Running an accounting firm means constantly juggling:

- leads

- client communication

- deadlines

- document collection

- tax filings

- compliance updates

- and recurring monthly work.

Without the right system, it’s easy for tasks to slip through the cracks – especially during tax season or the month-end rush.

GoHighLevel for Accountants helps you simplify and automate all the moving parts of your accounting workflow.

You can:

- manage leads

- onboard clients

- request documents

- collect payments

- schedule meetings

- track monthly deliverables

- and automate follow-ups from one centralized platform.

Whether you handle bookkeeping, taxes, payroll, audits, or financial consulting, GoHighLevel gives you a clear, structured, and automated way to manage your daily work.

This guide shows you exactly how to set up GoHighLevel for your accounting business so you can save more time, reduce stress, and give your clients fast, reliable, and professional service every time.

TL;DR: How GoHighLevel Transforms Your Accounting Firm

- GoHighLevel helps accountants automate onboarding, document collection, payment reminders, compliance follow-ups, and monthly/quarterly deliverables.

- You can build pipelines for bookkeeping, taxes, payroll, audits, and advisory services.

- Email + SMS automation keeps clients responsive, organized, and on track with deadlines.

- The CRM stores every client’s details, tasks, communication, and files in one place.

- This guide walks you step-by-step through how to use GoHighLevel to streamline your accounting workflow and deliver an excellent client experience.

How to Set Up GoHighLevel for Accountants – (Step by Step Tutorial)

Let’s get straight to the point – first, we’ll set up your account, then I’ll walk you through all the strategies you can use.

This is how to set it up:

Step 1: Create HighLevel Account for 30 Days Free

Since you’re just starting with GoHighLevel, you would need to properly set up your account.

And you can do that for free through our exclusive 30-Day Free Trial link here.

In order to start, head over to gohighlevel.com/30-day-free-tial free trial and click on “30 DAY FREE TRIAL” as you can see below.

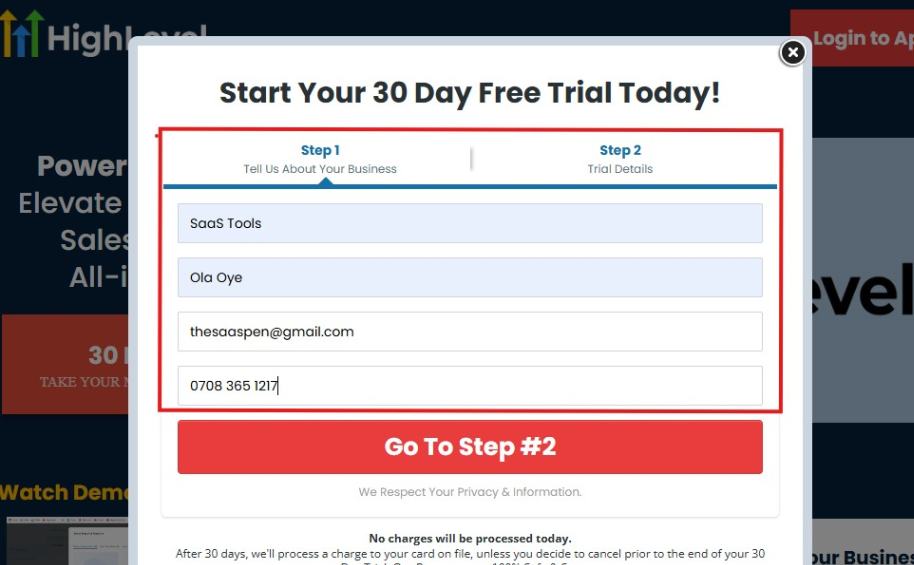

Upon clicking on “30 DAY FREE TRIAL“, a page will pop that looks exactly like the image below.

If you take a closer look at the image above, you will see that you need to supply your:

- Business name

- Company name

- Company email

- Phone number

Supply all the pieces of information and click on “Go To Step #2.”

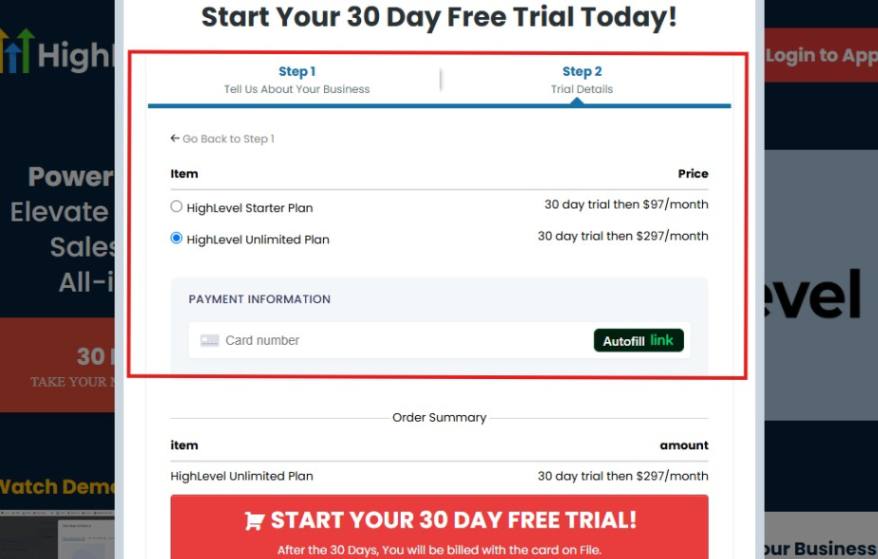

On the next page, you will be required to select the plan you want to opt in for.

As you can see from the image above, you can either choose from:

- HighLevel Starter Plan

- HighLevel Unlimited Plan

Select the HighLevel Unlimited Plan and continue – you can always upgrade to the SaaS Mode later if you want that or downgrade.

The next thing you want to do is supply your credit card information.

Note: You will not be debited anything today until the end of your trail that is if you don’t cancel. Keep in mind that $1 will be debited and refunded back instantly into your account just to test your card is working.

After you have supplied the information accordingly, click on “START YOUR 30 DAY FREE TRIAL” and you will be asked to confirm you’re not a robot.

After that, the page below will pop up.

The image above says, “Your Account has been created!” Now, you need to click on the blue button that says “Click Here to Get Started.“

Click on the blue button to start your onboarding process.

Step 2: GoHighLevel Onboarding Process

The onboarding questions help GoHighLevel understand why you have signed up for the platform so that it can tailor your experience accordingly.

This is all you need to do:

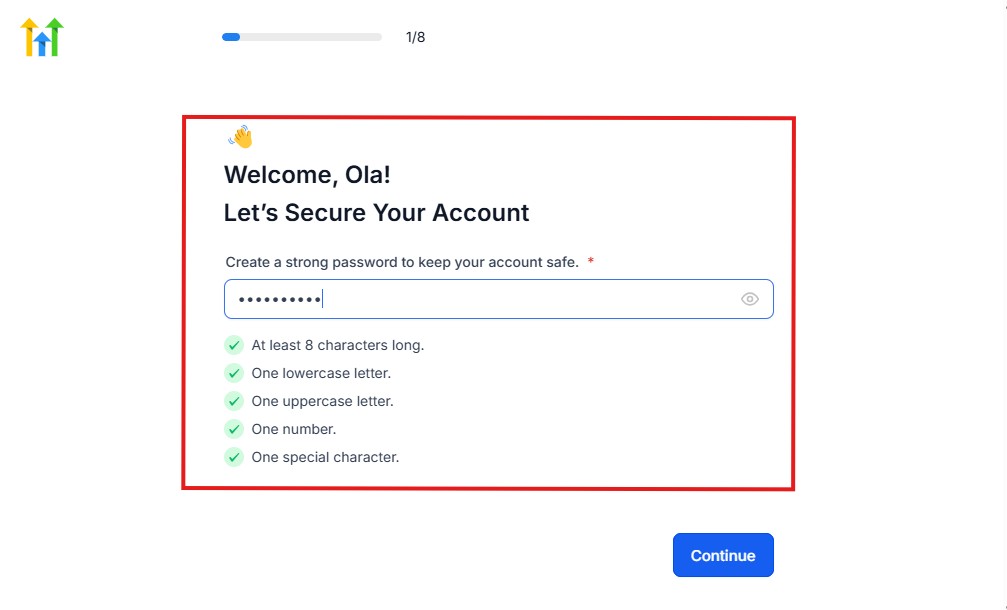

After you click on the blue button above, the page below will pop up.

As you can see above, you need to set up your password, and the password has to be:

- At least 8 characters long

- One lowercase letter

- One uppercase letter

- One number

- One special character

If you have input the password and it matches all the description above, everything will be green just the way it’s in the image.

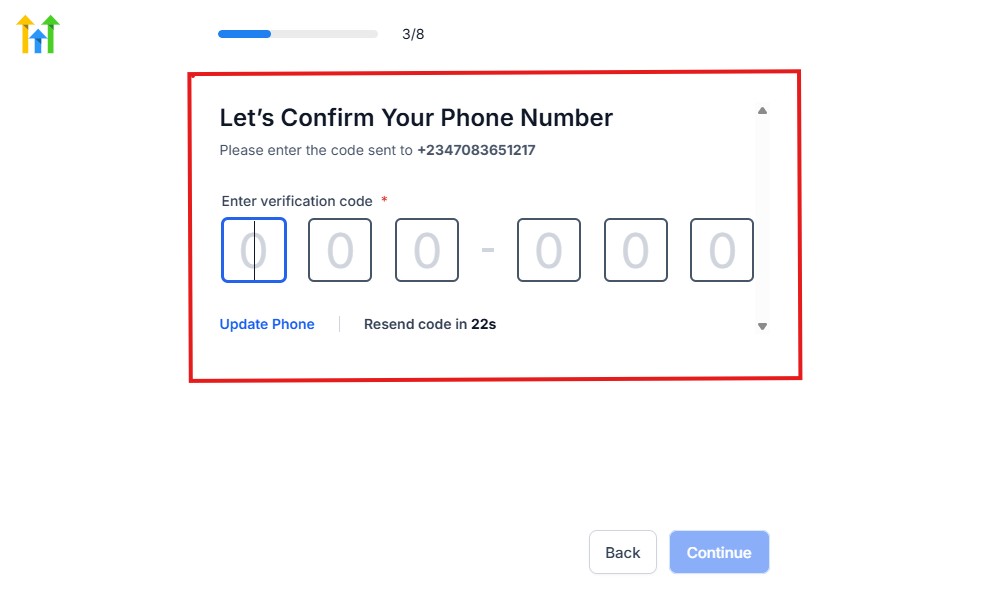

Click on “Continue” there after, and the image below will pop up.

As you can see, a code will be sent to you to confirm your email address and phone number. The process is the same for the 2.

The next thing you need to do is to select how you plan to use GoHighLevel, as you can see below.

Select what best matches why you have signed up and click on Continue.

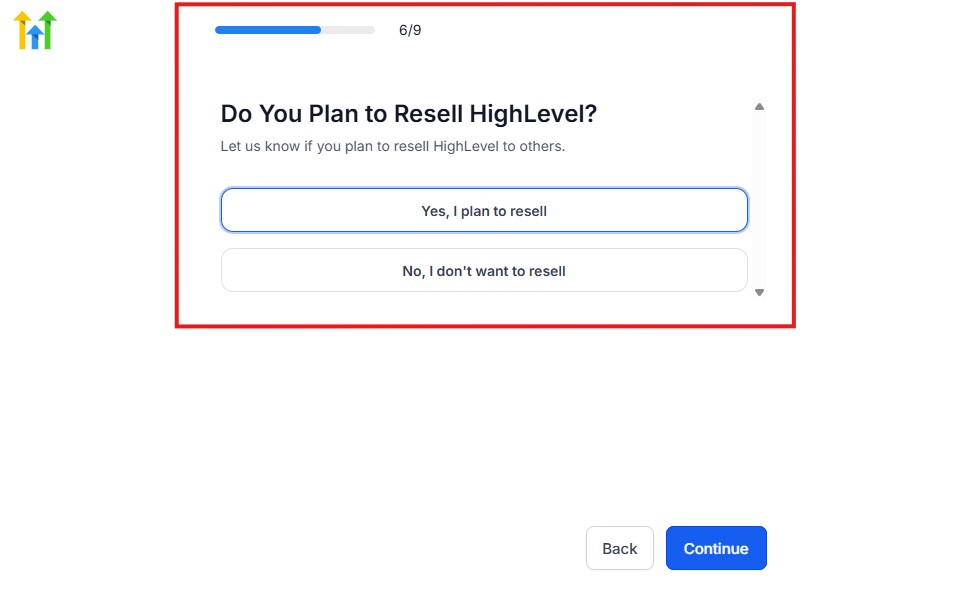

On the next page, you will be asked if you plan to resell GoHighLevel or not.

