The financial advisory world is more complex than ever. Between managing portfolios, staying compliant, following up with leads, and maintaining strong client relationships, most advisors find themselves buried in admin work – leaving little room for what truly matters:

- Helping clients achieve financial clarity and growth.

That’s where GoHighLevel for Financial Advisors comes in.

GoHighLevel isn’t just another CRM; it’s a complete client relationship, marketing, and automation platform designed to help financial advisors streamline operations, automate client communication, and scale their practices without losing the personal touch.

Whether you’re an:

- independent financial planner

- insurance broker

- a wealth management firm

This guide will walk you through step-by-step strategies to run a smarter, more efficient practice.

By the end, you’ll know how to:

- Build an automated client onboarding flow that runs 24/7.

- Manage all client communication – SMS, email, calls, WhatsApp – from one place.

- Track deals, renewals, and financial KPIs in real time.

- Automate reminders, reviews, and reports effortlessly.

- Integrate tools like QuickBooks, DocuSign, or Google Sheets for a complete workflow.

GoHighLevel is already transforming how modern financial advisors manage clients – and now it’s your turn to leverage it for maximum impact.

→ TL;DR: What You’ll Learn

If you’re short on time, here’s a quick snapshot of what this guide covers:

- Challenges financial advisors face – client management, compliance, time, and marketing.

- Why GoHighLevel is ideal – all-in-one CRM + marketing automation for financial services.

- Step-by-step setup – pipelines, workflows, calendars, and compliance customization.

- Client management and communication – build trust through automated yet personal touchpoints.

- Automation for efficiency – onboarding, follow-ups, renewals, and portfolio reviews.

- Data-driven growth – use dashboards and analytics to track performance and ROI.

- Integrations – connect GoHighLevel with QuickBooks, DocuSign, and other financial tools.

- Common mistakes and pro tips – avoid pitfalls and get the most out of your system.

By the end of this guide, you’ll have a fully functional GoHighLevel setup built for financial advisors – one that saves you hours weekly, keeps clients engaged, and drives consistent business growth.

Why GoHighLevel Is Perfect for Financial Advisors

As a financial advisor, your business thrives on relationships, trust, and consistent communication.

You’re not just selling financial products – you’re managing life goals, wealth, and long-term confidence.

GoHighLevel fits perfectly into that equation because it’s built to help relationship-driven professionals automate repetitive tasks, stay organized, and scale client relationships without losing personalization.

Here’s why GoHighLevel stands out for financial advisors: 👇

✅ All-in-One CRM for Relationship Management

Instead of juggling multiple apps for emails, SMS, scheduling, and client tracking, GoHighLevel gives you one centralized dashboard where everything lives.

You can:

- Store detailed client profiles – income, goals, risk level, and investment data.

- Track your entire pipeline, from lead capture to long-term portfolio management.

- Segment clients by service type (retirement planning, insurance, wealth management, etc.).

- Record calls, notes, and meeting histories all in one place.

No more bouncing between spreadsheets, email apps, and sticky notes – GoHighLevel keeps everything organized and easy to access.

⚙️ Automate Onboarding, Meetings & Follow-Ups

The average advisor spends hours each week on scheduling, reminders, and follow-up emails. GoHighLevel replaces all that with smart automation:

- Onboarding workflows: Send welcome messages, compliance forms, and introductory videos automatically after a new signup.

- Meeting reminders: Automate confirmation texts and follow-up emails for every consultation.

- Post-meeting automation: Trigger thank-you emails, recap notes, and next-step instructions.

Every client interaction feels personal – but it all runs automatically in the background.

💬 Built-In Communication Tools for Engagement

GoHighLevel brings all your communication channels – SMS, email, phone calls, and even WhatsApp – under one tab called “Conversations.”

You can:

- Message clients directly without switching apps.

- Set up automated birthday greetings or annual portfolio check-in reminders.

- Run targeted campaigns for different client categories (e.g., insurance renewal, new investment offers).

This helps you maintain consistent engagement without spamming or losing context.

📊 Centralized Dashboard for Deals, Renewals & Performance

Managing renewals, client deals, and performance metrics manually can quickly become overwhelming. GoHighLevel’s dashboard gives you real-time insights into:

- Client lifecycle stages (Lead → Consultation → Proposal → Signed Client → Renewal).

- Pipeline revenue and conversion rates.

- Tasks and appointments due across your entire advisory team.

You’ll always know where each client stands – and what to do next to move them forward.

🔒 Compliance, Privacy & Security You Can Trust

Financial services demand high levels of data security and compliance. GoHighLevel provides robust security measures, like:

- Role-based access controls (advisors, assistants, admins).

- Secure data encryption and protected client portals.

- Automated audit trails to maintain transparency.

- Option to include privacy disclaimers and consent messages in forms and funnels.

For advisors operating in regulated markets, these features help maintain professionalism and compliance effortlessly.

💡 In Short

GoHighLevel is not just a CRM – it’s your digital assistant, marketing manager, and compliance helper rolled into one.

By using it, you can:

- Spend less time on admin work.

- Automate more client touchpoints.

- Build stronger relationships with less manual effort.

- Grow your financial practice sustainably and confidently.

How to Set Up GoHighLevel for Financial Advisor Professionals

Let’s get straight to the point – first, we’ll set up your account, then I’ll walk you through all the strategies you can use.

This is how to set it up:

Step 1: Create HighLevel Account for 30 Days Free

Since you’re just starting with GoHighLevel, you would need to properly set up your account.

And you can do that for free through our exclusive 30-Day Free Trial link here.

In order to start, head over to gohighlevel.com/30-day-free-tial free trial and click on “30 DAY FREE TRIAL” as you can see below.

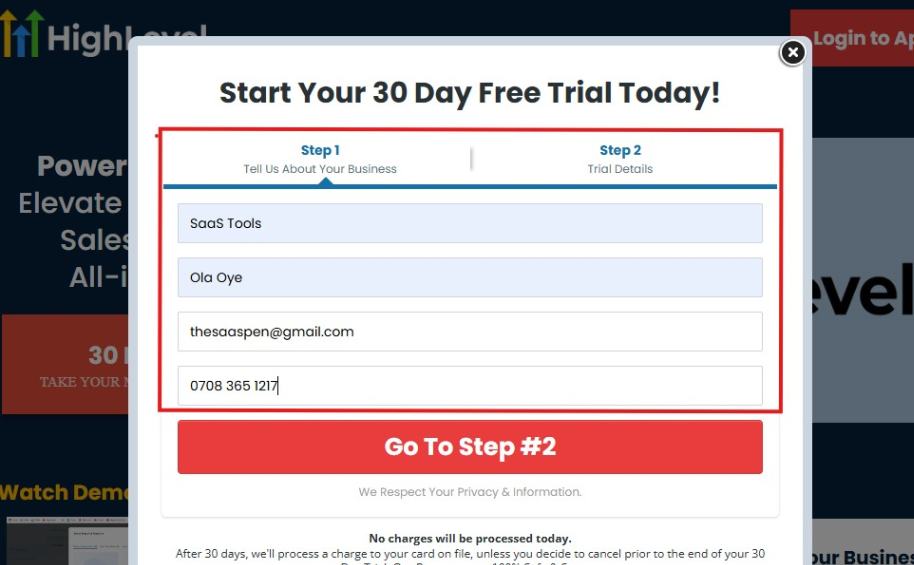

Upon clicking on “30 DAY FREE TRIAL“, a page will pop that looks exactly like the image below.

If you take a closer look at the image above, you will see that you need to supply your:

- Business name

- Company name

- Company email

- Phone number

Supply all the pieces of information and click on “Go To Step #2.”

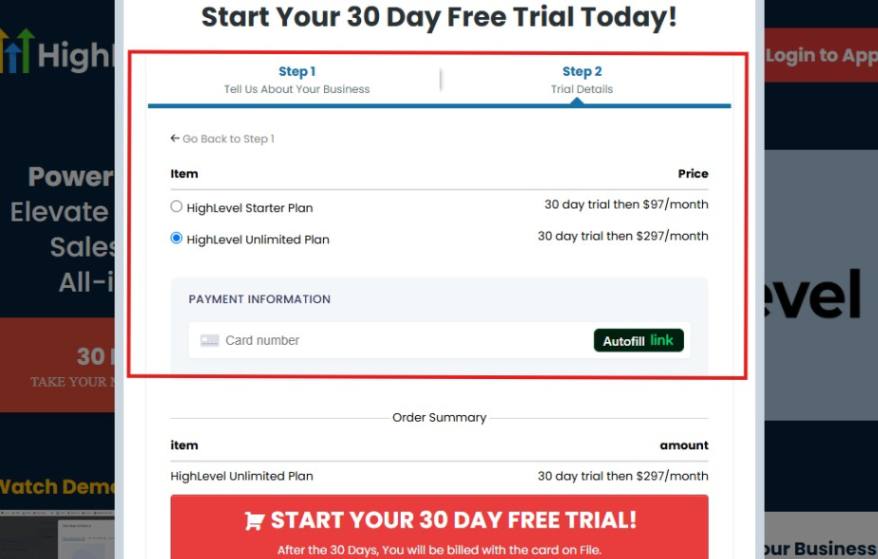

On the next page, you will be required to select the plan you want to opt in for.

As you can see from the image above, you can either choose from:

- HighLevel Starter Plan

- HighLevel Unlimited Plan

Select the HighLevel Unlimited Plan and continue – you can always upgrade to the SaaS Mode later if you want that or downgrade.

The next thing you want to do is supply your credit card information.

Note: You will not be debited anything today until the end of your trail that is if you don’t cancel. Keep in mind that $1 will be debited and refunded back instantly into your account just to test your card is working.

