.

This helps you improve your reminder system and booking funnels.

Monitor Email & SMS Performance for Better Engagement

Your communication strategy determines how well leads warm up.

Track important email metrics

- Open rate

- Click rate

- Reply rate

- Unsubscribe rate

- Bounce rate

SMS metrics

- Delivery rate

- Reply rate

- Link click rate

How to view it

- Go to Marketing → Emails → Analytics

- And Marketing → SMS → Analytics

This shows you which messages resonate – and which need improvement.

Review Workflow Performance to Spot Automation Gaps

Your automations should run your agency 24/7.

If something breaks, you need to know.

What to analyze

- Workflow conversion rate

- Drop-off points

- Steps with low engagement

- Messages with low opens or replies

- Automation errors

How to check

- Go to Automation → Workflows → View Stats

This helps you refine sequences, adjust timing, and improve message quality.

Track Renewal Performance to Protect Your Retention Rate

Renewals are your most valuable metric – because they protect your long-term revenue.

Track

- Total renewals due

- Renewal response rate

- Renewals completed

- Lapsed policies

- Renewal recovery rate

- Time-to-renewal

How to set up tracking

Use custom fields for Renewal Date

Create Smart Lists:

- Renewals This Month

- Renewals Next Month

- Lapsed Clients

This ensures no renewal slips through the cracks.

Use Smart Lists to Segment Clients by Performance Indicators

Smart Lists give you actionable insights at a glance.

Useful Smart Lists

- High-value policyholders

- Low-engagement leads

- Hot leads (recent opens/clicks)

- Quote Sent but No Response

- New Leads This Week

- Clients with multiple policies

- At-risk clients (no engagement for 90 days)

How to build them

- Go to Contacts → Smart Lists

- Filter by tags, custom fields, or pipeline stages

Your data becomes more actionable instantly.

Monitor Claims Metrics (If You Manage Claims Internally)

Claims are highly sensitive – you need a clear status overview.

Track

- Total claims submitted

- Claims requiring documents

- Claims under review

- Claims approved

- Claims denied

- Average claim resolution time

How to track

- Build a Claims Pipeline

- Track each stage visually

- Use custom fields like Claim Status

This ensures clients receive updates quickly and consistently.

Review Revenue Metrics for Better Forecasting

Even though GoHighLevel doesn’t replace carrier billing, it can help you track revenue-related metrics you control.

Track

- Agency fees collected

- Consultation fees

- Recurring service fees

- Completed renewals

- New policies per month

- Policy types generating the most commissions

How to organize this

- Use Stripe inside GoHighLevel

- Create product categories (auto, home, life, etc.)

- Track revenue in Payments → Transactions

This helps you forecast and plan your marketing budget.

Monitor Team Performance if You Run a Multi-Agent Agency

If multiple agents work under you, performance tracking becomes essential.

Track

- Leads assigned per agent

- Quotes sent

- Follow-up consistency

- Policy sales

- Renewal completions

- Average response time

How to view it

- Use Conversations → Filter by User

- Use Opportunities → Filter by User

This helps you spot high performers and identify who needs support.

The Result: Clear Data → Smart Decisions → Bigger Results

When you track your numbers consistently, you get:

- A predictable pipeline

- Higher quote conversions

- Better follow-up performance

- More renewals

- Lower no-show rate

- Better team accountability

- Higher profitability

- More control over growth

Instead of guessing what’s working, you’ll know – and you’ll scale your insurance agency with confidence.

Integrating GoHighLevel With Insurance Tools & Carriers

Your insurance business already relies on multiple tools – rating software, carrier portals, document systems, e-signing tools, payment processors, and communication platforms.

Instead of juggling everything manually, GoHighLevel lets you connect these tools together so your workflow becomes smoother, faster, and more accurate.

While GoHighLevel won’t replace your carrier systems, it will act as the central hub that connects everything and triggers the right actions automatically.

This section shows you what tools to integrate, why each matters, and how to set it up step-by-step so your agency runs like a well-organized machine.