Select the answer based on the reason why you have signed up and click on “Continue”

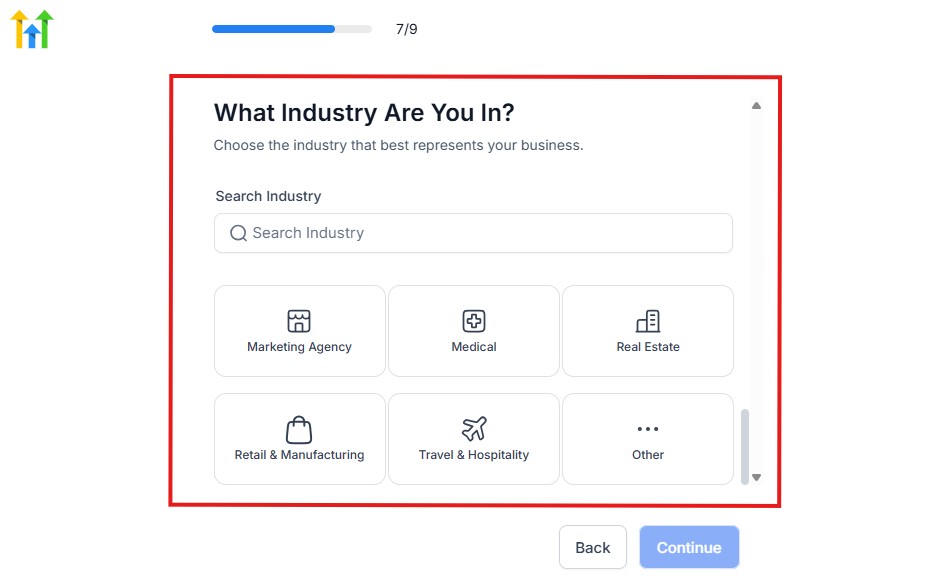

Then, the page below will pop up.

From the image above, you need to select the industry that you fall on. You can also make use of the search button if you can’t find it right away.

Then, click on continue after you select your industry.

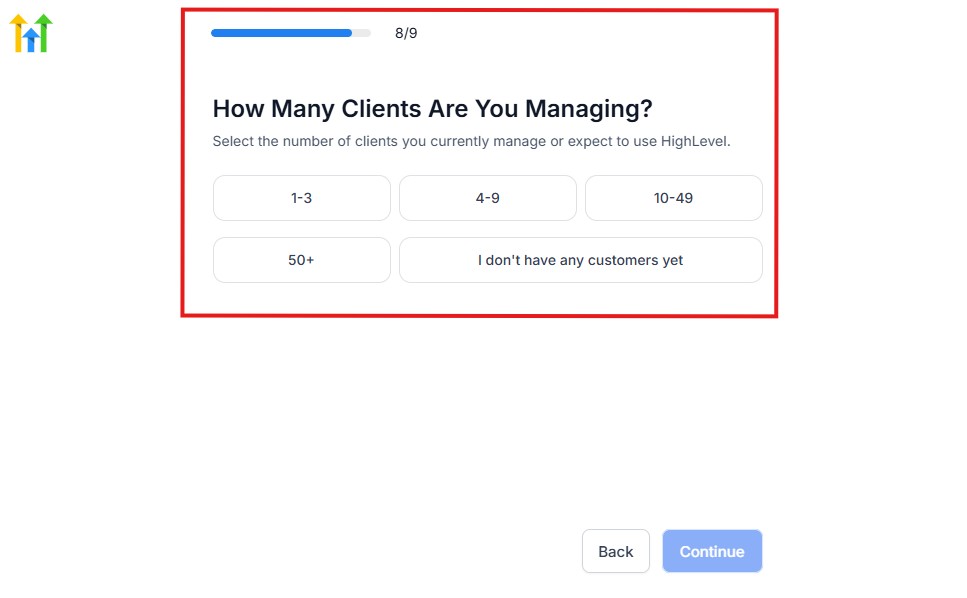

Then, the next thing you need to do is to select the number of clients that you currently have. Select “I don’t have any customers” yet if you currently don’t have one.

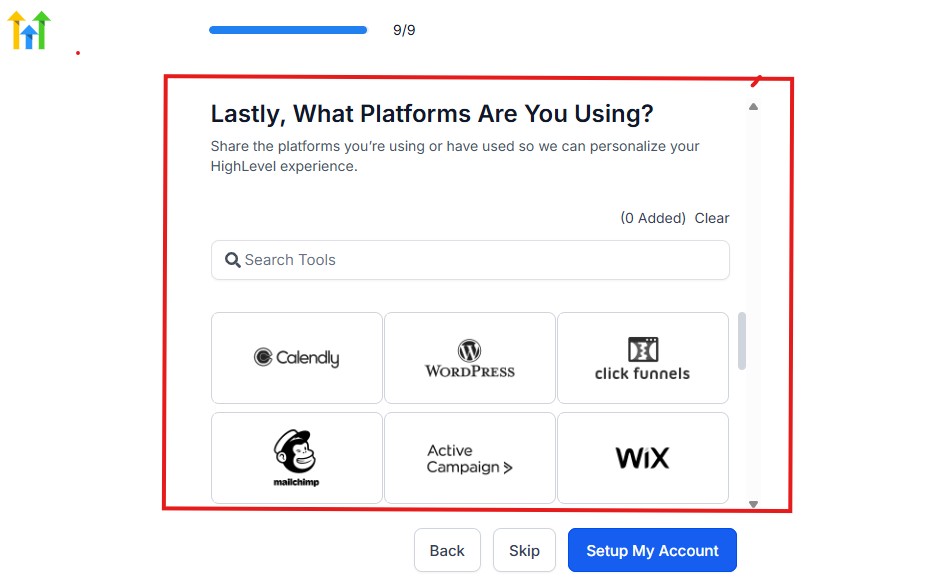

On the next page, you will be asked to select the platforms you currently use that you can integrate with GoHighLevel right away.

You can use the search button to search for any tools you want to add to your GoHighLevel account.

You can also skip this process and do it later if you want to.

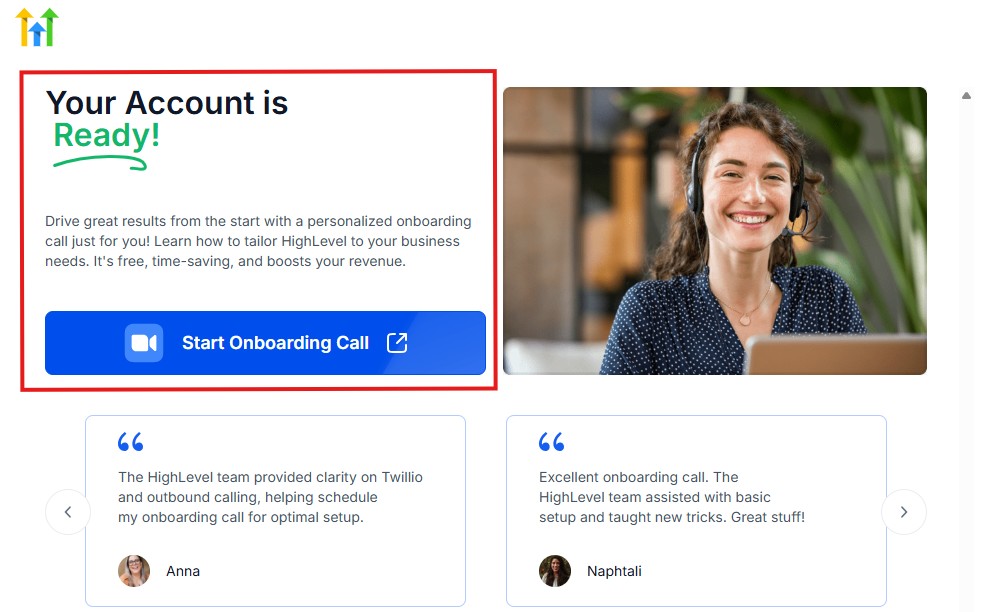

After that, the page below will pop up.

The page above says your account is ready and is asking you to “Start Onboarding Call.”

The “Onboarding Call” allows you to connect with the Go High Level team in order to discuss your account set-up process and everything regarding your plan in using HighLevel.

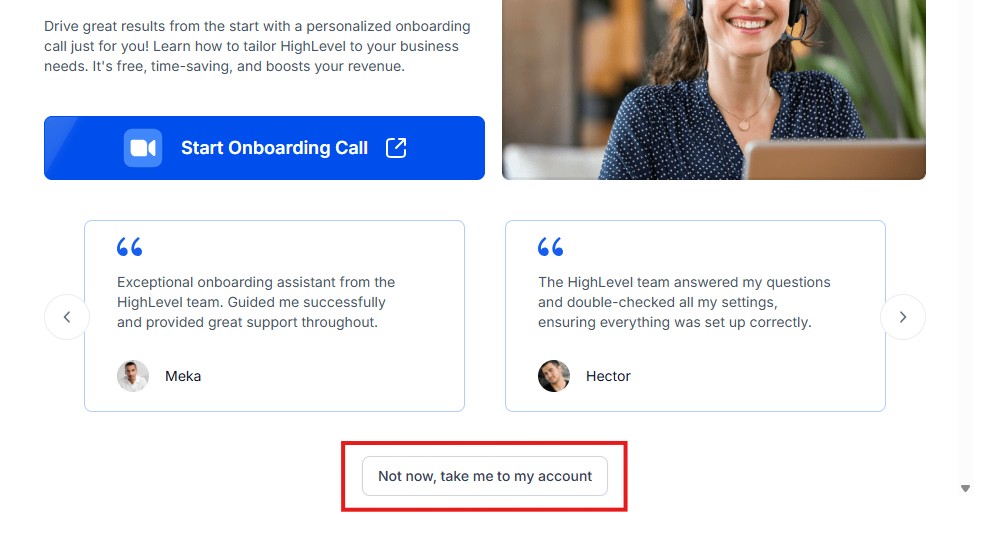

If you don’t want to start the “Onboarding Call” yet, just stroll down, and you will see the button in the image below.

Simply click on “Not now, take me to my account“, and you will have access to your dashboard.

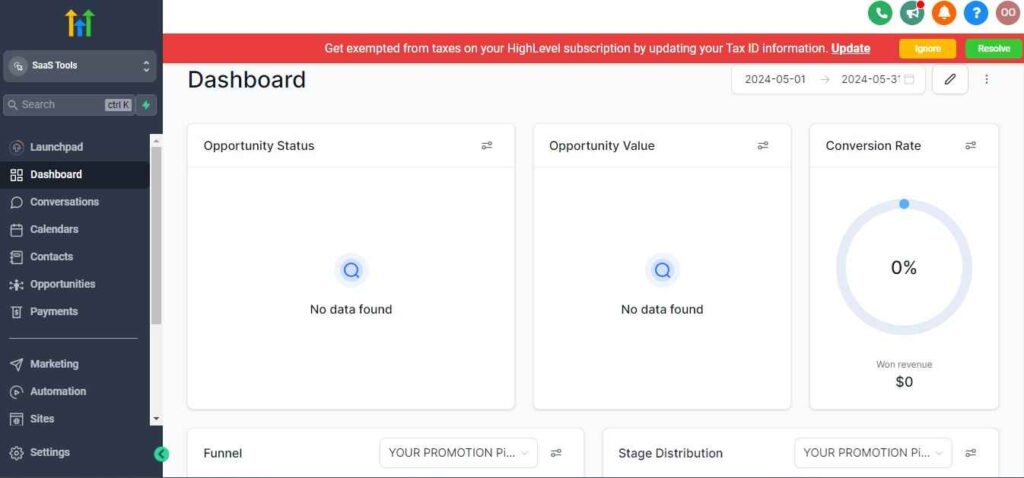

Note: If you have indicated that you want to resell HighLevel, you would have access to the agency dashboard by default, which looks like the image below.