After you have supplied the information accordingly, click on “START YOUR 30 DAY FREE TRIAL” and you will be asked to confirm you’re not a robot.

After that, the page below will pop up.

The image above says, “Your Account has been created!” Now, you need to click on the blue button that says “Click Here to Get Started.“

Click on the blue button to start your onboarding process.

Step 2: GoHighLevel Onboarding Process

The onboarding questions help GoHighLevel understand why you have signed up for the platform so that it can tailor your experience accordingly.

This is all you need to do:

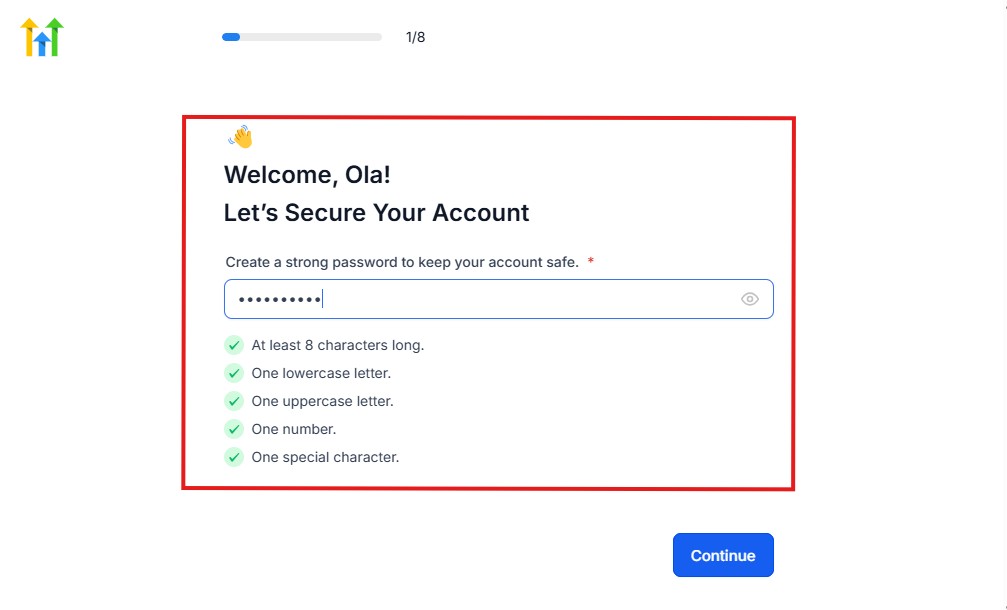

After you click on the blue button above, the page below will pop up.

As you can see above, you need to set up your password, and the password has to be:

- At least 8 characters long

- One lowercase letter

- One uppercase letter

- One number

- One special character

If you have input the password and it matches all the description above, everything will be green just the way it’s in the image.

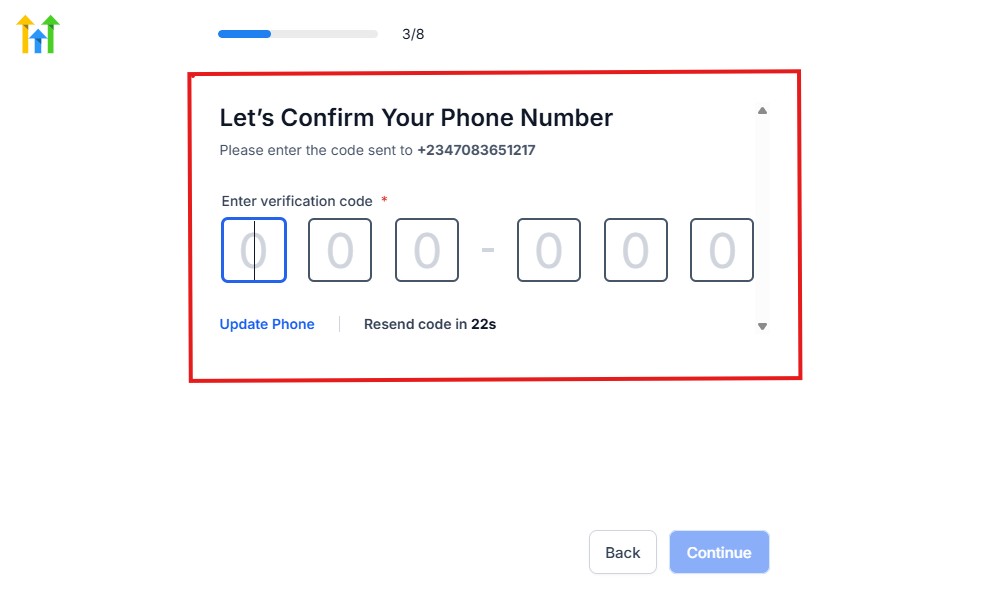

Click on “Continue” there after, and the image below will pop up.

As you can see, a code will be sent to you to confirm your email address and phone number. The process is the same for the 2.

The next thing you need to do is to select how you plan to use GoHighLevel, as you can see below.

Select what best matches why you have signed up and click on Continue.

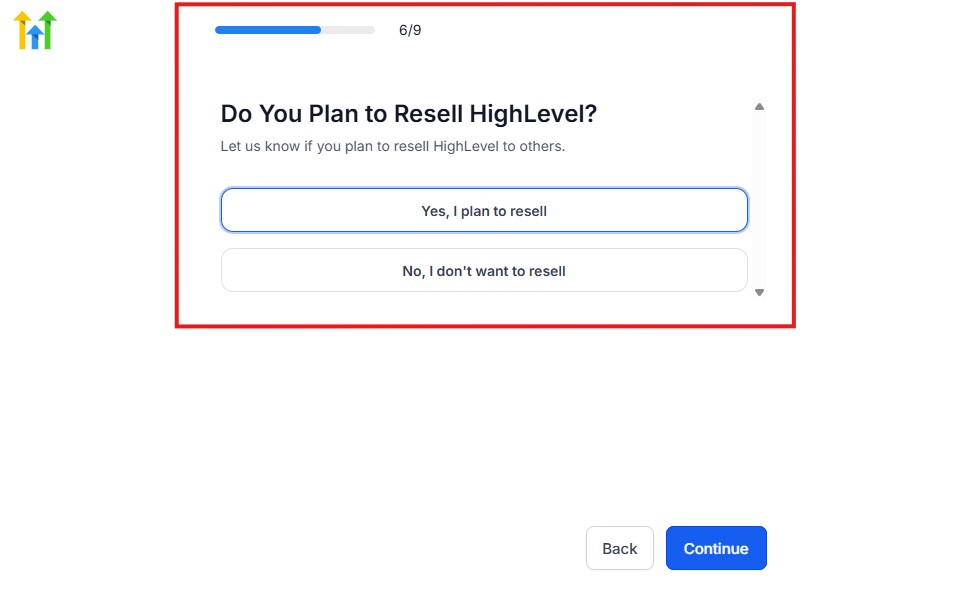

On the next page, you will be asked if you plan to resell GoHighLevel or not.

Select the answer based on the reason why you have signed up and click on “Continue”

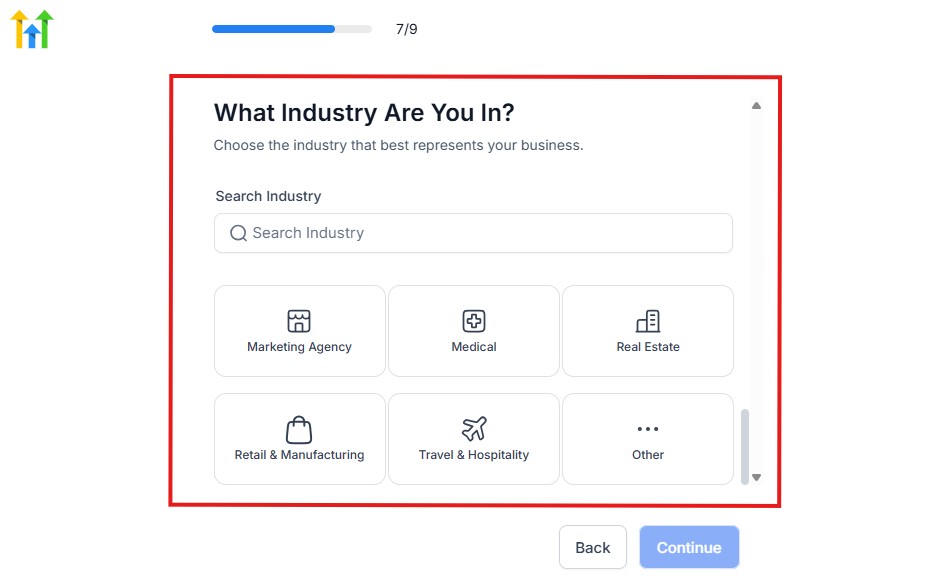

Then, the page below will pop up.

From the image above, you need to select the industry that you fall on. You can also make use of the search button if you can’t find it right away.

Then, click on continue after you select your industry.