Integrate Your Quote & Rating Tools (For Faster Quote Workflows)

Many insurance agents use rating tools to generate quotes quickly.

Popular rating tools you may be using

- EZLynx

- Applied Rater

- QQCatalyst

- PL Rating (Vertafore)

- Canopy Connect (document gathering + data extraction)

- Semsee (commercial quote platform)

How integration works

GoHighLevel doesn’t directly replace these systems, but you can integrate them using:

- Zapier

- Webhooks

- Email parsing

- Custom API connections (advanced users)

Ways to connect them

- When a lead submits a form → send data to your rating tool.

- When a quote is generated → send it back into GHL as a file or note.

- When a quote is ready → add tag Quote Sent to trigger workflows.

This pulls quote workflows into one place.

Connect E-Signature Tools for Applications & Forms

Insurance involves a lot of signatures – applications, disclosures, forms, and agreements.

Best e-sign tools to integrate

- DocuSign

- HelloSign

- PandaDoc

- Adobe Sign

How to integrate with GoHighLevel

- Create templates inside your e-sign tool.

- Use Zapier or Webhook triggers:

- “Document Sent” → update client record in GHL.

- “Document Completed” → add tag Policy Signed.

- Add signed documents to Contacts → Files automatically.

Use-case example

When a client signs a life insurance application →

GHL updates their stage to Pending Approval and sends a confirmation email.

This reduces manual admin work significantly.

Integrate Carrier Portals (Indirect but Powerful)

You can’t directly connect carriers like State Farm, Allstate, Travelers, or Progressive – but you can sync the data flow around them.

How agents usually integrate carriers indirectly

- Use Zapier or email parsing to detect carrier email updates

- Update the CRM when:

- A policy becomes active

- Renewal notices arrive

- Document packets are issued

- Claims notifications come in

How to automate this

Set up a dedicated email for carrier notifications.

Use “Email Parser by Zapier” to extract key info:

- Policy number

- Effective date

- Renewal date

- Policy status

Send the data into GoHighLevel → update custom fields.

This keeps your client records accurate without manual entry.

Integrate Your Phone, SMS & Calling Tools

Communication is the core of insurance.

GoHighLevel already includes calling & SMS, but you can extend it.

Tools to integrate

- Twilio (for more SMS/phone routes)

- JustCall

- Aircall

- RingCentral

How to integrate

- Go to Settings → Phone (for Twilio direct).

- For JustCall/Aircall → use Zapier triggers:

- New call → update GHL notes

- Missed call → start missed-call workflow

- SMS received → add to GHL conversation

This creates a unified communication record for compliance and history.

Integrate Email Platforms for Better Deliverability

If you already use external email platforms, you can sync them with GHL.

Supported providers

- Gmail

- Outlook

- Office 365

- Custom SMTP

How to set it up

- Go to Settings → Email Services.

- Connect your email provider.

- Verify domain for high deliverability.

This centralizes conversations and improves inbox visibility.

Connect Payment & Billing Systems (For Fees You Control)

Carriers handle premiums, but your agency may charge:

- Setup fees

- Broker fees

- Consultation fees

- Administrative fees

Payment processors you can integrate

- Stripe

- PayPal (through funnel embeds)

- NMI

- Authorize.net

How to integrate

Go to Settings → Payments.

Connect Stripe or NMI.

Create:

- Checkout pages

- Payment links

- Recurring subscriptions

Automation example

Payment completed →

Add tag “Fee Paid” →

Trigger onboarding workflow.

Integrate Document Management Platforms

If you store files elsewhere:

Platforms

- Google Drive

- Dropbox

- OneDrive

How to integrate

Use Zapier to:

- Upload new signed documents to Drive

- Create folders per client

- Sync uploaded funnel documents to your storage

Your documents stay organized while GoHighLevel holds the client-facing pieces.

Integrate Calendars for Smooth Scheduling

Every agent should sync at least one external calendar.

Supported calendars

- Google Calendar