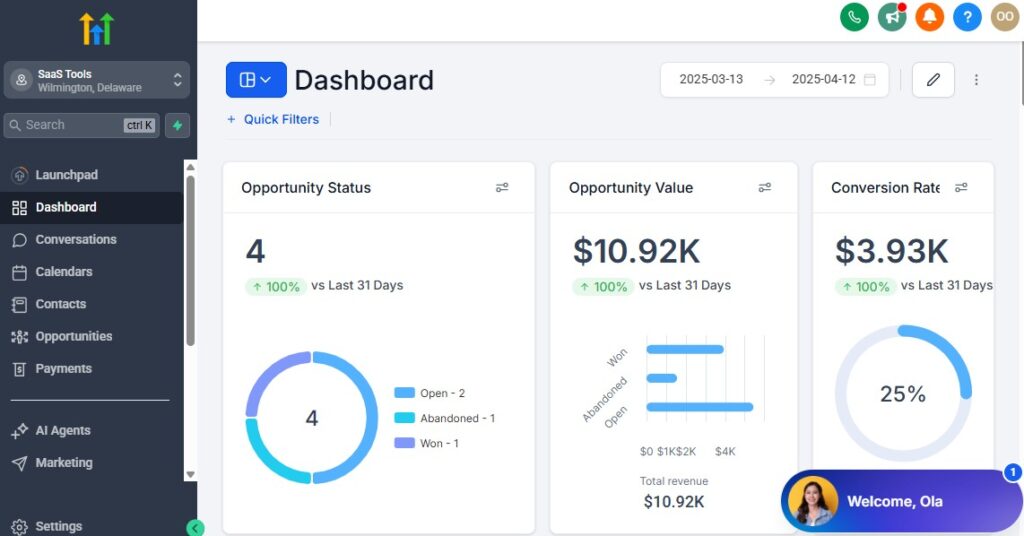

But if you didn’t indicate interest in reselling GHL, your dashboard will look like the image below.

You can switch between these dashboards at any time.

The data you see on the dashboard above are not real data, they’re snapshots that you can use to kickstart your account setup process.

I want to say congratulations. You have successfully set up your Go High Level account.

Step 3: Branding & Professional Firm Setup

Your accounting firm should look polished and trustworthy everywhere your clients interact with you. Set up your brand identity so every email, page, and message feels professional.

What to set up:

- Upload your firm logo

- Choose your brand colors

- Add your business name and address

- Set up your professional email signature

How to do it in GoHighLevel

- Go to Settings → Company Settings

- Upload your logo and color scheme

- Update your business contact details

- Add a custom email signature under Profile

A strong brand presence instantly builds trust with new clients.

Step 4: Set Up Your Domain & Professional Email

Accountants often deal with sensitive financial documents, so credibility matters. Using a custom domain and verified email protects your deliverability and improves trust.

What to set up:

- Custom domain (e.g., yourfirm.com)

- Subdomains for portals (e.g., clients.yourfirm.com)

- Verified sending email (you@yourfirm.com*)

How to do it

- Go to Settings → Domains and connect your domain

- Verify DNS (SPF, DKIM, DMARC) to improve email deliverability

- Go to Settings → Email Services to verify your sending email

This helps ensure your reminders and document requests never land in spam.

Step 5: Build CRM Foundations for Accounting Clients

Accountants manage various client types – monthly bookkeeping, annual tax clients, payroll clients, and business advisory clients. Structure your CRM so each client type is easy to track.

What to set up:

- Custom fields for tax info, business type, deadlines, financial year-end, etc.

- Tags for service type (Bookkeeping, Payroll, Tax Prep, etc.)

- Custom client categories (Business, Individual, SME, Corporate)

How to create them

Go to Settings → Custom Fields

Add fields like:

- EIN/Tax ID

- Financial year-end

- Entity type (LLC, S Corp, etc.)

- Payroll frequency

- Bookkeeping cycle (monthly, quarterly)

Go to Contacts → Bulk Actions → Add Tags to create segmentation tags

This structure helps you automate communication accurately.

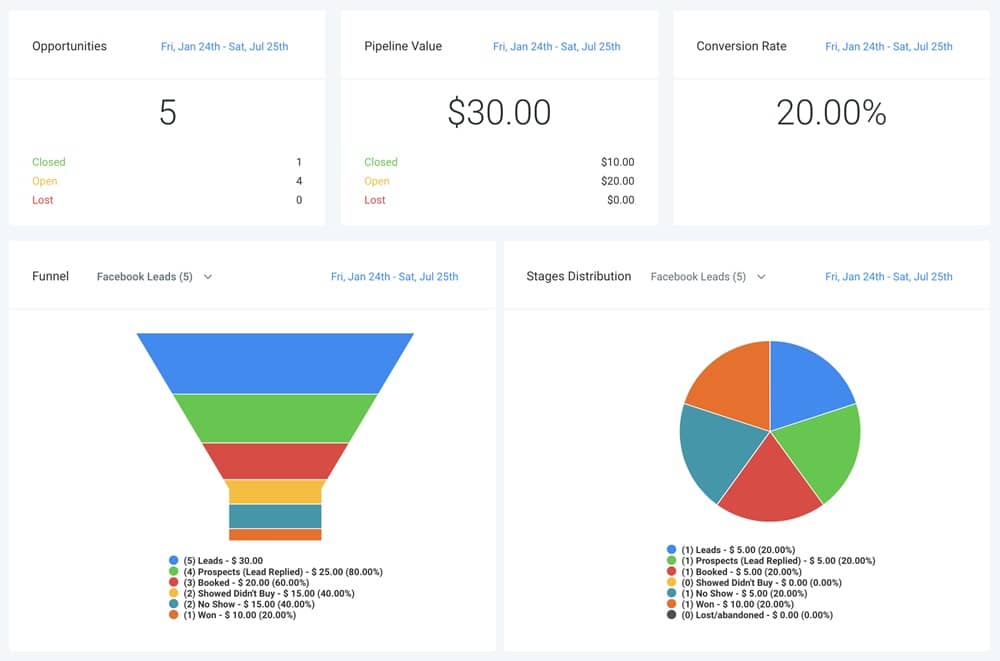

Step 6: Create Pipelines for All Your Accounting Services

Instead of mixing all clients together, create separate pipelines for each service category.

Suggested pipelines:

- Tax Preparation Pipeline

- Bookkeeping Cycle Pipeline

- Payroll Services Pipeline

- Audit Engagement Pipeline

- CFO/Advisory Services Pipeline

Each pipeline should include stages like:

- New Lead

- Discovery Call Booked

- Engagement Letter Sent

- Documents Requested

- Work in Progress

- Review Stage

- Completed

- Retainer/Recurring Client

How to build them

- Go to Opportunities → Pipelines → Create New Pipeline

- Add all stages for each service type

- Use triggers later to move clients between stages automatically

This makes your workflow cleaner and easier to manage.

Step 7: Set Up Segmentation With Tags & Custom Fields

Segmentation ensures your automations stay relevant and accurate.

Useful tags include:

- Individual tax client

- Business tax client

- Monthly bookkeeping

- Quarterly bookkeeping

- Payroll client

- High-priority

- Deadline approaching

- Requires document submission

How to tag clients automatically

- Use Workflows → Triggers → Form Submitted / Calendar Booked / Tag Added

- Add auto-tagging steps based on the service they choose

This helps you personalize your automation and follow-up messages.

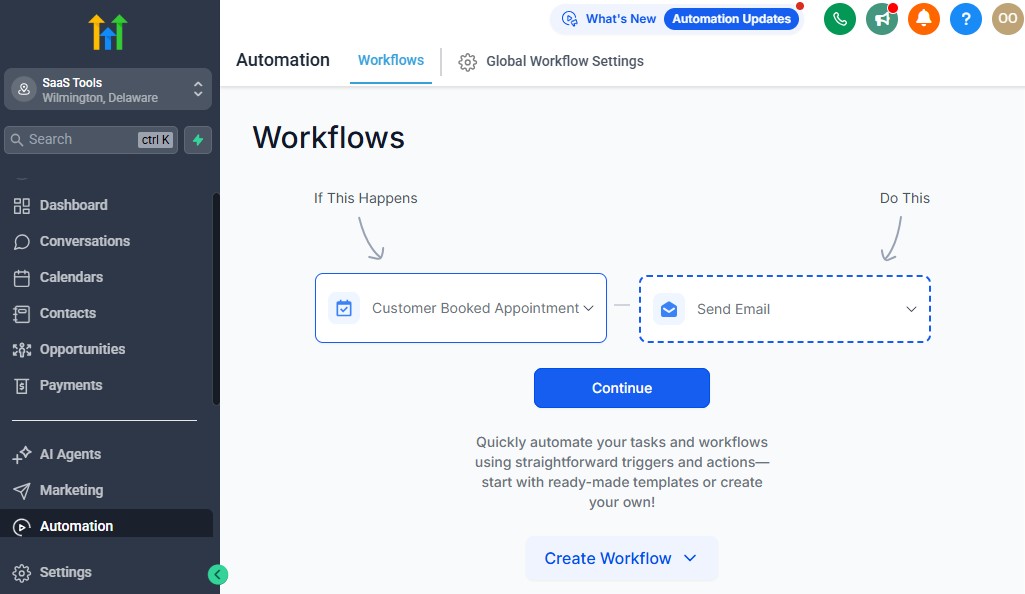

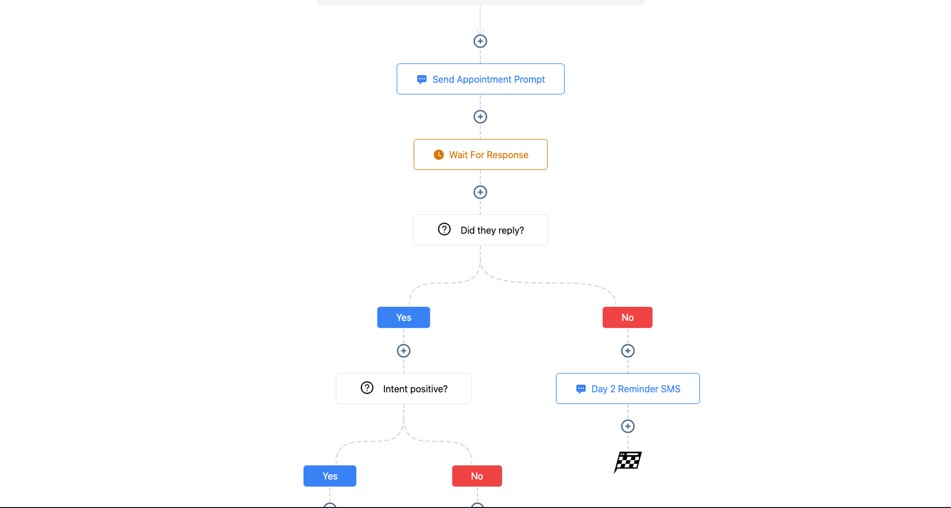

Step 8: Add Your Core Workflows for Client Management

Before building advanced automation, set up your essential workflows.

Essential workflows include:

- New client onboarding

- Document request automation

- Tax season reminders

- Recurring monthly bookkeeping tasks

- Payment reminder workflow

- Engagement letter + contract automation

How to get started

Go to Automation → Workflows → Create Workflow

Choose a trigger (Form Submitted, Tag Added, Stage Changed)

Add steps like:

- “Send Email”

- “Send SMS”

- “Wait Timer”

- “If/Else Condition”

- “Move to Pipeline Stage”

This builds a powerful system that handles client management automatically.