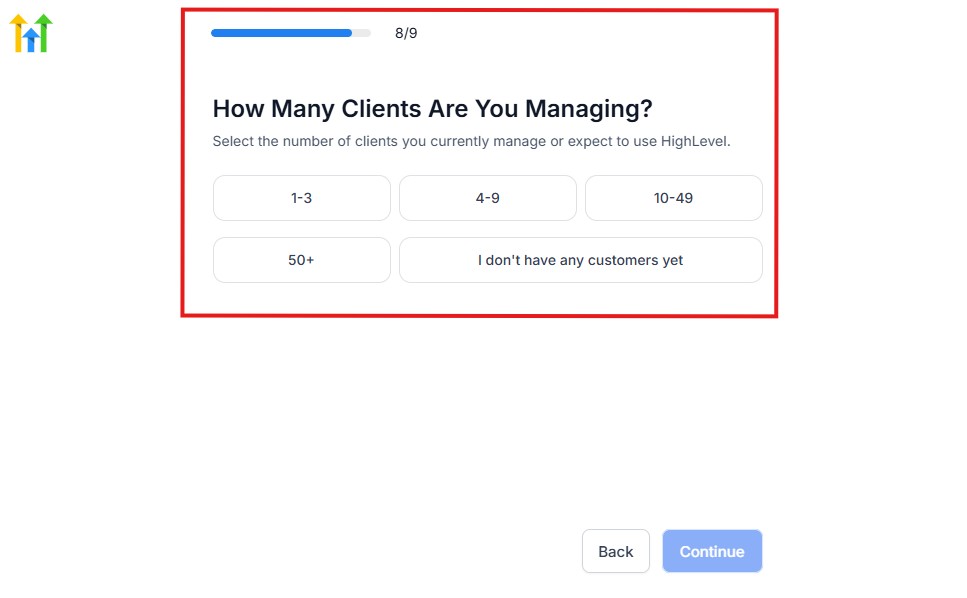

Then, the next thing you need to do is to select the number of clients that you currently have. Select “I don’t have any customers” yet if you currently don’t have one.

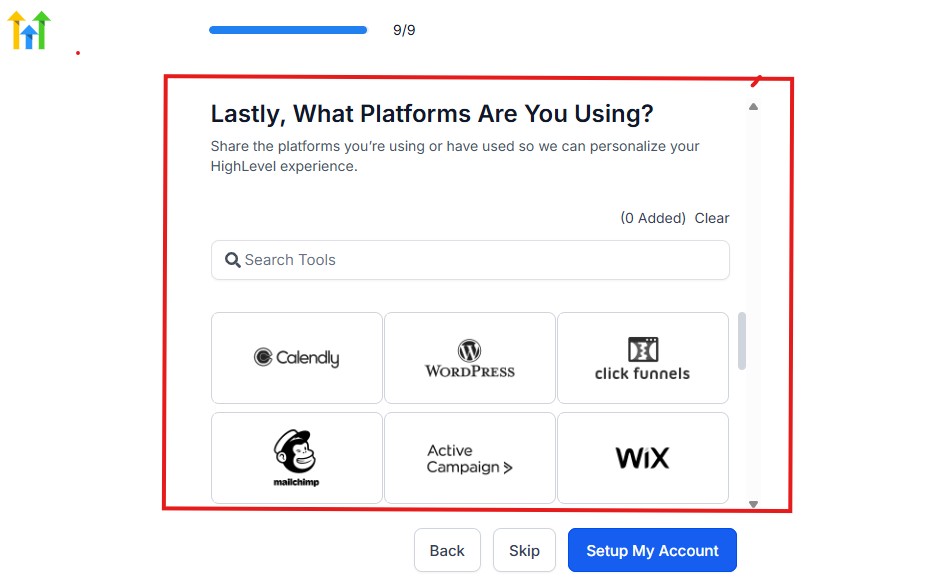

On the next page, you will be asked to select the platforms you currently use that you can integrate with GoHighLevel right away.

You can use the search button to search for any tools you want to add to your GoHighLevel account.

You can also skip this process and do it later if you want to.

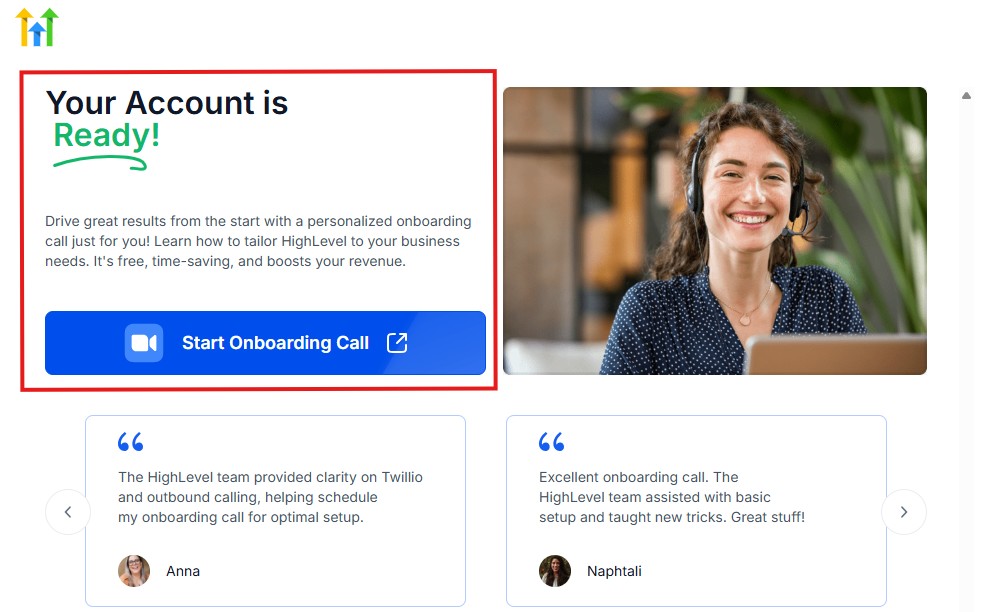

After that, the page below will pop up.

The page above says your account is ready and is asking you to “Start Onboarding Call.”

The “Onboarding Call” allows you to connect with the Go High Level team in order to discuss your account set-up process and everything regarding your plan in using HighLevel.

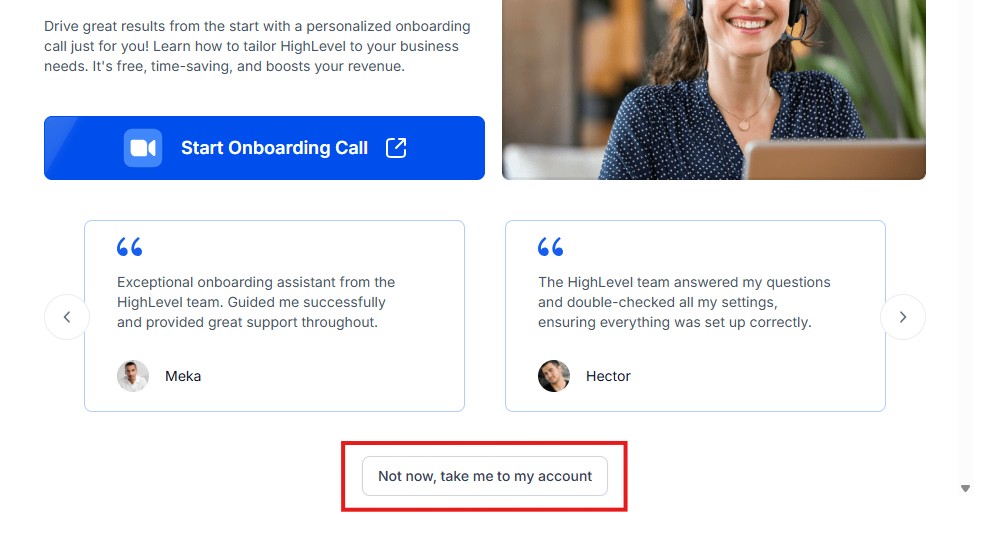

If you don’t want to start the “Onboarding Call” yet, just stroll down, and you will see the button in the image below.

Simply click on “Not now, take me to my account“, and you will have access to your dashboard.

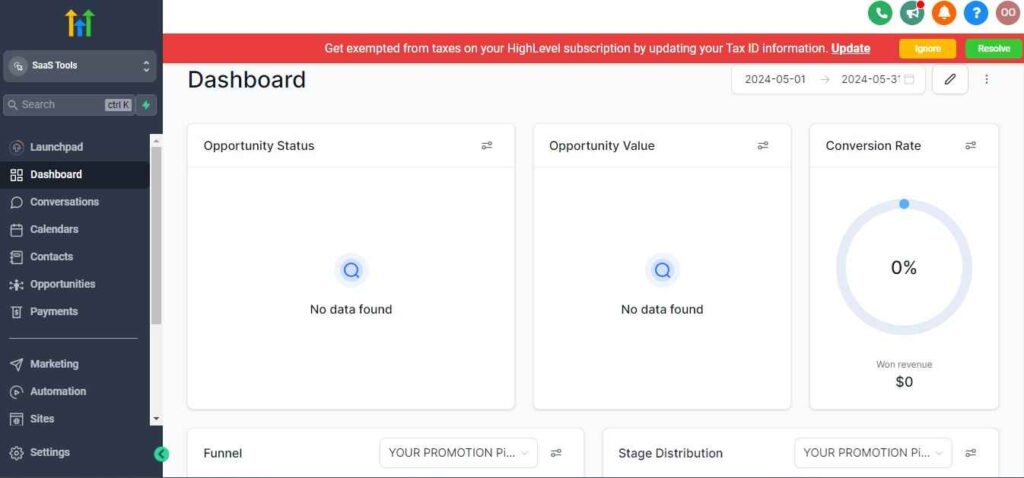

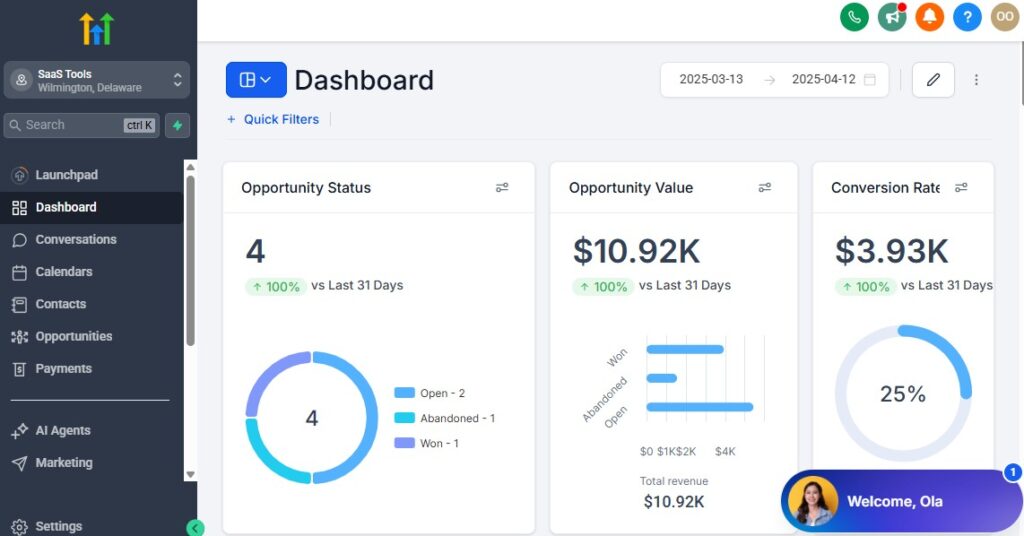

Note: If you have indicated that you want to resell HighLevel, you would have access to the agency dashboard by default, which looks like the image below.