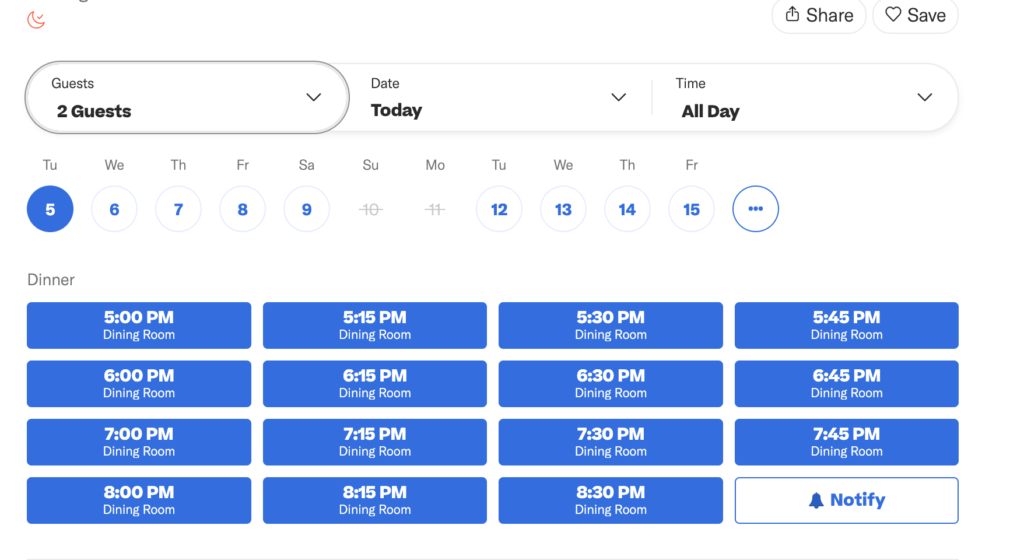

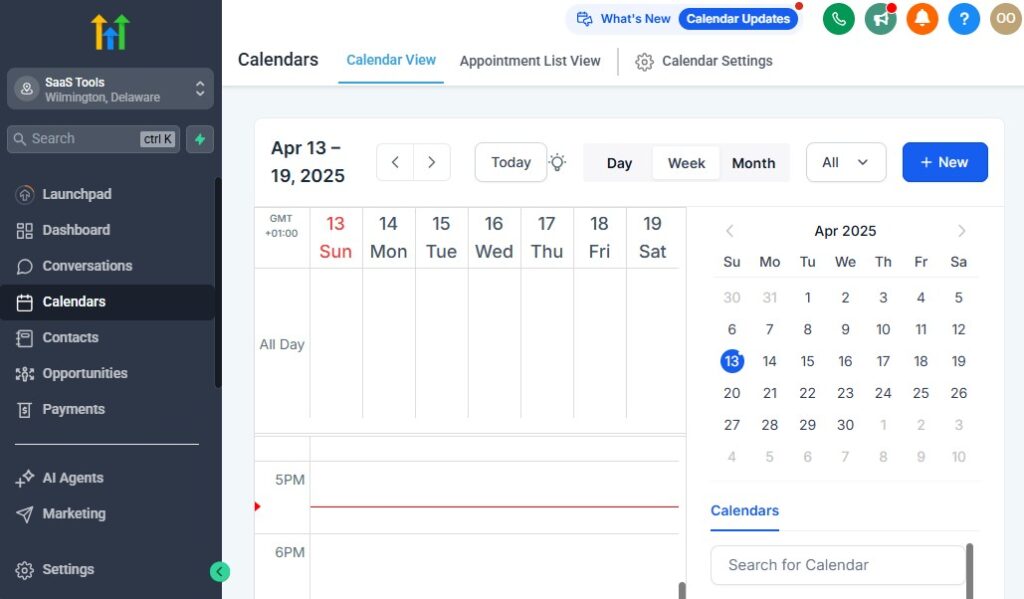

Step 9: Prepare Your Calendar System

Accountants need clear scheduling for:

- Discovery calls

- Tax review sessions

- Quarterly planning

- Monthly bookkeeping check-ins

- Corporate meetings

How to set it up

- Go to Calendars → Create Calendar

- Create a calendar for each type of meeting

- Add availability, buffers, and rescheduling rules

- Connect to Google or Outlook calendar

A clean calendar setup prevents double-bookings and improves client experience.

Step 10: Secure Your Communication Channels

Accountants handle sensitive financial information, so choose secure communication paths.

Enable:

- SMS

- Call forwarding

- Voicemail drops

- WhatsApp (if needed)

How to activate them

- Go to Settings → Phone Numbers to buy/select a number

- Connect WhatsApp or FB Messenger under Integrations

- Toggle communication channels inside your workflows

This ensures every message is logged and trackable for compliance.

By setting up these foundational elements correctly, you prepare your accounting firm for a smoother, automated, and highly professional client journey.

Managing Clients, Leads & Accounting Work with the CRM

Your CRM is the heart of your accounting workflow. When it’s organized properly, you’ll always know which clients need attention, which deliverables are due, and which leads are ready to convert.

This section shows you how to manage accounting clients inside GoHighLevel and gives you practical steps to implement everything smoothly.

Organize All Clients & Leads in One Central Dashboard

As an accountant, you manage multiple client types – individual taxpayers, small businesses, corporations, payroll clients, and monthly bookkeeping clients. Keeping everything in one CRM helps you avoid missed deadlines and communication gaps.

What this helps you do

- Track where every lead or client stands

- Instantly recall tax info, business details, or deadlines

- See all conversations in one place

- Keep financial notes or compliance logs attached to each profile

How to do it

Go to Contacts → Smart Lists

Create lists like:

- “Tax Clients”

- “Bookkeeping Clients”

- “Payroll Clients”

- “Prospects – Not Converted”

- “Quarterly Filers”

Use tags (created earlier) to auto-sort contacts into the correct list

Add custom fields to store accounting-specific information

This becomes your “command center” for all accounting work.

Build Detailed Client Profiles for Faster Work

Every client needs a profile filled with important data so you never have to dig through emails or spreadsheets.

What to store

- Contact details

- Business name + entity type

- Tax ID/EIN

- Financial year-end

- Filing deadlines

- Bookkeeping frequency

- Payroll schedule

- Compliance obligations

- Meeting notes

- Document links

- Engagement letter status

How to set it up

- Open any contact

- Click Custom Fields

- Add fields like:

- “Financial Year End”

- “Tax Client Type”

- “Business Type”

- “Required Documents Received?”

- Use the Notes tab for compliance-critical information

- Upload relevant documents under the Files tab

A fully detailed profile saves you hours during tax season and monthly cycles.

Use Pipelines to Track Client Work From Start to Finish

Accounting work is process-driven. Pipelines help you clearly see what’s pending, what’s in review, and what’s completed.

Examples of pipelines for accountants

Tax Preparation Pipeline

- New Inquiry

- Discovery Call Booked

- Engagement Letter Sent

- Documents Requested

- Reviewing

- Ready for Filing

- Filed/Completed

Bookkeeping Pipeline

- New Client

- Waiting on Documents

- Monthly Bookkeeping Started

- Reconciliation

- Review

- Sent to Client

- Completed

Payroll Pipeline

- New Hire Setup

- Payroll Pending

- Processing

- Approved

- Delivered

How to build them

- Go to Opportunities → Pipelines → Create Pipeline

- Add each stage in order

- Assign automatic stage changes inside workflows:

- e.g., when a client uploads documents → move to next stage

- e.g., when engagement letter is signed → move to “Onboarding”

This pipeline visibility ensures nothing slips through the cracks.

Track Monthly, Quarterly & Annual Deliverables Easily

Accounting runs on cycles – monthly reconciliations, quarterly tax tasks, annual filings. GoHighLevel lets you track them cleanly.

What to track

- Monthly bookkeeping tasks

- Quarterly estimated tax deadlines

- Sales tax filings

- Financial statement reviews

- Payroll cycles

- Year-end closeouts

How to do it

- Use Custom Smart Lists to filter clients based on due dates

- Set workflow triggers based on date fields like “Financial Year End”

- Use Recurring tasks inside workflows to remind you or your client

For example:

- Automatically send “Quarterly Tax Reminder” 15 days before due date

- Automatically notify you when monthly bookkeeping is due

This keeps everything running consistently.

Centralize All Communication for Better Compliance

Accountants must document communication for audit trails.

What centralizing communication does

- Stores all email

- Stores SMS

- Stores call logs

- Stores voice messages

- Stores WhatsApp/Facebook messages (if connected)

- Keeps a clean audit record for every client

How to use it

- Go to Conversations → Inbox

- Connect messaging channels via Settings → Integrations

- Send all client messages through GHL to keep communication logged

This helps you stay compliant and makes record-keeping painless.

Use Lead Scoring to Prioritize High-Value Prospects

Not all leads are equal – GoHighLevel helps you prioritize.

Why this matters

- High-value business clients

- Seasonal tax clients

- Recurring monthly retainer clients

- Corporate advisory clients

Lead scoring helps you focus on the most profitable opportunities.

How to do it

Inside Workflows, add conditions like:

- “If lead visited funnel page → +10 points”

- “If they booked a call → +20 points”

- “If they opened 3+ emails → +5 points”

Create tags like “Hot Lead,” “Warm Lead,” “Cold Lead”

Route hot leads to your call calendar automatically

This helps you close more leads faster.

Log Tasks & Deadlines Inside Each Client Profile

Accounting involves strict deadlines. Use GoHighLevel to never miss them.

What to track

- Tax filing deadlines

- Document due dates

- Payroll submission deadlines

- Bookkeeping delivery dates

- Meeting reminders

- Compliance follow-ups

How to set it up

- Open a contact

- Go to Tasks → Add Task

- Add deadline

- Assign to yourself or a team member

- Add automation to trigger follow-up reminders

This turns GHL into your deadline management system.

Automate Stage-Based Email & SMS Updates

Whenever a client moves to a new stage, GoHighLevel can send automatic updates.

Examples

- When documents are received → “Thanks! We’ll review shortly.”

- When tax return is ready for review → “Your filing is ready for approval.”

- When payroll is processed → “Payroll completed for this cycle.”

How to do it

Go to Workflows → Create Workflow

Choose trigger: When Opportunity Stage Changes

Add actions like:

- “Send Email”

- “Send SMS”

- “Add Task”

- “Update Field”

- “Notify staff member”

This keeps clients informed automatically and reduces back-and-forth messaging.

With your CRM set up this way, your accounting workflow becomes organized, predictable, and easy to manage – even during tax season.

Automating Client Onboarding, Document Requests & Tax Preparation

Accounting work depends heavily on deadlines, documents, communication, and consistency.

If you try to manage everything manually, clients will delay uploads, deadlines will sneak up on you, and bottlenecks will form – especially during tax season.

GoHighLevel helps you automate these critical steps so you stay organized, your clients stay responsive, and your workflow stays predictable.

This section explains exactly what to automate and how to set it up inside GoHighLevel.

Automate New Client Onboarding

A smooth onboarding experience builds trust from the very beginning. Instead of manually sending welcome emails or chasing clients for basic information, GoHighLevel can handle all of it automatically.

What your onboarding workflow should include

- Welcome email + introduction

- Instructions on next steps

- Link to complete an intake form

- Calendar link for a kickoff call

- Engagement letter or contract

- Payment/deposit (if applicable)

- Document checklist

How to automate onboarding in GoHighLevel

Go to Automation → Workflows → Create Workflow

Choose the trigger: Form Submitted, Tag Added, or Pipeline Stage Changed

Add steps:

- “Send Email: Welcome + Next Steps”

- “Send SMS: Thanks for joining our firm!”

- “Wait Step: 1 hour”

- “Send Form: Intake Questionnaire”

- “Send Link: Contract/Engagement Letter”

- “Move to Pipeline Stage: Onboarding”

Save and activate the workflow

This creates a consistent experience for every new client – even when you’re busy.

Automate Document Requests

Document chasing is one of the most time-consuming tasks for accountants. You need W-2s, 1099s, receipts, bank statements, payroll reports, and financial records – all submitted on time.

GoHighLevel can request, follow up, and remind clients automatically.

What to automate

- Initial document checklist

- Secure file upload link

- Weekly reminders

- Deadline notifications

- Alerts when documents are missing

- “Thanks, we received your file!” confirmation messages

How to automate document requests

Create a “Document Checklist” email template

Use a file upload tool (Google Drive, Dropbox, Jotform, etc.)

Inside Workflows, create triggers:

- Tag Added: Documents Needed

- Form Not Completed

- No reply after 3 days

Add steps:

- “Send Email: Please upload the following documents…”

- “Wait 3 days”

- “If/Else: Documents Uploaded?”

- If NO → send reminder

- If YES → move to next pipeline stage

How to help the reader implement this

Tell them to:

- Create a “Documents Needed” tag for each service type

- Build separate checklists for tax clients, bookkeeping clients, and business clients

- Connect their upload forms to GoHighLevel so notifications and workflow steps fire automatically

This eliminates 80–90% of manual document chasing.

Automate Engagement Letter & Contract Signing

Every accounting engagement requires agreements. Instead of sending them manually, GoHighLevel can handle the process from start to finish.

What to automate

- Engagement letter delivery

- Signature reminders

- Signed document confirmation

- Move client to next pipeline stage

- Trigger payment request once signed

How to do it

Prepare your contract in PandaDoc, DocuSign, or Jotform Sign

Create a workflow with trigger: Tag Added: Engagement Letter Sent

Add steps:

- “Send Email: Please review and sign your engagement letter”

- “Wait 2 days”

- “If/Else: Contract Signed?”