But if you didn’t indicate interest in reselling GHL, your dashboard will look like the image below.

You can switch between these dashboards at any time.

The data you see on the dashboard above are not real data, they’re snapshots that you can use to kickstart your account setup process.

I want to say congratulations. You have successfully set up your Go High Level account.

⚙️ Step 3: Create Your Agency or Practice Workspace

Start by setting up your GoHighLevel Agency account (if you plan to manage multiple advisors or branches) or a single sub-account for your personal financial advisory business.

- Agency account: Best for firms with multiple advisors or offices. It allows you to oversee multiple pipelines and staff members from a top-level dashboard.

- Sub-account: Ideal if you’re an independent advisor managing your own clients.

👉 After logging in, go to “Sub-Accounts” → “Create New” → choose a template (you can even start from the built-in “Professional Services” snapshot) → customize it for financial advisory workflows.

🏗 Step 4: Customize Pipelines for Your Financial Planning Stages

Your pipeline should mirror how clients move through your process – from initial inquiry to loyal client.

A sample setup might look like this:

| Stage | Purpose | Example Actions |

|---|---|---|

| Lead Captured | A new prospect fills out your consultation form | Auto-send welcome email and booking link |

| Consultation Booked | Prospect schedules a discovery call | Trigger reminder and pre-meeting questionnaire |

| Proposal Sent | You’ve shared investment or insurance options | Automated follow-up in 48 hours |

| Client Onboarded | Client signs contract and provides documents | Send onboarding email and welcome message |

| Review/ Renewal | Annual review or policy renewal | Send review reminders and satisfaction survey |

You can create this under “Opportunities → Pipelines” in GoHighLevel.

👥 Step 5: Set Up User Roles and Permissions

If you have multiple team members (e.g., junior advisors, assistants, or admins), define user roles to keep everything organized and compliant.

Examples:

- Admin: Full access – ideal for business owners or partners.

- Advisor: Access to leads, opportunities, and communication tools.

- Assistant: Can schedule calls, send reminders, and manage client documents.

You can assign roles under Settings → My Staff → Add Employee → Permissions.

This ensures data privacy and reduces human error when handling sensitive financial information.

🧾 Step 6: Add Compliance & Privacy Disclaimers

Financial advisors operate under strict regulatory guidelines. GoHighLevel allows you to integrate disclaimers and privacy notices throughout your funnels, emails, and forms.

Here’s how to stay compliant:

- Add disclaimer sections in all landing pages (e.g., “This content does not constitute financial advice…”).

- Use custom fields to record client consent for data use and communication.

- Include opt-in checkboxes in your lead capture forms.

- Add a compliance footer with your registration or license number in all email templates.

💡 Pro tip: Create a reusable disclaimer snippet inside the “Sites” builder and apply it to every funnel automatically.

📁 Step 7: Personalize Your Dashboard & Branding

First impressions matter. Make your GoHighLevel dashboard reflect your professionalism:

- Add your logo and brand colors under “Settings → Company.”

- Set up your custom domain (e.g., app.youradvisoryfirm.com).

- Update your email signature with your name, credentials, and contact info.

This not only boosts your brand credibility but also builds client trust during onboarding.

✅ In Short

Setting up GoHighLevel correctly gives you a rock-solid foundation for success. You’ll have:

- A clear, customized client pipeline.

- Defined team roles and permissions.

- Built-in compliance measures.

- Professional branding and automated systems ready to go.

Once your account is ready, the next step is to start managing your clients and portfolios inside GoHighLevel’s CRM – which we’ll cover next.

Managing Clients & Portfolios with GoHighLevel CRM

Once your GoHighLevel account is set up, the next step is to build an organized system for managing your clients, portfolios, and daily interactions.

GoHighLevel’s CRM lets you see every client’s journey – from first contact to ongoing financial reviews – all in one place.

Here’s how to make the most of it: 👇

📂 Organize Client Data Effectively

Your CRM should serve as your digital filing cabinet – storing every important client detail you’ll ever need.

Within each contact profile, you can store:

- Personal details: Name, phone, email, birthday, and location.

- Financial data: Income, risk level, investment goals, and portfolio type.

- Engagement info: Notes, tags, last contact date, and open deals.

- Documents: Upload files like contracts, statements, and compliance forms.

💡 Pro tip: Use custom fields (e.g., “Retirement Goal,” “Insurance Renewal Date,” “Investment Preference”) to capture data unique to your advisory services.

🏷 Segment Clients by Type or Service Level

Not every client is the same – GoHighLevel’s tagging and smart lists help you organize them effortlessly.

You can tag clients by:

- Service type: Retirement, insurance, tax planning, or investment.

- Engagement level: Hot lead, active client, dormant, or VIP.

- Income range or portfolio size: For targeted advice or upsells.

Once tagged, you can send personalized messages or automate specific workflows for each segment – keeping your communication relevant and valuable.

📅 Schedule & Track Meetings Easily

GoHighLevel integrates your Google Calendar or Outlook Calendar, allowing you to manage all consultations and review sessions directly from the dashboard.

Here’s what you can do:

- Schedule one-on-one consultations or recurring portfolio review sessions.

- View upcoming meetings alongside client opportunities.

- Automatically log meetings under each client record.

💬 Example: A client books a “Quarterly Financial Review” – it appears in your calendar, triggers reminders, and updates their contact history automatically.

📝 Use Notes, Tasks & Reminders for Better Recordkeeping

Never miss an important detail or follow-up again.

Inside each client profile, you can:

- Add meeting notes or next steps after a consultation.

- Assign tasks to team members (e.g., “Prepare investment summary for Mr. Johnson”).

- Set reminders for follow-ups or renewal calls.

This ensures your advisory practice stays proactive and organized – even as your client list grows.

📎 Upload & Manage Client Documents Securely

Financial advisors handle sensitive files daily – GoHighLevel lets you upload, categorize, and share them securely.

You can attach:

- Client contracts and service agreements.

- Investment statements or projections.

- Compliance and risk assessment documents.

Files are stored within the client’s record, ensuring easy access for authorized team members only.

✅ In Short

GoHighLevel’s CRM helps you:

- Centralize every client’s data and documents.

- Track communication history, deals, and renewals.

- Automate reminders and task management.

- Deliver a highly personalized experience for every client.

By mastering client management inside GoHighLevel, you’re setting your advisory firm up for consistency, professionalism, and long-term client retention.

Automating Client Onboarding & Consultations – GoHighLevel for Financial Advisors

A smooth onboarding process sets the tone for every client relationship.

With GoHighLevel, you can fully automate how new clients are welcomed, guided, and scheduled – all while maintaining a personal, professional touch.

This saves you time, reduces back-and-forth communication, and ensures every client receives a consistent first-class experience.

Let’s walk through how to make it happen: 👇

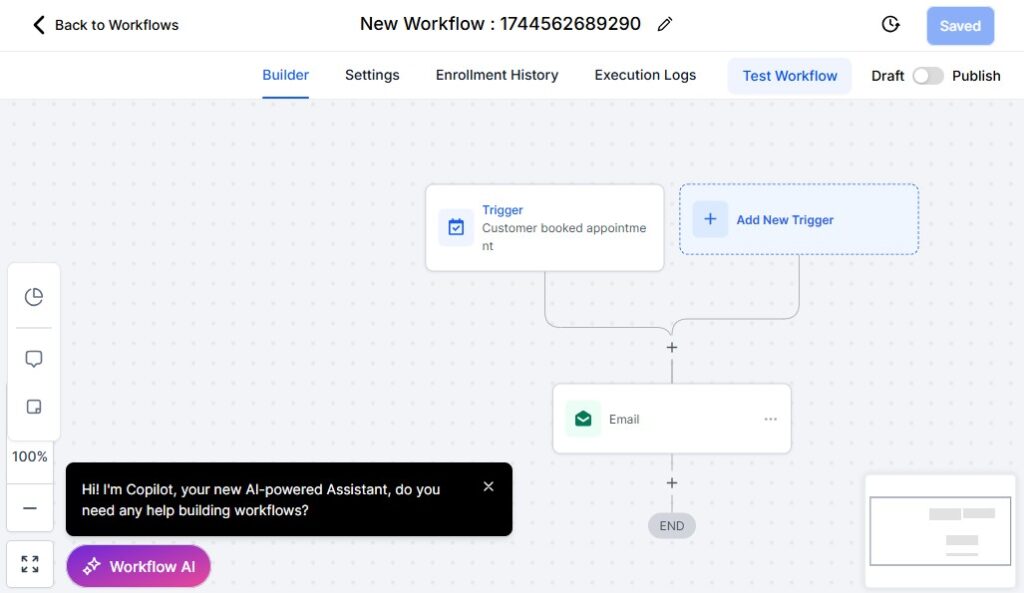

🚀 Step 1: Automate Your New Client Onboarding Sequence

When a prospect becomes a client, GoHighLevel can automatically launch a full onboarding workflow that does the heavy lifting for you.

Here’s how it works in practice:

- Trigger: When a contact moves to “Client Onboarded” in your pipeline.

- Automation sequence:

- Send a personalized welcome email with your logo and a thank-you message.

- Deliver secure document upload links for KYC, ID verification, or financial forms.

- Assign an intro call task to your assistant or advisor.

- Add them to your “Client Onboarding” campaign for further follow-ups.

💡 Pro tip: Use the Workflows Builder to include conditional steps (e.g., send different messages for retirement clients vs. insurance clients).

📋 Step 2: Send Pre-Meeting Questionnaires Automatically

Before your first consultation, it’s smart to collect vital information – income details, goals, risk tolerance, etc. GoHighLevel makes this seamless with automated forms and surveys.

- Create a custom form (e.g., “Client Financial Snapshot”) using the “Forms” tool.

- Add it to your onboarding email or appointment confirmation page.

- Set up an automation to send reminders if the form isn’t completed within 48 hours.

This saves time during consultations and ensures you have everything you need before the meeting starts.

📅 Step 3: Automate Consultation Scheduling – GoHighLevel for Financial Advisors

Forget endless email threads trying to find a convenient meeting time. With GoHighLevel’s Calendar feature, clients can book calls directly into your schedule.

Automation ideas:

- When a lead completes a consultation form, send a “Book Your Strategy Call” link automatically.

- Trigger confirmation and reminder emails/SMS before the meeting.

- If a client cancels, GoHighLevel can send a reschedule link automatically.

📆 Example: A new lead signs up → receives your calendar link → books a time → receives automatic confirmation, reminders, and follow-up messages without any manual effort.

🤝 Step 4: Automate Follow-Ups & Thank-You Messages

After each consultation, keeping the conversation going is key to building trust.

Set up a post-consultation workflow that:

- Sends a thank-you message via email or SMS.

- Shares recap notes or presentation slides from your meeting.

- Triggers a proposal email (if applicable).

- Adds them to a nurture campaign if they haven’t converted yet.

💬 Example:

“Hi Sarah, thanks for today’s call. Attached is your financial roadmap summary. Let’s review it together next week. You can schedule your follow-up here [link].”

This level of automation keeps your brand top-of-mind while showing genuine professionalism.

🧾 Step 5: Automate Document Collection & Storage

Financial advisory requires gathering sensitive documents – GoHighLevel can handle that too.

- Use form uploads for client ID, tax records, or signed agreements.

- Connect your workflow with Google Drive or Dropbox (via Zapier/Pabbly) for secure storage.

- Tag clients automatically once all documents are received (e.g., “KYC Complete”).

This ensures no document gets lost and compliance remains airtight.

✅ In Short

By automating client onboarding and consultations, you:

- Eliminate repetitive manual tasks.

- Ensure consistent client experiences every time.

- Save hours weekly while improving conversion rates.

- Build trust through structured, transparent communication.

Your clients feel guided, informed, and valued – while you stay focused on strategy, not admin work.

Streamlining Appointments, Calls & Scheduling – GoHighLevel for Financial Advisors

Time is the most valuable resource in financial advising – and managing it efficiently can make or break your client relationships.

GoHighLevel simplifies your entire scheduling process by automating bookings, confirmations, reminders, and follow-ups.

This means no more double bookings, forgotten meetings, or wasted time coordinating schedules. Everything runs smoothly – both for you and your clients.

📅 Step 1: Sync Your Calendar for Real-Time Availability

Start by connecting your Google Calendar or Outlook Calendar to GoHighLevel.

This allows the system to:

- Automatically detect available time slots.

- Prevent double bookings.

- Sync meetings across all your devices.

Once synced, GoHighLevel updates in real time – so if you add a manual appointment or block off personal time, it instantly reflects in your booking calendar.

💡 Pro tip: Set your working hours and preferred meeting durations (e.g., 30, 45, or 60 minutes) in the Calendar Settings to give clients flexibility while keeping your schedule efficient.

🌐 Step 2: Let Clients Book Consultations from Your Website

Make it effortless for prospects and clients to book calls with you.

Using GoHighLevel’s Calendar widget, you can embed a booking form directly on your:

- Website’s “Book a Consultation” page.

- Landing page for lead generation.

- Email signatures or social media bios.

You can also create different calendars for:

- Initial Consultations (free 30-min session).

- Follow-Up Reviews (existing clients).

- Premium Advisory Calls (paid strategy sessions).

Each can have unique workflows for reminders, confirmations, and follow-ups – giving your practice a professional, organized appearance.

📲 Step 3: Automate Confirmation & Reminder Notifications

Missed appointments are costly. GoHighLevel ensures clients show up by sending automated confirmations and reminders across multiple channels.

Here’s how it works:

- Immediately after booking → Client receives a confirmation email + SMS.

- 24 hours before meeting → Reminder message is sent.

- 1 hour before → Final reminder with meeting link or location.

Example reminder SMS:

“Hi David 👋, this is a reminder for your financial consultation with [Your Name] tomorrow at 10 AM. Please confirm or reschedule here [link].”

These reminders not only reduce no-shows but also make clients feel guided and cared for.

📞 Step 4: Manage Calls & Virtual Meetings Seamlessly

GoHighLevel integrates with video and communication platforms like Zoom, Google Meet, and Twilio.

You can:

- Add a Zoom/Meet link automatically to each booking confirmation.

- Make or receive calls directly from the Conversations tab.

- Log all calls under the client’s contact history for easy follow-up tracking.

💬 Example: A client books a “Retirement Planning Consultation” → GoHighLevel auto-generates a Zoom link → sends it with the confirmation → logs the session under that client’s profile.

🔁 Step 5: Automate Recurring Financial Review Sessions

For long-term clients, regular reviews are crucial – but remembering them manually isn’t scalable.

Set up recurring sessions inside GoHighLevel to automatically remind both you and your clients about:

- Quarterly portfolio reviews.

- Annual insurance policy renewals.

- Investment performance check-ins.

You can build workflows that rebook these sessions automatically – keeping your clients engaged year-round without constant follow-up.

✅ In Short

GoHighLevel turns your scheduling chaos into a seamless, automated process. You can:

- Sync calendars for accurate availability.

- Allow clients to self-book with ease.

- Automate reminders, confirmations, and follow-ups.

- Keep recurring reviews and meetings running on autopilot.

With GoHighLevel managing your appointments and calls, your financial advisory business runs smoothly, looks more professional, and gives clients the responsive experience they expect.

Building Strong Client Relationships with Smart Communication

In financial advising, relationships are everything. Clients don’t just want advice – they want consistent communication, reassurance, and trust.

GoHighLevel helps you deliver all three effortlessly by keeping every interaction centralized, personalized, and automated when needed.

Here’s how to use GoHighLevel’s communication tools to strengthen your client relationships and boost retention.

💬 Step 1: Manage All Conversations from One Unified Inbox

GoHighLevel’s Conversations Tab is where all your client messages – emails, SMS, WhatsApp, Facebook Messenger, and calls – come together.

This means:

- You’ll never lose a message or forget a reply.

- Every conversation is logged under the client’s profile.

- Team members can collaborate without confusion.

💡 Example: A client sends a WhatsApp message about a portfolio update, then follows up with an email – GoHighLevel links both threads automatically, giving you full context in one place.

📣 Step 2: Personalize Client Communication with Automation

Automation doesn’t mean robotic – it’s about being consistent and timely.

GoHighLevel lets you personalize messages using custom fields and conditional logic to make every message feel one-on-one.

Examples:

- Birthday messages: “Happy Birthday, John! 🎉 Hope it’s a fantastic year for your goals and investments.”

- Portfolio updates: Send automated quarterly updates via email or SMS.

- Policy renewals: “Hi Sarah, your insurance review is due this month. Let’s schedule a quick 15-minute call to go over your coverage.”

You can create these in Workflows → Triggers → Send Message, using conditions like client tags, dates, or custom fields.

📞 Step 3: Use Multi-Channel Communication for Maximum Reach

Different clients prefer different channels. With GoHighLevel, you can reach them where they’re most responsive:

- SMS: For quick reminders and short updates.

- Email: For reports, summaries, and newsletters.

- WhatsApp or Facebook Messenger: For casual, ongoing engagement.

- Phone calls or voicemail drops: For personal touchpoints or check-ins.

Every message is tracked, so you know who opened, clicked, or replied – making your follow-ups smarter.

🎯 Step 4: Send Targeted Campaigns to Specific Client Segments

Not all clients need the same information. GoHighLevel’s Smart Lists and tags let you group clients and send campaigns based on interest or status.

Examples:

- Retirement clients: Send educational newsletters on pension planning.

- Insurance clients: Share updates on new policy options or benefits.

- High-net-worth clients: Send invitations to exclusive webinars or strategy sessions.

💡 Pro tip: Combine tags like “Active + Retirement” to target clients precisely and avoid sending irrelevant content.

🗓 Step 5: Maintain Consistent Check-Ins & Relationship Nurturing

Regular contact shows clients you care beyond transactions. You can schedule automated check-ins or annual review reminders that go out automatically.

Example sequence:

- 90 days after onboarding → “How are you feeling about your portfolio so far?”