- If NO → send reminder

- If YES → move to “Documents Requested” stage

This ensures your contracts are signed quickly without chasing clients.

Automate Tax Preparation Workflows

Tax preparation is deadline-driven and repetitive. Automation ensures each client gets the right reminders, on time, every year.

What to automate for tax prep

- Pre-season reminders

- Intake questionnaire

- Document uploads

- Signature requests

- Payment reminders

- “Your return is ready for review” email

- Filing confirmation

- Post-filing follow-up

- Next-year reminders

How to build a tax-prep workflow

Trigger:

- Tag Added: Tax Client

- OR Date-Based Trigger: January 1

Add steps:

- Send “Tax Season Begins” notification

- Send intake form

- Send document checklist

- Send reminders every 3–5 days

- Move to “Ready for Review” when files are received

- Send “Your return is ready” message

- Move to “Filed/Completed” when done

Add a long-term reminder:

- “Wait 11 months → Send: It’s almost time for next year’s tax prep”

Why this helps

Your clients stay on track, deadlines don’t get missed, and your team works more efficiently.

Automate Recurring Bookkeeping Cycles

Monthly bookkeeping is repetitive – but predictable. Automation keeps your workflow consistent every month.

What to automate

- Month-end reminders

- Bank statement requests

- Reconciliation alerts

- Review stage updates

- Monthly financial report delivery

- “Next month’s cycle begins” notification

How to automate it

Use a Date-Based Trigger tied to “Bookkeeping Frequency”

Add steps for:

- Document request

- Workflow pause

- Reconciliation stage

- Review stage

- Delivery email

- Follow-up scheduling

This automates your monthly bookkeeping cycle from start to finish.

Automate Payment Requests & Reminders

Clients forget invoices – automation solves that.

What to automate

- Payment links

- Overdue reminders

- Subscription renewals

- Retainer renewal reminders

How to set it up

Connect Stripe

Create a workflow triggered by:

- “Invoice Created”

- “Invoice Overdue”

Add payment reminders:

- “Your invoice is due today”

- “Invoice overdue by 3 days”

- “Final reminder”

You collect payments faster and eliminate uncomfortable follow-ups.

Automate Client Status Updates

Accounting clients love regular updates because the process is often invisible. Automations help keep them informed without adding extra work for you.

What to automate

- “Documents received”

- “Bookkeeping in progress”

- “Tax return being prepared”

- “Return ready for review”

- “Filed successfully”

How to implement it

- Use Stage Change triggers inside workflows

- Add personalized SMS or email updates at each stage

Clients feel supported and confident throughout the journey.

The Result: A Fully Automated Accounting Workflow

When you automate onboarding, document collection, contracts, tax prep, and bookkeeping cycles, your firm becomes:

- Faster

- More organized

- Less stressful

- More profitable

- More client-friendly

You eliminate repetitive tasks, reduce bottlenecks, and deliver a world-class accounting experience – from onboarding to year-end filing.

Appointment Scheduling for Consultations, Reviews & Tax Meetings

Scheduling is one of the most important parts of running an accounting firm.

Clients need consultations, tax reviews, quarterly planning, payroll discussions, and year-end meetings – often during tight deadlines.

GoHighLevel helps you eliminate back-and-forth messaging and keeps your calendar organized so every appointment feels smooth and professional.

This section explains exactly what to schedule, and how to set it up inside GoHighLevel so clients can book appointments easily while you stay in control of your availability.

Create Dedicated Calendars for Each Accounting Service

Instead of putting all meetings into one calendar, create separate calendars for each type of appointment. This gives clients clarity and prevents scheduling conflicts.

Useful calendars for accountants

- Discovery/consultation calls

- Tax preparation meetings

- Annual tax reviews

- Quarterly planning sessions

- Monthly bookkeeping check-ins

- Payroll meetings

- Corporate advisory sessions

How to set them up

- Go to Calendars → Create Calendar

- Choose Round Robin (for teams) or Single User

- Name the calendar (e.g., Tax Review Call)

- Set location: Zoom, Google Meet, phone call, or office visit

- Add availability blocks

- Add buffers before/after appointments

- Connect your Google or Outlook calendar

This gives each service its own space and reduces booking mistakes.

Use Time Buffers to Avoid Overlapping Meetings

Accounting meetings often require preparation or follow-up work. Buffers ensure you’re never rushed.

Why buffers matter

- You get time to prepare documents

- You avoid back-to-back calls

- You reduce meeting fatigue

- You leave room for overruns

How to add buffers

- Open your calendar settings

- Add “15-minute before” and “15-minute after” buffers

- Increase it to 30–45 minutes for complex sessions like tax planning

This creates a healthier, more manageable schedule.

Automate Booking Confirmations

Once a client books, GoHighLevel can immediately send a full confirmation with every detail they need.

What the confirmation should include

- Meeting date & time

- Meeting type (tax review, bookkeeping, planning call, etc.)

- Location or video link

- Preparation instructions

- Required documents

- Rescheduling link

How to automate it

- Inside the calendar settings, enable “Send Confirmation Email/SMS”

- Customize the templates under Marketing → Templates → Emails/SMS

- Add a workflow trigger:

- Trigger: Appointment Booked

- Send additional instructions automatically

This helps clients arrive ready and reduces confusion.

Use Automated Reminders to Reduce No-Shows

Reminders keep your schedule tight, especially during tax season.

Recommended reminder schedule

- 24 hours before

- 2 hours before

- 15 minutes before

How to automate reminders

- Go to your calendar

- Enable built-in reminders

- Create a workflow with trigger:

- Appointment Reminder

- Add SMS + email reminder messages

This dramatically reduces missed meetings and protects your time.

Give Clients Easy Rescheduling Options

Clients occasionally need to change meeting times. GoHighLevel lets them reschedule without contacting you.

Why this matters

- Clients appreciate flexibility

- You avoid back-and-forth messages

- Your schedule stays accurate

How to enable this

In Calendar → Settings, toggle “Allow Rescheduling”

Add rules:

- Minimum notice (e.g., 12–24 hours before)

- Limit same-day changes

- Block last-minute cancellations

This keeps your calendar predictable.

Use Multi-Location Calendars for Firms With Offices

If your firm works across locations or you meet clients in different cities, set up multi-location calendars.

How to use them

- Create a new location under Settings → Business Info → Locations

- Assign each calendar a specific address

- Let clients choose their preferred location during booking

Great for firms with multiple branches or service areas.

Sync GoHighLevel With Google or Outlook Calendars

Calendar syncing ensures your accounting schedule doesn’t conflict with personal events or other meetings.

How to sync

- Go to Settings → Profile → Calendar Sync

- Connect Google or Outlook

- Select which calendars to sync

- Enable two-way sync

Now all your meetings stay consistent everywhere.

Use Intake Forms Before the Meeting

You can make calls more productive by collecting information before the appointment.

What to include

- Business type

- Financial year-end

- Filing needs

- Challenges or questions

- Required documents

- Service they’re interested in

How to implement it

- Create a form under Sites → Forms

- Add it to your booking confirmation workflow

- Send automatically after booking

This helps every meeting start with clarity.

Route Appointments Automatically in Teams

For firms with multiple accountants or tax preparers:

Use round-robin scheduling

- Distribute leads across your team evenly

- Assign specific services to specific team members

- Automatically notify the assigned accountant

How to set it up

- Go to Calendars → Create Calendar → Round Robin

- Add team members

- Set weights (equal or priority-based)

- Connect to workflows for notifications

This keeps your team efficient and eliminates manual assignment.

Automate Follow-Up Tasks After the Meeting

After the consultation, GoHighLevel can automatically trigger tasks.

What to automate

- Document checklists

- Proposal/engagement letter

- Payment link

- Pipeline stage update

- Reminder for next meeting

- Assign internal tasks to your team

How to implement it

Create a workflow

Trigger: Appointment Status = Completed

Add steps for:

- Email/SMS follow-up

- Add internal tasks

- Move to next stage in pipeline

This ensures every meeting leads to action.

The Result: A Stress-Free, Organized Accounting Schedule

With a proper scheduling system inside GoHighLevel, you get:

- Fewer missed meetings

- Faster onboarding

- More organized client communication

- A predictable workflow

- A professional experience your clients appreciate

- More time for actual accounting work

Your calendar becomes your automated assistant – handling booking, reminders, preparation, and follow-ups while you stay focused on client results.

Building High-Converting Funnels for Accounting Services

Your accounting services become much easier to sell when prospects travel through a focused, distraction-free funnel that guides them from interest → trust → booking → onboarding.

Instead of sending people to a busy homepage, GoHighLevel lets you build simple, high-converting funnels tailored to each accounting service you offer.

This section explains what funnels to build, why they matter, and how to create them step-by-step inside GoHighLevel so your firm consistently attracts quality clients.

Create Separate Funnels for Each Accounting Service

Different services attract different types of clients, so each service needs its own dedicated funnel.

High-converting funnels accountants should create

- Tax Preparation Funnel (individual or business)

- Monthly Bookkeeping Funnel

- Payroll Services Funnel

- CFO/Financial Advisory Funnel

- Audit & Compliance Funnel

- New Business Setup Funnel

- Corporate Tax Planning Funnel

Each funnel speaks directly to the client’s problem and offers the next step clearly.

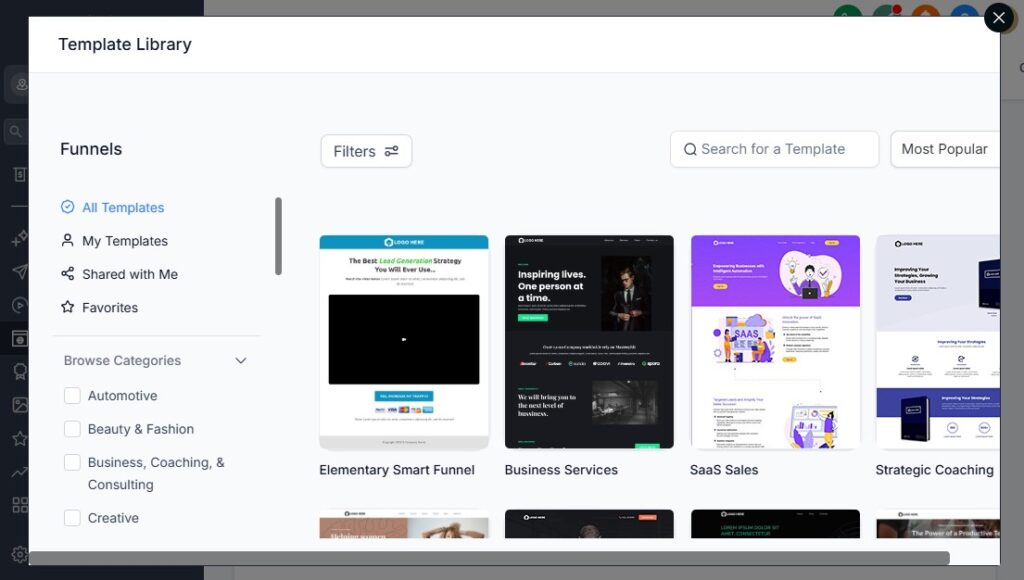

How to build separate funnels

Go to Sites → Funnels → Create Funnel

Name it based on service (e.g., “Business Tax Funnel”)

Add funnel steps:

- Landing page

- Lead magnet / checklist

- Booking page

- Thank-you page

Connect the funnel to the correct workflow

Add tags to segment leads coming from each funnel

This ensures every visitor enters the right sales path and receives relevant follow-up.

Use Strong Landing Pages That Speak to Your Client’s Pain Points

Accounting clients are often stressed about:

- Taxes

- Cash flow

- Deadlines

- Payroll compliance

- Mismanaged books

Your landing pages should speak directly to these issues.

What to include on each landing page

- Clear headline (“Get Professional Tax Filing Without Stress”)

- Quick explanation of what you do

- Benefits in bullet points

- Your unique value (fast turnaround, fixed fees, accuracy)

- Client reviews or trust badges

- A simple call to action (“Book a Free Consultation”)

How to build it in GoHighLevel

- Go to Sites → Funnels → Select Funnel → Edit Page

- Use the drag-and-drop builder

- Add your headline, list of services, and CTA button

- Insert social proof or reviews

- Add your form or calendar link

The simpler your landing page, the higher your conversions.

Add Lead Magnets to Capture High-Quality Prospects

Accounting is trust-based. A lead magnet helps you capture leads even if they aren’t ready to book immediately.