- 6 months → “Let’s schedule your mid-year review.”

- 1 year → “Your annual review is coming up – here’s what we’ll cover.”

This builds trust, encourages renewals, and positions you as a proactive advisor who’s always one step ahead.

💡 Step 6: Use Templates to Keep Messaging Consistent

GoHighLevel lets you save message templates for:

- Welcome messages.

- Meeting reminders.

- Check-in emails.

- Seasonal greetings.

This ensures consistency across your brand and saves time when communicating with multiple clients or teams.

✅ In Short

Smart communication is the heartbeat of a thriving financial advisory business – and GoHighLevel gives you the tools to do it right.

With it, you can:

- Manage every client conversation from one unified inbox.

- Automate key touchpoints without losing personalization.

- Use multiple channels to stay connected and top-of-mind.

- Segment clients for targeted, meaningful communication.

- Build long-term trust through proactive, timely engagement.

When used effectively, GoHighLevel doesn’t just manage communication – it helps you nurture stronger, lasting relationships that lead to higher satisfaction, retention, and referrals.

Marketing & Lead Generation for Financial Advisors

As a financial advisor, your growth depends on a steady stream of qualified leads – people who not only need financial guidance but also trust you enough to handle their future.

GoHighLevel gives you everything you need to attract, nurture, and convert leads into loyal clients through automation, smart funnels, and data-driven marketing.

Here’s how to build a lead generation system that works for you 24/7: 👇

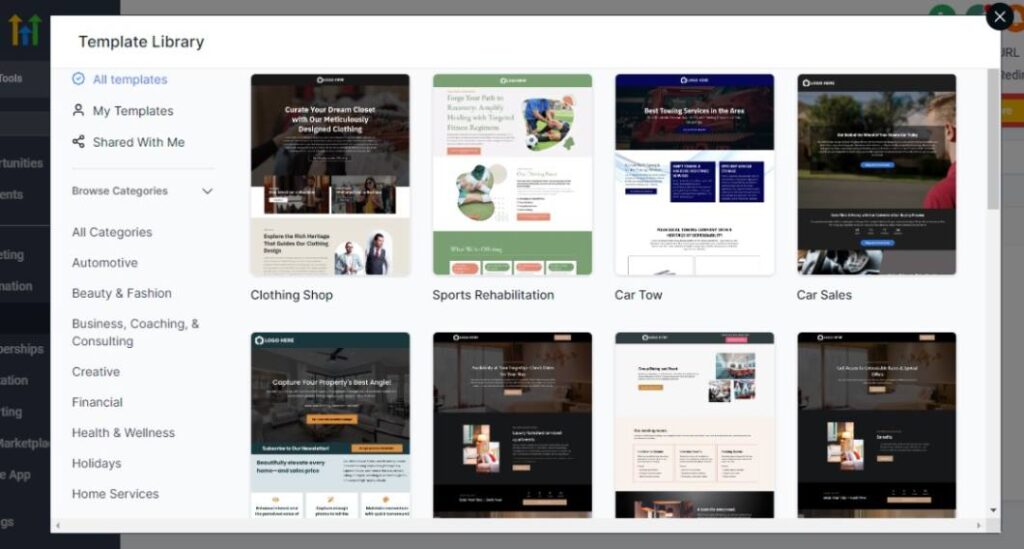

🎯 Step 1: Create High-Converting Funnels for Lead Capture

Forget generic landing pages – GoHighLevel’s Funnel Builder lets you create professional, conversion-focused pages in minutes.

You can build funnels for:

- Free consultations (e.g., “Book a Free Retirement Strategy Call”).

- Financial planning guides (e.g., “Download: 7 Steps to Wealth Stability”).

- Webinars or workshops (e.g., “Join our ‘Smart Investing in 2026’ webinar”).

Each funnel can collect leads through forms and automatically send them into your CRM, tagged and ready for nurturing.

💡 Pro tip: Add trust elements – certifications, testimonials, and case studies — to make your funnels more credible and increase conversions.

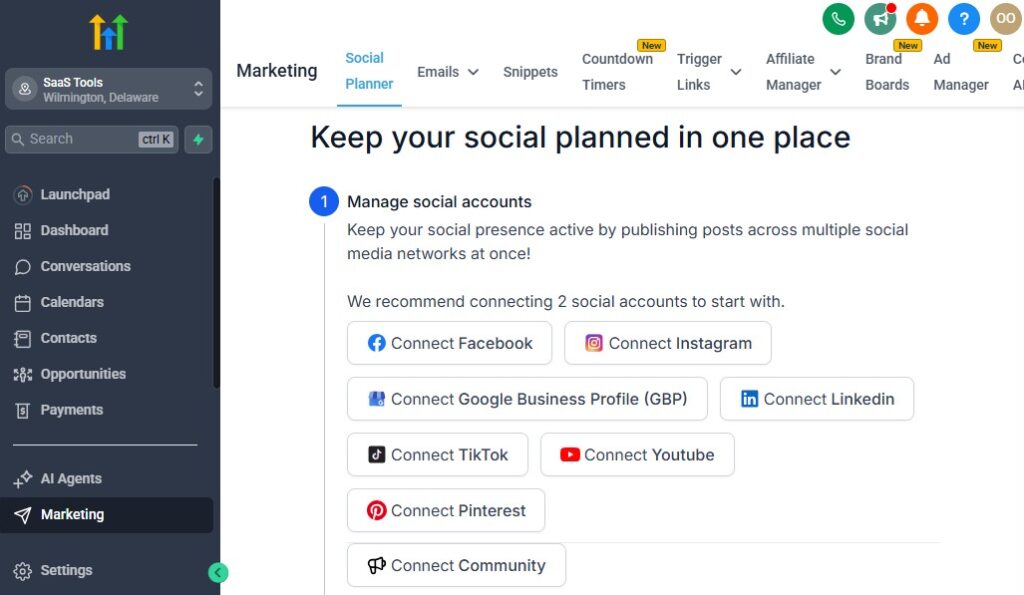

📧 Step 2: Automate Lead Nurturing Campaigns (Email + SMS)

Leads rarely convert after one interaction. GoHighLevel helps you nurture them automatically with smart follow-up campaigns.

Example sequence:

- Day 1: Send a welcome email with a link to your free guide.

- Day 3: Share a short story about how you helped a client reach financial freedom.

- Day 5: Send an invite to schedule a consultation.

- Day 10: Follow up with a success case or testimonial.

You can mix email, SMS, and even voicemail drops for a more human touch.

📈 Goal: Build trust and familiarity before pitching your services.

🔁 Step 3: Use Funnels + Workflows for Continuous Lead Engagement

Combine your funnels and workflows to create a self-sustaining marketing system.

Example:

- A visitor downloads your “Retirement Guide.”

- GoHighLevel automatically:

- Adds them to your CRM.

- Sends a thank-you email.

- Starts a 10-day educational drip campaign.

- Triggers a reminder for you to follow up manually after Day 7.

This type of automation ensures no lead falls through the cracks while maintaining a personal touch at every stage.

📊 Step 4: Retarget and Re-Engage Interested Leads

Not every lead converts the first time – some just need more time or exposure.

GoHighLevel integrates with Facebook, Google, and LinkedIn ads for retargeting campaigns, so you can:

- Show ads to visitors who viewed your consultation page but didn’t book.

- Offer new free resources to inactive leads.

- Re-engage past clients for new services.

💡 Example: “Still thinking about your financial goals for 2026? Schedule your free strategy call today.”

This keeps your brand visible and increases conversions from warm traffic.

💬 Step 5: Track ROI and Lead Source Attribution

GoHighLevel’s built-in analytics show you which marketing channels drive the best results.

From your dashboard, you can see:

- Which campaigns generate the most leads.

- Cost per acquisition (CPA) and conversion rate.

- ROI per funnel, ad, or keyword.

- Client journey – from first contact to signed deal.

This data helps you double down on what’s working and stop wasting money on what’s not.

📈 Step 6: Build Automated Referral Campaigns

Referrals are the most powerful (and affordable) form of marketing.

With GoHighLevel, you can:

- Create automated post-meeting campaigns that encourage satisfied clients to refer friends.

- Include referral rewards or thank-you gifts.

- Track referrals automatically using tags or form submissions.

Example message:

“Hi James, thanks for trusting us with your portfolio! If you know anyone who’d benefit from a personalized wealth strategy, share this link – we’d love to help them too.”

✅ In Short

GoHighLevel gives you the marketing power of a full team – all in one place.

You can:

- Build lead-capturing funnels that run 24/7.

- Nurture prospects automatically with personalized campaigns.

- Retarget visitors and follow up with precision.

- Measure every lead source and ROI from your dashboard.

- Turn happy clients into consistent referral engines.

With these tools, your financial advisory practice moves from chasing leads to consistently attracting and converting them on autopilot.