Effective lead magnets for accountants

- “Small Business Tax Deduction Checklist”

- “Top 10 Bookkeeping Mistakes to Avoid”

- “Quarterly Tax Prep Guide”

- “Payroll Compliance Checklist”

- “Year-End Financial Prep Template”

How to implement this

Create the lead magnet as a PDF

Upload it to GoHighLevel under Sites → Media

Build a two-step funnel:

- Step 1: Opt-in for the guide

- Step 2: Thank-you + booking CTA

Automate delivery using a workflow

Add the lead to your nurture sequence

This turns cold traffic into warm leads automatically.

Include a Strong, Simple Contact Form

Forms should be short so more people complete them.

What to include

- Name

- Phone

- Business name (optional)

- Service interested in

How to create your form

- Go to Sites → Forms → Create Form

- Add your fields

- Add hidden tags like “Tax Lead” or “Bookkeeping Lead”

- Embed the form on your landing page

This feeds leads directly into your CRM with correct segmentation.

Use Calendar Booking Pages for Direct Consultations

Many accounting clients are ready to book immediately. Sending them to a calendar increases conversion dramatically.

How to set it up

Create a calendar for your consultation call

Insert it as the final step in your funnel

Add automation that triggers after a booking:

- Confirmation email

- SMS reminder

- Intake form

- Pipeline stage change

This removes friction and helps clients move forward fast.

Add Trust Elements to Increase Conversions

Accounting is a credibility-heavy industry. Strengthen your funnel with trust signals.

Add elements such as

- Reviews and testimonials

- Certifications (CPA, EA, CMA, etc.)

- Company awards

- “Serving clients since…” badges

- Case studies

- Client logos (if applicable)

- Compliance statements (e.g., “Your data is secure and encrypted”)

How to add them

- Add a Testimonials section in the funnel builder

- Embed Google reviews

- Add logos from trusted partners

The more trust you display, the easier it is for leads to convert.

Use Upsells for Additional Accounting Services

Once someone downloads a guide or books a call, show them related offers.

Examples

- Add “Payroll Setup” upsell after Tax Prep funnel

- Add “Monthly Bookkeeping Discount” after a consultation booking

- Add “Corporate Tax Planning Session” after a guide download

How to add this

- Create a new funnel step (Upsell page)

- Add a special offer

- Add a CTA linking to a booking calendar or payment page

- Create a tag-based workflow trigger

This increases your revenue per lead.

Attach Each Funnel to an Automation Workflow

The funnel collects the lead – your workflow converts them.

What your workflow should do

- Send a confirmation email

- Deliver lead magnets

- Send follow-up messages

- Remind them to book a call

- Tag leads correctly

- Notify you or your team

- Move leads to the correct pipeline stage

How to attach it

- Open your funnel

- Go to the step with the form

- Select “Automation: Add to Workflow”

- Choose the correct workflow

This ensures every lead receives consistent, automated communication.

Test Your Funnel Before Going Live

Always test your funnel end-to-end.

What to check

- Form submissions

- Calendar booking

- Email/SMS automation

- Thank-you pages

- Funnel links

- Mobile responsiveness

How to test it

- Open your funnel

- Preview it

- Submit a test form

- Check your inbox and CRM

Fix any broken steps before launching.

The Result: A Funnel System That Attracts and Converts Accounting Clients

With high-converting funnels in place, you get:

- More qualified leads

- Higher consultation bookings

- Better service segmentation

- Faster conversions

- A predictable pipeline of accounting clients

- A fully automated lead-to-client journey

Your firm becomes easier to scale because your marketing and lead capture run on autopilot.

Running Email & SMS Marketing Campaigns for Accounting Clients

Marketing is what keeps your accounting pipeline full year-round.

The challenge is that most prospects don’t convert immediately – especially business owners, busy executives, or individual taxpayers who wait until deadlines get close.

This is where GoHighLevel becomes powerful.

It helps you automate email and SMS campaigns that nurture prospects, educate clients, share reminders, and move leads toward booking or submitting documents.

This section explains what campaigns to run, why they matter, and exactly how to build them inside GoHighLevel so your firm stays top-of-mind all year.

Use Email & SMS as Your Core Accounting Communication Channels

Email works well for detailed messages, reports, and educational content. SMS works best for reminders, deadlines, and quick prompts – especially during tax season.

Why both channels matter

- Email helps you educate and share value

- SMS boosts responsiveness and eliminates delays

- Using both increases conversions dramatically

How to set them up

- Verify your sending domain under Settings → Email Services

- Buy a phone number under Settings → Phone Numbers

- Connect business email (Gmail or Outlook) under Integrations

Now your campaigns avoid spam issues and reach clients quickly.

Create a 5–10 Step Nurture Sequence for New Leads

New leads need education and reassurance before they trust an accountant.

A nurture sequence helps you build credibility from day one.

What to include

- Introduction to your firm

- What makes your services different

- Common mistakes clients make

- Tax tips or bookkeeping advice

- Invitation to book a consultation

- Success stories or case studies

- Clear call-to-action to move forward

How to build it in GoHighLevel

Go to Workflows → Create Workflow

Trigger: Form Submitted, Funnel Viewed, or Tag Added

Add steps:

- Day 0: Welcome email

- Day 1: SMS – “Thanks for reaching out!”

- Day 3: Educational email

- Day 5: Case study

- Day 7: Offer consultation

Finish with a reminder email + booking link

This sequence warms cold leads into ready clients.

Run Tax Season Campaigns to Increase Bookings

Tax season is your busiest period – use automation to make it predictable and profitable.

Campaigns to set up

- “Tax Season Is Open” announcement

- Document checklist email

- Missing document reminders

- Filing deadline countdown

- Late-filer reminders

- Extension filing reminders

How to implement

Create date-based triggers:

- Trigger: Date = Jan 1

- Trigger: Date = March 1

- Trigger: One month before tax deadline

Add reminders:

- Email + SMS: “Upload your documents today.”

- Email: “Deadline approaching – don’t risk penalties.”

This keeps clients moving without you manually chasing anyone.

Build Quarterly Tax Planning & Compliance Campaigns

Business clients require year-round communication – not just at tax time.

Send quarterly:

- Estimated tax payment reminders

- Sales tax deadlines

- Payroll tax notices

- Quarterly financial review invites

How to build it

Use a Date-Based Workflow tied to client’s fiscal year

Add steps:

- “Send Email: Quarter 1 Tax Reminder”

- Wait 90 days

- “Send Email: Quarter 2 Reminder”

Add SMS nudges for critical deadlines

This builds trust and reduces compliance problems for your clients.

Create Campaigns for Monthly Bookkeeping Clients

Recurring bookkeeping clients appreciate structure and predictability.

Monthly campaigns to automate

- Bank statement reminders

- Transaction review reminders

- Payroll submission alerts

- “Your monthly bookkeeping is complete” updates

- Monthly financial summary or video recap

How to do it

Use Trigger: Date Based → Every Month

Add:

- Email requesting statements

- SMS reminder if no response

- “Work completed” email once done

Your workload becomes more consistent and clients stay engaged.

Use Educational Campaigns to Build Trust

Most prospects don’t understand accounting – they need guidance.

Educational campaign topics

- Deduction strategies

- Bookkeeping best practices

- Tax law changes

- Payroll compliance tips

- End-of-year checklist

- Business financial planning

- Audit preparation

- Expense categorization

How to build it

- Create a 6–12 month drip sequence

- Send 1 email every 2–4 weeks

- Add soft calls to action:

- “Need help? Book a consultation.”

This positions you as their go-to advisor.

Launch Reactivation Campaigns for Old Leads & Past Clients

Old clients = easiest clients to convert. Many simply forgot.

What to include

- “Are you still working on your taxes/bookkeeping?”

- “We noticed you didn’t finish your documents.”

- “Last-year clients get early access to tax prep slots.”

- “We can help you catch up on past financials.”

How to build it

- Create a Smart List for “Inactive Clients”

- Tag them with “Reactivation”

- Run a 3–7 message sequence (email + SMS)

This can bring back 5–20% of old clients easily.

Use SMS for High-Priority Deadlines

SMS has a 90%+ open rate. Use it for urgent messages.

Best uses

- Tax deadline reminders

- Missing document alerts

- Meeting reminders

- Compliance notices

- Payment reminders

How to implement

- Inside workflows, add “Send SMS” at key steps

- Keep messages short and direct

- Add booking or upload links

This improves client responsiveness immediately.

Add Personalization to Increase Conversion

Personalized emails convert better.

What to personalize

- Client name

- Business name

- Service type

- Deadlines

- Previous work done

- Relevant tax reminders

How to do it

Use Custom Fields with placeholders like:

- {{contact.name}}

- {{custom_value.tax_deadline}}

- {{custom_value.business_type}}

Clients feel like you’re speaking directly to them.

Trigger Marketing Based on Client Behavior

GoHighLevel lets you create dynamic campaigns based on actions:

Useful behavior triggers

- Opened an email

- Clicked a link

- Didn’t respond

- Didn’t upload documents

- Didn’t book a call

- Abandoned a funnel

- Viewed rates page

How to build behavioral marketing

Create workflow triggers:

- “Email Opened”

- “Link Clicked”

- “Form Not Completed”

Add appropriate follow-ups:

- SMS reminder

- Second offer

- Another CTA

This makes your marketing smarter and more effective.

Promote Seasonal Offers & Value-Added Services

Throughout the year, run campaigns for seasonal opportunities.

Examples

- Year-end financial review

- “Catch-Up Bookkeeping” promotion

- Sales tax season

- Payroll setup discounts

- Tax strategy consultations

- New business setup/LLC formation

How to implement

- Create a short 3–5 step email/SMS sequence

- Add urgency & scarcity (limited slots/dates)

- Link to your service funnel

These campaigns fill your calendar during quieter months.

The Result: Marketing That Runs Automatically & Brings Predictable Clients

When your email and SMS campaigns run smoothly, you get:

- More consistent leads

- More consultations booked

- More organized clients

- Faster document submission

- Higher retention rates

- Higher lifetime value

- A more scalable firm

Your accounting firm becomes a marketing machine – constantly attracting, educating, nurturing, and converting clients with very little manual effort.

Managing Payments, Engagement Letters & Contracts

Managing payments and contracts is one of the most sensitive parts of running an accounting firm.

You deal with retainers, recurring subscriptions, one-time tax filing fees, payroll services, advisory packages, and engagement letters for every client.

If you try to handle all this manually, you’ll waste time chasing signatures, reminding clients about overdue invoices, and tracking payments across multiple platforms.

GoHighLevel helps you automate the entire process – so clients sign faster, pay on time, and stay organized. This section covers what to set up, why it matters, and exactly how to implement each step inside GoHighLevel.

Collect Service Payments Seamlessly Through GoHighLevel

GoHighLevel lets you accept payments for:

- Tax preparation

- Monthly bookkeeping

- Payroll processing

- Corporate advisory services

- Year-end cleanup

- Catch-up bookkeeping

- New business setup

- One-time consulting calls

Why this matters

- Faster cash flow

- Fewer overdue invoices

- Less admin work

- Clients can pay anytime, anywhere

How to set it up

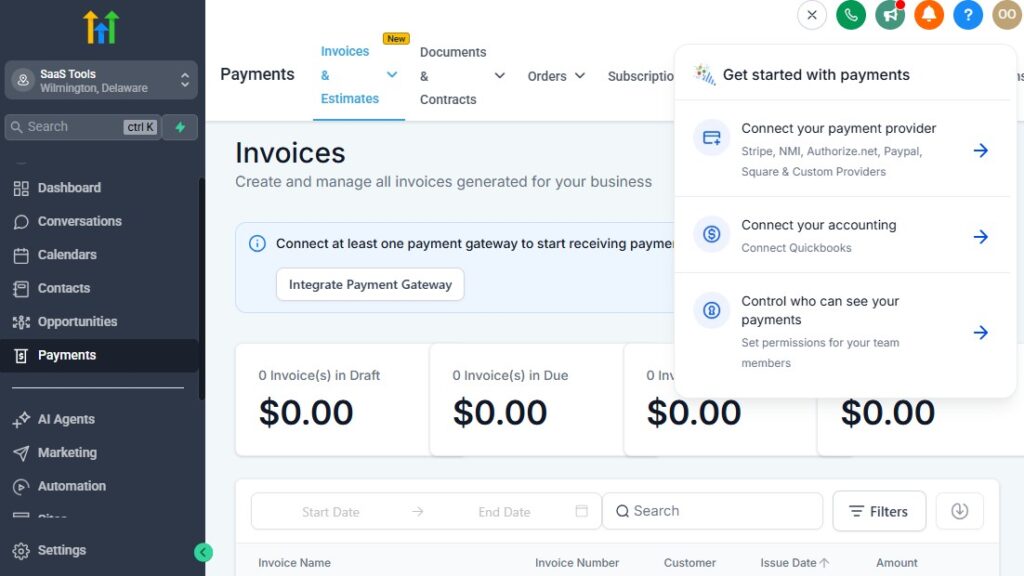

- Go to Settings → Payments

- Connect Stripe (recommended) or PayPal

- Create products (e.g., “Individual Tax Filing – $350”)

- Add checkout pages or payment links to funnels

- Add a workflow trigger:

- “Invoice Created” → send payment request

- “Invoice Overdue” → send reminder

This creates a system where payments flow in smoothly with minimal intervention.