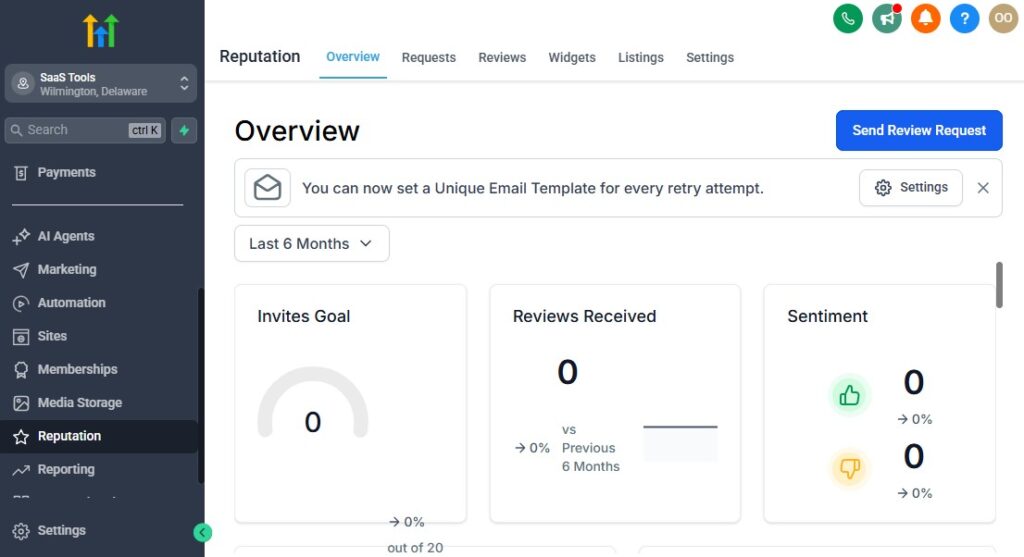

Collecting Reviews & Building Online Reputation – GoHighLevel for Financial Advisors

In financial services, trust is everything – and in today’s digital age, your reputation is your currency.

Clients want to see proof that others trust you before they do the same.

GoHighLevel helps you collect, manage, and showcase reviews effortlessly, turning satisfied clients into your most persuasive marketing assets.

Here’s how to use it to strengthen your reputation and attract more clients: 👇

⭐ Step 1: Automate Review Requests After Consultations

Once a client completes a consultation, GoHighLevel can automatically send a polite, branded message asking for feedback or a testimonial.

Example automation:

- Trigger: When a pipeline stage changes to “Consultation Completed” or “Review.”

- Action: Send a text/email like: “Hi Sarah, thank you for trusting us with your financial goals. Could you take 30 seconds to share your experience? Your feedback helps us grow and serve you better. [Review Link]”

You can schedule it to go out immediately or a few days after the meeting to catch clients when they’re most satisfied.

💡 Pro tip: Add your review link to Google Business Profile, Facebook Page, or directly to your website form inside GoHighLevel.

🗂 Step 2: Manage Testimonials in the Reputation Tab

GoHighLevel’s Reputation Management Tab centralizes all incoming reviews across multiple platforms – Google, Facebook, or custom feedback forms.

From one dashboard, you can:

- Read and respond to every review quickly.

- Filter by rating (e.g., 5-star, 4-star).

- Track your overall average rating and response rate.

- Flag negative reviews for internal follow-up.

This ensures you never miss a client’s comment – positive or negative – and gives you full control over your brand perception.

🌟 Step 3: Showcase Verified Reviews on Your Website

Once you’ve collected glowing feedback, show it off. GoHighLevel lets you embed testimonials directly onto your website or landing pages.

You can:

- Use the built-in Review Widget to display real-time ratings.

- Create a dedicated “What Our Clients Say” page with auto-updated reviews.

- Add client names and profile pictures (with permission) for authenticity.

📈 Result: Prospects who land on your page see real, verified reviews – boosting trust and increasing your conversion rate.

💬 Step 4: Turn Positive Reviews into Marketing Content

Each great review is a potential marketing asset. Repurpose them into:

- Social media posts: Highlight happy clients (anonymized if needed).

- Email newsletters: “Here’s what our clients are saying this month.”

- Sales funnels: Add testimonials to your consultation pages for credibility.

💡 Example caption:

“We love helping people feel more confident about their financial future. Here’s what one of our clients said after their first review session 👇 [Insert Review]”

This creates a steady flow of authentic content that promotes your credibility – without sounding salesy.

⚠️ Step 5: Monitor & Respond Professionally to Every Review

Responding to reviews – especially negative ones – shows professionalism and care.

In GoHighLevel’s dashboard, you can reply directly within the platform:

- Positive review: “Thank you, James! It’s always a pleasure helping you with your financial strategy.”

- Neutral/negative review: “Hi Mary, we appreciate your feedback and would love to address your concern. Please contact us directly so we can make it right.”

This proactive approach turns potential setbacks into opportunities to demonstrate your reliability and empathy.

✅ In Short

GoHighLevel makes reputation management effortless by automating review collection, tracking feedback, and showcasing testimonials everywhere that matters.

With it, you can:

- Request reviews automatically after meetings.

- Monitor and respond from one dashboard.

- Showcase authentic testimonials on your website.

- Repurpose client feedback for social proof and marketing.

- Build trust that attracts new clients and retains existing ones.

In financial advising, your reputation drives referrals and growth – GoHighLevel ensures it stays strong, visible, and well-managed.

Tracking Financial KPIs & Performance Reports

In financial advising, data is everything – not just for your clients’ portfolios but for your own business performance too.

GoHighLevel makes it simple to track, measure, and optimize every part of your operations.

From lead generation to client retention, it gives you full visibility into what’s working and where to improve.

Here’s how to use GoHighLevel to stay on top of your numbers and grow strategically: 👇

📊 Step 1: Monitor Client Engagement and Communication Metrics

Strong relationships drive retention, and GoHighLevel’s analytics let you measure how well you’re keeping clients engaged.

From your Conversations and Workflows dashboards, you can track:

- Open and click rates for emails and SMS.

- Response rates to automated campaigns.

- Call logs, missed calls, and response time.

- Client activity across different communication channels.

💡 Pro tip: Low engagement might mean it’s time to update your messaging tone, send more relevant content, or adjust the timing of your outreach.

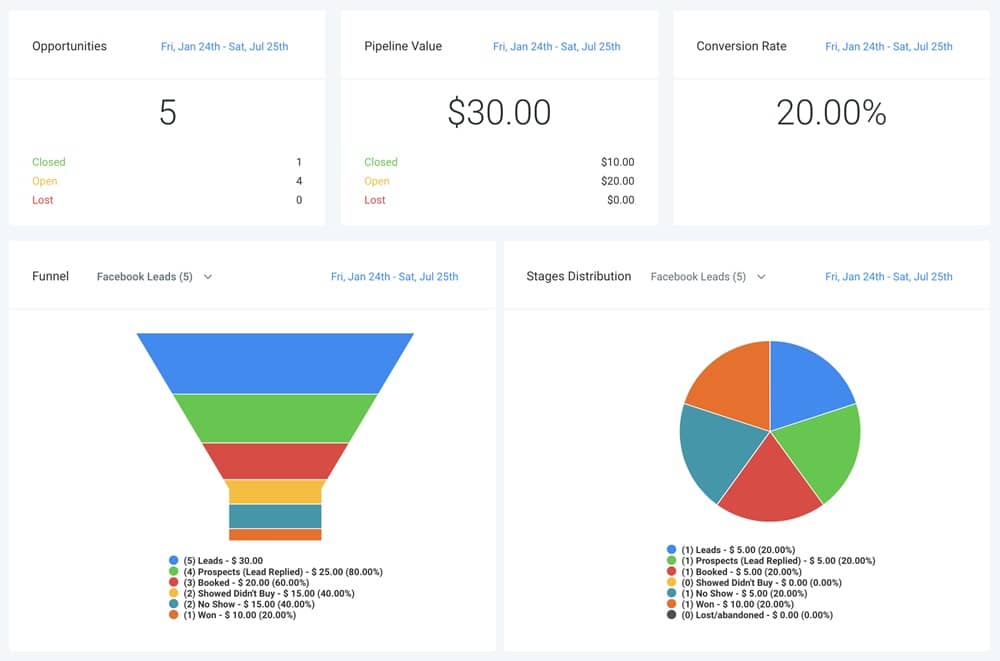

📈 Step 2: Track Conversions from Leads to Clients

GoHighLevel’s Pipeline view gives you a real-time snapshot of your entire sales funnel – from cold lead to signed client.

You can easily see:

- Number of new leads per week or month.

- Conversion rate from consultations to clients.

- Time taken for leads to move between pipeline stages.

- Drop-off points that need attention.

Example insight:

If 60% of your leads book a consultation but only 20% become clients, you can analyze your proposal or follow-up process to boost conversions.

💰 Step 3: Track Revenue, Fees & Renewals Automatically

With GoHighLevel’s Reporting and Dashboard tools, you can keep an eye on your financial performance without manual spreadsheets.

You can track:

- Monthly recurring revenue (MRR) from retainers or subscription-based plans.

- One-time fees from consultations or financial planning packages.

- Renewal rates for insurance or investment clients.

- Total pipeline value (expected revenue from ongoing deals).

💡 Pro tip: Set up pipeline stages that represent income milestones – this helps you forecast earnings and identify high-value clients easily.

📆 Step 4: Analyze Appointment and Conversion Data

Your Calendar Reports give you insights into scheduling patterns and conversion efficiency.

Track metrics like:

- Number of appointments booked per week.

- No-show and reschedule rates.

- Conversion rate from booked meetings to paying clients.

📈 Example: If you notice many first consultations don’t convert, you might improve your pre-meeting questionnaires or follow-up workflows to strengthen conversions.

📑 Step 5: Build Custom Dashboards for Your KPIs

Every financial advisory firm measures success differently. GoHighLevel allows you to create custom dashboards that reflect your most important metrics.

You can display data such as:

- Lead source breakdown (Google Ads, referrals, website forms).

- Client retention and churn rates.

- Average client lifetime value (LTV).

- Campaign ROI comparisons.

💡 Pro tip: Use widgets like “Funnel Performance,” “Revenue per Pipeline,” and “Appointments by Source” to get an instant overview of your business health.

📤 Step 6: Export or Share Reports with Your Team

GoHighLevel lets you export or schedule reports to be automatically sent to your inbox or team members.

You can:

- Share weekly KPI summaries with advisors.

- Send monthly performance updates to management.

- Keep records for compliance or investor reporting.