Offer Subscriptions for Monthly & Quarterly Accounting Services

For recurring services like bookkeeping, payroll, or advisory retainers, subscriptions give you stable, predictable income.

What services should be subscription-based

- Monthly bookkeeping

- Quarterly bookkeeping

- Payroll services

- CFO/advisory packages

- Monthly tax compliance

How to create a subscription in GHL

- Go to Payments → Products

- Click Create Product

- Choose Subscription

- Set billing frequency (monthly, quarterly, yearly)

- Add this subscription to your funnels or invoices

Your clients enroll once and are billed automatically – no manual follow-ups.

Automate Payment Reminders for Overdue Invoices

Accountants shouldn’t chase clients for money. Automation handles it.

What to automate

- Invoice sent

- Payment due reminders

- Overdue alerts

- Final 3-day reminder

How to automate reminders

Create a workflow with trigger:

- “Invoice Due Date” or “Invoice Overdue”

Add steps:

- “Send Email: Your invoice is due today”

- Wait 3 days

- If unpaid → “Send SMS: Please complete your payment”

This protects your cash flow without uncomfortable conversations.

Send Engagement Letters Automatically

Every new accounting client must sign an engagement letter before work begins. GoHighLevel integrates easily with e-signing platforms so you can automate this entire step.

Popular tools you can connect

- PandaDoc

- DocuSign

- Jotform Sign

- Adobe Sign

What to include in an engagement letter

- Scope of services

- Terms & conditions

- Fees and billing cycles

- Confidentiality agreement

- Tax compliance policy

- Client responsibilities

How to automate sending engagement letters

Build your contract in PandaDoc or DocuSign

In GoHighLevel, create a workflow with trigger:

- “Tag Added: Engagement Letter Needed”

Add steps:

- Email: “Please sign your engagement letter”

- Wait 2 days

- If not signed → send reminder

Add a “Contract Signed” webhook or trigger

Move the client automatically to the “Onboarding” stage

This ensures no client begins work without signing.

Automate Contract Follow-Ups & Tracking

Most firms lose time manually checking who signed what. GoHighLevel eliminates this.

What to automate

- Track contract status

- Alert your team when contract is signed

- Move client to next pipeline stage

- Trigger payment link after signing

- Add onboarding tasks

How to do it

Use webhook triggers from PandaDoc/DocuSign

Inside the workflow:

- “If contract is signed → move to next step”

- Assign internal tasks automatically

No more guessing who’s signed or who hasn’t.

Use a Dedicated “Contracts & Compliance” Pipeline

Instead of mixing contract-related clients into your service pipelines, create a separate pipeline just for agreement handling.

Suggested pipeline stages

- Engagement letter sent

- Waiting for signature

- Signature overdue

- Contract signed

- Ready for onboarding

How to build it

- Go to Opportunities → Pipelines → Create Pipeline

- Name it Contracts & Compliance

- Add the above stages

- Create a workflow so clients move stages based on signature status

This gives you instant clarity on who needs follow-up.

Send Payment Links Automatically After Contract Signing

Once your client signs, they’re ready to pay. Automate this step to secure revenue faster.

How to set it up

- Trigger: Contract Signed

- Add “Send Email: Your next step – Complete payment”

- Insert payment link or checkout page

- Add reminder sequences if unpaid

By combining signature automation + payment automation, you create a frictionless onboarding flow.

Use Pre-Built Templates for Efficiency

You can save dozens of hours by creating templates for:

- Service invoices

- Engagement letters

- Proposal documents

- Payment request emails

- Subscription confirmations

How to implement

- Build templates in Marketing → Email/SMS Templates

- Build contract templates in PandaDoc or DocuSign

- Save invoice templates inside Stripe

Templates make your firm feel more professional and consistent.

Secure Your Compliance & Documentation Trail

Accounting firms need strong documentation for audits and legal protection.

What GoHighLevel helps you store

- Signed contracts

- Payment receipts

- Client correspondence

- Uploaded documents

- Timeline logs of actions

How to secure your record-keeping

- Store signed contracts in Contact Files

- Add internal notes after every key interaction

- Use workflows to create time-stamped logs

This builds a reliable audit trail automatically.

The Result: A Smooth, Automated Payments & Contracts System

Once your engagement letters, payments, and reminders are automated, your firm becomes:

- More professional

- More organized

- More efficient

- Less stressed

- More profitable

- Better positioned to scale

Clients sign faster, pay on time, and move through your workflow without friction.

Integrating GoHighLevel With Accounting Tools

Your accounting firm already relies on multiple tools – tax software, bookkeeping platforms, e-signing solutions, document storage, payroll systems, and communication apps.

The goal of integrating GoHighLevel with these tools is simple: connect everything so your workflows run smoothly without switching between platforms all day.

This section breaks down the most important tools to integrate, why they matter, and exactly how to set up each integration so your accounting operations stay fast, secure, and organized.

Integrate GoHighLevel With Your Bookkeeping & Accounting Software

Your bookkeeping and accounting apps hold financial data your CRM can’t store. Integrating them helps automate workflows and reduce administrative work.

Popular platforms accountants use

- QuickBooks Online

- Xero

- FreshBooks

- Wave Accounting

- Zoho Books

Why integrate them

- Sync client billing info

- Automate invoice creation

- Keep payment status updated

- Trigger workflows when invoices are paid

- Send reminders automatically

- Reduce duplicate data entry

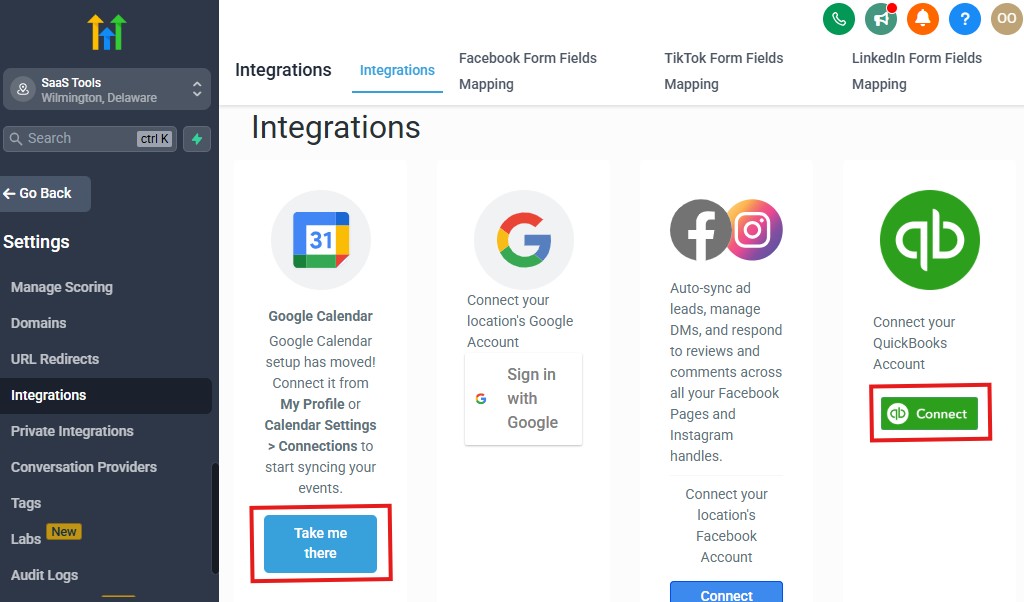

How to integrate

Most accounting tools connect through Zapier, Make (Integromat), or direct API.

Steps to integrate via Zapier

Go to Zapier.com and create a new Zap

Choose GoHighLevel (LeadConnector) as the trigger

Choose QuickBooks/Xero/etc. as the action

Map fields like:

- Client name

- Invoice amount

- Payment status

Turn on the Zap

Example automation:

“When a bookkeeping client signs an engagement letter → automatically create a customer in QuickBooks and generate an invoice.”

This keeps your billing system updated without manual entry.

Connect GoHighLevel With E-Signing Tools for Contracts & Engagement Letters

Every accountant needs contracts signed efficiently.

E-signing tools help automate this legally sensitive step.

Trusted tools

- PandaDoc

- DocuSign

- Jotform Sign

- Adobe Sign

- HelloSign

Why integrate

- Automatically send contracts to new clients

- Receive signature status updates

- Trigger onboarding workflows after signing

- Keep contracts stored in client profiles

How to integrate

Create a contract template in your e-sign tool

Use webhooks or Zapier to trigger delivery when:

- A lead fills a form

- A tag like “Engagement Letter Needed” is applied

Add the webhook URL inside GoHighLevel workflows

Add a second automation for “Contract Signed” status

Example:

“When a contract is signed → add tag ‘Signed’, move client to Onboarding, and send payment link.”

This saves hours every week and eliminates follow-up hassles.

Integrate Cloud Storage Tools for Document Collection

Accountants handle sensitive tax forms, receipts, payroll logs, bank statements, and year-end reports.

Integrating storage tools helps automate document management.

Common tools

- Google Drive

- Dropbox

- OneDrive

- Box

- Jotform Uploads

- File Request Pro

Why integrate

- Collect documents securely

- Automatically organize folders by client

- Trigger workflows when files are uploaded

- Store links inside client profiles

- Save time during tax season

How to integrate

- Create a document upload form (Jotform, Drive upload link, etc.)

- Add the link in your onboarding workflow

- Use Zapier to organize files automatically:

- “When a new client is created → create a folder in Google Drive”

- Add the folder link to the client’s custom field

Your document workflow becomes cleaner and more secure.

Integrate GoHighLevel With Payroll Systems

For payroll clients, accuracy and timing are critical. Integrations help automate reminders and data syncs.

Payroll tools accountants use

- Gusto

- ADP

- Paychex

- QuickBooks Payroll

- Patriot

Why integrate

- Automate payroll-cycle reminders

- Track employee changes

- Trigger workflows when payroll is approved

- Notify clients automatically

How to integrate

Use Zapier to connect:

- “Payroll submitted” → trigger internal task

- “New employee added” → send onboarding checklist

Add calendar reminders for payroll deadlines

Store payroll documents in client profiles

This keeps payroll delivery smooth and error-free.

Integrate GoHighLevel With Tax Software

Direct integration with tax software is rare, but you can automate key status updates.

Common tax software

- TaxAct

- Drake

- ProSeries

- UltraTax

- TaxSlayer Pro

How to integrate (practical method)

Use Zapier or folders to trigger updatesSet up status tags like:

- “Ready for Prep”

- “In Progress”

- “Ready for Filing”

- “Filed Successfully”

Build workflows that send client updates based on these statuses

While tax software doesn’t plug directly into GHL, you can still automate the communication part beautifully.

Integrate Your Phone, SMS & Communication Channels

All client communication should live inside GoHighLevel for compliance.

Connect these tools

- Gmail

- Outlook

- Facebook Messenger

- Instagram DMs

- Zoom / Google Meet

How to integrate

- Connect Gmail/Outlook under Integrations

- Connect social channels under Conversations → Channels

- Connect Zoom/Meet when setting up calendars

This keeps your message history clean and audit-ready.

Integrate With Productivity & Team Management Tools

For firms with a team, workflow collaboration is critical.

Useful tools

- Slack

- Trello

- Asana

- Notion

- Monday.com

- ClickUp

Why integrate

- Assign tasks automatically

- Notify team members when documents arrive

- Move jobs through a task board

- Log internal communication

How to integrate

Use Zapier to connect GoHighLevel → Task platform

Create rules like:

- “When pipeline stage changes → add task for accounting team”

- “When documents uploaded → notify Slack channel”

This keeps your internal workflow organized.

Integrate With BI & Reporting Tools for Financial Insights

If you want deeper analytics than GoHighLevel’s default metrics:

Tools you can connect

- Google Sheets

- Microsoft Excel

- Power BI

- Looker Studio

- Databox

How to integrate

Use Zapier to export CRM or pipeline data

Build visual dashboards for:

- Revenue per service

- Client LTV

- Tax-season performance

- Conversion rates

- Monthly bookkeeping workload

This gives your firm richer insights for decision-making.

The Result: A Fully Connected Accounting Tech Ecosystem

Once all your systems are integrated, your firm operates with:

- Less manual work

- More reliable automation

- Faster onboarding

- Better compliance

- Cleaner workflows

- Stronger communication

- Higher accuracy

- Increased client satisfaction

GoHighLevel becomes the central hub that ties your entire accounting tech stack together – saving time and helping your firm scale seamlessly.

Advanced Automation for Accounting Firms

Advanced automation is where GoHighLevel truly becomes a powerhouse for accountants.

Once your basic processes – onboarding, document requests, payments, and scheduling – are automated, you can build deeper systems that manage your entire workflow with minimal manual effort.

These automations help you stay ahead of deadlines, streamline recurring tasks, and give clients a premium, organized experience year-round.

This section breaks down what advanced automations accountants should use, why they matter, and exactly how to implement each one inside GoHighLevel.

Automate Monthly Bookkeeping Cycles From Start to Finish

Monthly bookkeeping is repetitive but predictable – perfect for automation.

What to automate

- Statement request reminders

- Upload confirmations

- “Bookkeeping started” messages

- Reconciliation stage updates

- Review notifications

- “Bookkeeping complete” delivery

- Tasks assigned to your team

- Follow-up messages for missing documents

How to build a complete monthly cycle

Create a Date-Based Trigger tied to each client’s bookkeeping start date

Add steps:

- Send monthly document request

- Wait 3 days → SMS reminder

- Move to “In Progress” stage

- Notify team via Slack/email

- After reconciliation → move to “Review”

- Send review message or report

End with:

- “Bookkeeping completed” message

- Pipeline stage = Completed

This automates an entire month of bookkeeping without manual chasing.

Automate Quarterly Tax Obligations & Compliance Checks

Quarterly reminders help business clients stay compliant with estimated taxes, sales taxes, and payroll filings.

Quarterly tasks to automate

- Estimated tax payment reminders

- Sales tax deadlines

- 941/945 payroll filings

- Quarterly financial review invitation

How to do it

Create a Date-Based Workflow

Trigger it based on a custom field like:

- {{custom_value.fiscal_year_end}}

Add steps every 90 days:

- Send email reminder

- Send SMS with deadline

- Add task for internal review

- Move client to “Quarterly Review” pipeline stage

Your clients stay compliant and less stressed.

Automate Year-End Accounting & Tax Preparation Cycles

Year-end is chaotic. Automation organizes the entire process.

What to automate

- Year-end document checklist

- Start-of-season announcements

- Missing document reminders

- “Tax return ready for review” messages

- Filing completion notifications

- Post-tax-season follow-ups

How to implement

Trigger workflow using Date = Jan 1 or tag “Tax Client”

Add steps:

- Send yearly checklist

- Reminder sequence (every 3–5 days)

- Move to “Ready for Review” after uploads

- Send “Return ready” message

- Move to “Filed/Completed” stage

This removes 90% of the chaos from tax season.

Use Conditional Logic to Create Smart, Personalized Workflows

Not all clients need the same messages. Conditional logic adjusts communication based on behavior.

Examples

- If client opens email → send next steps

- If they don’t open → send SMS

- If documents uploaded → move to next stage

- If overdue → send reminder or alert team

- If business client → send payroll/tax reminders

- If individual → send W-2/1099 reminders

How to add conditional logic

In your workflow, add “If/Else” condition

Choose triggers like:

- Email opened

- Field value

- Tag present

- Form completed

Branch the workflow into different actions

This creates a personalized experience that feels human.

Automate Internal Team Workflows to Improve Efficiency

Automation isn’t only for clients – you can also automate internal tasks.

What to automate internally

- Assign tasks when documents arrive

- Notify preparers when tax returns are ready

- Alert reviewers when bookkeeping is complete

- Create Slack or email notifications for pipeline changes

- Assign clients to specific team members

How to set it up

Use triggers like:

- Document upload

- Pipeline stage changed

- Appointment completed

Add actions:

- “Assign Task to User”

- “Send internal email”

- “Send Slack notification”

- “Update opportunity owner”

This keeps your team organized automatically.

Build Multi-Step Onboarding Journeys Based on Client Type

Different service types need different onboarding journeys.

Examples of onboarding variations

- Tax clients → document checklist + intake questionnaire

- Monthly bookkeeping → bank access + software setup + statements

- Payroll clients → employee info + onboarding forms

- Corporate advisory → financial review + planning session

How to implement it

Use a trigger:

- Tag = “Bookkeeping Client”

Build the onboarding workflow for that service type

Add:

- Email instructions

- Form links

- Upload reminders

- Payment links

- Stage changes

This customizes onboarding while keeping it automated.

Automate Follow-Ups for Missing Documents or Incomplete Tasks

Don’t manually remind clients – they’re busy and forget.

What to automate

- Missing tax documents

- Missing payroll info

- Missing receipts

- Outstanding approvals

- Incomplete intake forms

How to do it

Trigger: “Form Not Completed” or “Document Missing”

Add a reminder sequence:

- Email reminder

- SMS reminder

- Soft deadline message

If still no response:

- Notify your team

- Move client to “Waiting on Client” stage

This keeps clients accountable without manual effort.

Create Workflow Paths for Every Pipeline Stage

Each pipeline stage should trigger its own automation.

Examples

- When client moves to “Review Stage” → send reviewer checklist

- When moved to “Ready for Filing” → notify preparer

- When moved to “Filed” → send confirmation + next steps

- When moved to “Completed” → request review

How to build it

- For each pipeline stage, create a Stage Change Trigger

- Add messages, tasks, and notifications

- Move clients through automated steps

This turns your pipeline into a fully automated engine.

Automate Client Retention & Renewal Cycles

Accountants often lose clients simply because they forget to follow up.

Retention workflows to automate

- Monthly retainer renewal messages

- Annual tax prep renewal

- Yearly financial review invite

- “It’s been a while” messages for inactive clients

How to automate

Use wait timers (e.g., 1 year)

Add reminders:

- “It’s time to renew your services”

- “Book your annual review session”

This keeps clients with you longer and stabilizes revenue.

Run Upsell & Cross-Sell Automations

Automations can help promote additional services.

Examples

- Bookkeeping client → payroll offer

- Tax client → monthly bookkeeping proposal

- Business client → CFO advisory services

- Payroll client → year-end tax planning

How to build it

- Add trigger: “Service Completed”

- Add a short upsell sequence

- Add booking links or payment links

This increases revenue without extra effort.

Build a Post-Tax Season Engagement System

After tax season ends, most firms go quiet – this is a mistake.

Automation keeps clients engaged.

What to automate

- Thank-you message

- Next-year checklist

- Bookkeeping services offer

- Quarterly business planning invite

- Google review request

How to implement

- Create a workflow with trigger “Filed/Completed Stage”

- Add follow-up messages over 30–60 days

This strengthens client relationships and improves long-term retention.

The Result: An Accounting Firm That Runs Smoothly at Scale

With advanced automation, your firm becomes:

- Faster and more efficient

- Better at meeting deadlines

- Highly organized

- Less stressful during tax season

- More consistent with communication

- More professional and client-friendly

You spend less time chasing clients and more time delivering real financial value.

Learn More:

- What is GoHighLevel? (Features, Use Cases, Pricing & More)

- GoHighLevel Review: (My Experience After 5 Years)

- GoHighLevel Pricing: (+ Discount Codes)

- GoHighLevel Features: (Full List of Tools)

- GoHighLevel Onboarding Checklist: (Complete Tutorial)

- GoHighLevel for Property Management: (Detailed Tutorial)

- GoHighLevel for Small Businesses: (2026 Helpful Tutorial)

- GoHighLevel for Service Businesses: (2026 Helpful Tutorial)

- GoHighLevel for Local Businesses: (2026 Helpful Tutorial)

Common Mistakes Accountants Make in GoHighLevel

Even though GoHighLevel is powerful, many accountants still use it in a way that slows them down, creates duplicate work, or leaves clients confused.

Avoiding these mistakes will help your accounting firm operate smoothly, stay organized, and deliver a consistent client experience – especially during busy months like tax season.

Below are the most common mistakes accountants make, why they matter, and how to fix them so your system works flawlessly.

Using One Pipeline for All Services Instead of Separate Pipelines

Most accountants try to manage taxes, bookkeeping, payroll, and advisory work inside a single pipeline. This quickly becomes chaotic.

Why this is a mistake

- No clarity on which services clients are receiving

- Harder to track deadlines

- Stages become overloaded

- You lose visibility into each workflow

How to fix it

Create separate pipelines:

- Tax preparation

- Monthly bookkeeping

- Payroll

- Advisory/CFO

- Engagement letters

How to do it:

Go to Opportunities → Pipelines → Create Pipeline, then divide your stages clearly.

Not Using Tags or Custom Fields to Segment Clients

Accounting clients have different needs. Without segmentation, your automations become messy and irrelevant.

Why this is a mistake

- Wrong messages go to wrong clients

- Deadlines don’t match

- Compliance reminders get mixed up

- Leads don’t convert because follow-ups aren’t tailored

How to fix it

Use tags such as:

- “Bookkeeping Client”

- “Business Tax Client”

- “Individual Tax Client”

- “Payroll Client”

How to implement:

Use Workflows → Triggers → Form Submitted to auto-tag clients based on what they request.

Overcomplicating Workflows Too Early

Some accountants build overly complex workflows with too many conditions before understanding the basics.

Why this is a mistake

- Causes workflow errors

- Hard to troubleshoot

- Clients get duplicate or wrong messages

How to fix it

Start with simple workflows like:

- Document request

- Onboarding

- Payment reminders

- Appointment reminders

Then add conditional logic slowly once the basics work flawlessly.

Not Automating Document Requests

Document collection is one of the most manual parts of accounting, yet many accountants don’t automate it.

Why this is a mistake

- Constant back-and-forth

- Missed deadlines

- Clients forget to upload files

- You waste hours sending reminders manually

How to fix it

Create a workflow triggered by:

- Tag “Documents Needed”

- Form submission

- Stage change

Add timed reminders until the client uploads everything.

Failing to Automate Payment Reminders

Manually following up on unpaid invoices drains your time and feels awkward.

Why this is a mistake

- Causes cash flow delays

- Leads to uncomfortable conversations

- Creates inconsistent billing

How to fix it

Use workflow triggers:

- Invoice created

- Invoice overdue

Then automate email + SMS reminders with payment links.

Not Using Date-Based Automations for Deadlines

Accounting is driven by dates – monthly, quarterly, and annual.

Without date-based automations, your reminders fall apart.

Why this is a mistake

- Clients miss quarterly obligations

- Tax season becomes chaotic

- Your team is overwhelmed

How to fix it

Use Date-Based Triggers tied to:

- Fiscal year-end

- Payroll cycle

- Tax deadlines

- Monthly bookkeeping schedules

This ensures consistent communication.

Not Leveraging Appointment Automations

Many accountants manually schedule calls, reminders, and follow-ups. This leads to confusion or missed meetings.

Why this is a mistake

- Manual scheduling = wasted time

- Clients forget meeting times

- No-shows increase

- You handle too much admin work

How to fix it

- Create separate calendars

- Enable automated reminders

- Add post-meeting workflows

- Make rescheduling automatic

Let GoHighLevel handle everything after the client selects a time.

Ignoring Long-Term Nurture Campaigns

Most accountants only engage clients during tax season. This means they lose clients who could have become retained monthly or quarterly customers.

Why this is a mistake

- Lost revenue opportunities

- Low client retention

- Leads “go cold” for 11 months

How to fix it

Create nurture sequences:

- 30-day

- 90-day

- Quarterly newsletter

- Annual review invite

This keeps you top-of-mind all year.

Not Tracking Client Communication in One Place

Many accountants still use emails, WhatsApp, SMS, and social messages separately.

Why this is a mistake

- Communication gets scattered

- Hard to find records when needed

- Compliance becomes risky

- Team members lack visibility

How to fix it

Use GHL’s unified inbox:

- Connect email accounts

- Connect WhatsApp & Facebook

- Keep all client messages inside CRM

This builds a clean audit trail.

Not Using Templates for Repetitive Tasks