This keeps everyone aligned and ensures accountability across the team.

✅ In Short

With GoHighLevel, your financial advisory business runs on real-time insights – not guesswork. You can:

- Track every client interaction and lead conversion.

- Measure marketing ROI and revenue growth.

- Identify bottlenecks and improve processes.

- Forecast income and retention rates with accuracy.

- Keep your team accountable with automated reports.

When you know your numbers, you can make smarter decisions – and GoHighLevel makes that process effortless.

Integrating GoHighLevel with Other Financial Tools

Your advisory business doesn’t run on GoHighLevel alone – you probably rely on accounting, document signing, and portfolio management apps too.

The good news?

GoHighLevel integrates seamlessly with your existing tools to create a fully connected, automated ecosystem that keeps your workflows smooth and efficient.

Let’s explore how to connect GoHighLevel with the tools financial advisors use daily 👇

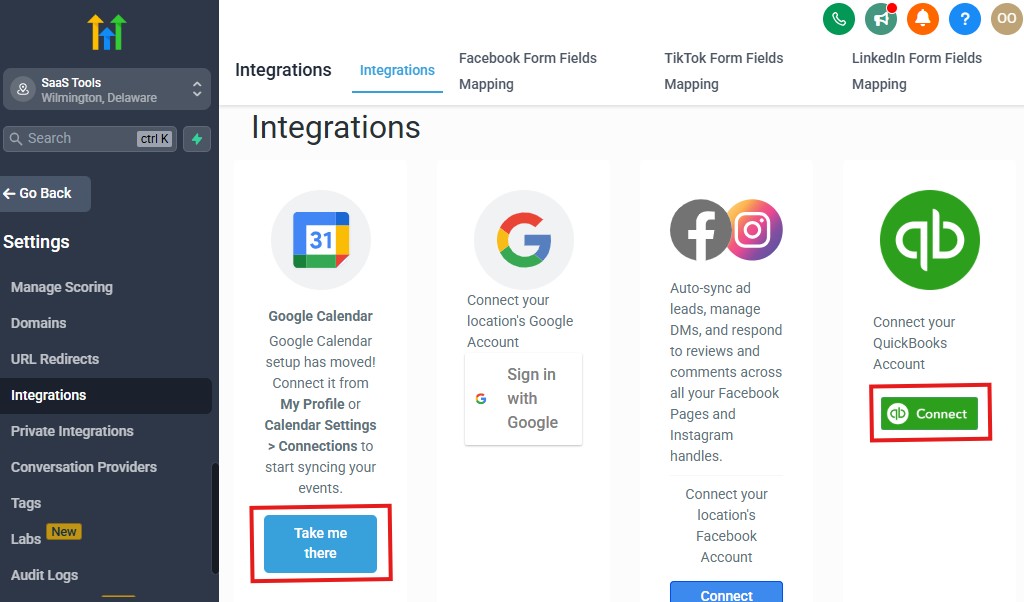

🔗 Step 1: Connect Accounting Tools (QuickBooks, Xero, Wave)

Financial advisors need accurate and real-time financial data – and GoHighLevel can integrate with accounting software to simplify payment tracking, invoicing, and reporting.

Using Zapier or Pabbly Connect, you can:

- Automatically create invoices in QuickBooks or Xero when a deal is marked as “Closed Won.”

- Log payments received into GoHighLevel to update client records.

- Sync transaction data to your CRM for quick access.

💡 Pro tip: Use tags like “Invoice Sent” or “Payment Received” in GoHighLevel to trigger accounting automations and keep financial workflows clean.

🖊 Step 2: Integrate with Document Signing Tools (DocuSign, PandaDoc)

Client onboarding often involves agreements, disclosures, and signatures. Instead of managing paperwork manually, integrate DocuSign or PandaDoc with GoHighLevel to handle everything digitally.

Example automation:

- Client accepts a proposal in your GoHighLevel pipeline.

- The system sends a DocuSign link automatically for signature.

- Once signed, the document is uploaded to the client’s record in GoHighLevel.

This creates a smooth, compliant, and paperless signing process – perfect for advisors managing multiple clients daily.

📊 Step 3: Connect Google Sheets for Tracking & Analysis

If you prefer a visual or manual record of client data, GoHighLevel easily syncs with Google Sheets.

You can:

- Export client data, deals, and revenue stats into a spreadsheet.

- Build custom dashboards or KPI reports.

- Track referrals, commissions, or renewal schedules.

💡 Pro tip: Use Sheets as a live performance tracker by automating updates – every time a deal closes in GoHighLevel, a new row is added in your sheet.

💼 Step 4: Integrate CRM or Portfolio Tools (Redtail, Wealthbox, Morningstar)

Many financial advisors already use industry-specific CRMs or portfolio management software. GoHighLevel can complement – not replace – them.

Through Zapier or webhooks, you can:

- Sync contact details between GoHighLevel and your existing CRM.

- Automatically create notes or tasks when client portfolios change.

- Trigger GoHighLevel workflows based on activity in your financial platform (e.g., renewal dates, investment performance updates).

This keeps your marketing, communication, and financial tracking in perfect sync.

📱 Step 5: Extend Functionality with Zapier, Pabbly, or Webhooks

GoHighLevel integrates natively with many tools, but for everything else, Zapier, Pabbly Connect, or custom webhooks bridge the gap.

Use them to connect with:

- Calendly (for external scheduling).

- Slack or Microsoft Teams (for internal notifications).

- Dropbox or Google Drive (for secure document storage).

- Stripe or PayPal (for payment processing).

You can literally automate an entire workflow from lead capture to onboarding, payment, and post-service follow-up – all hands-free.

🧠 Step 6: Integrate AI Assistants & Chat Tools

Want to stay ahead of the curve? GoHighLevel’s API and marketplace allow AI-based integrations too.

You can connect tools like:

- ManyChat or Tidio for chatbots.

- ChatGPT API or Jasper AI for personalized client communications.

- Voice AI tools for follow-up calls and appointment confirmations.

These integrations save you time while improving client engagement and responsiveness.

✅ In Short

Integrations turn GoHighLevel from a CRM into your complete financial operations hub. With the right connections, you can:

- Sync accounting and payments automatically.

- Handle contracts digitally with e-sign tools.

- Share and analyze data in real time.

- Keep marketing and portfolio management perfectly aligned.

- Use AI and automation to stay efficient and compliant.

Whether you’re managing five clients or five hundred, connecting GoHighLevel with your favorite financial tools gives you a seamless, tech-powered system that runs like clockwork.

Learn More:

- What is GoHighLevel? (Features, Use Cases, Pricing & More)

- GoHighLevel Review: (My Experience After 5 Years)

- GoHighLevel Pricing: (+ Discount Codes)

- GoHighLevel Features: (Full List of Tools)

- GoHighLevel Onboarding Checklist: (Complete Tutorial)

- GoHighLevel for Property Management: (Detailed Tutorial)

- GoHighLevel for Small Businesses: (2026 Helpful Tutorial)

- GoHighLevel for Service Businesses: (2026 Helpful Tutorial)

- GoHighLevel for Local Businesses: (2026 Helpful Tutorial)

Advanced Automation for Financial Advisors

Once your GoHighLevel system is running smoothly, it’s time to take things up a notch with advanced automation – the kind that helps you scale your business, stay consistent, and deliver next-level client experiences without lifting a finger.

These automations go beyond basic workflows; they’re designed to help you anticipate client needs, personalize communication, and optimize every touchpoint from onboarding to renewal.

Here’s how to set them up: 👇

🔔 Step 1: Triggered Reminders for Insurance Renewals & Investment Reviews

Never let a client’s renewal date or review period slip through the cracks again.

Using date-based triggers in GoHighLevel workflows, you can:

- Automatically send reminders 30 days before a policy renewal or portfolio review.

- Follow up with personalized scheduling links.

- Notify your team to prepare reports or updated proposals.

💬 Example automation:

Trigger: “Insurance Renewal Date – 30 Days” →

Action 1: Send reminder email to client.

Action 2: Assign “Renewal Task” to advisor.

Action 3: Add client to “Active Renewal” tag list.

This ensures every renewal happens smoothly – no missed opportunities, no manual tracking.

📧 Step 2: Automated Follow-Ups After Consultations

Follow-ups are where deals are closed, yet they’re often forgotten. Automate them once and never worry again.

Create a post-consultation workflow that:

- Sends a thank-you email immediately after the meeting.

- Waits 48 hours, then sends a “Did you have any questions?” follow-up.

- Waits 5 days, then sends a “Ready to move forward?” message with a booking link.

💡 Pro tip: Include dynamic content so follow-ups differ based on consultation outcome (e.g., “Proposal Sent” vs. “Still Considering”).

🎯 Step 3: Smart Drip Campaigns for Different Client Categories

One-size-fits-all messaging doesn’t work in financial services. GoHighLevel allows you to create segmented drip campaigns for each client type.

Examples:

- New leads: 7-day educational sequence explaining your advisory process.

- Active clients: Quarterly updates and personalized check-in messages.

- Dormant clients: Re-engagement campaigns offering free financial reviews.

- Referral partners: Exclusive updates, referral rewards, and special insights.

Each workflow automatically adapts based on tags, service type, or pipeline stage – keeping your communication sharp and relevant.

🤖 Step 4: AI-Powered Communication & Appointment Scheduling

GoHighLevel’s built-in AI tools (and integrations like ChatGPT or ManyChat) can automate conversations with leads and clients intelligently.

You can set up:

- AI chatbots on your website that qualify leads and book appointments.

- Auto-reply messages for after-hours inquiries.

- AI-generated emails for personalized follow-ups or summaries.

💬 Example:

“Hi James! I noticed you downloaded our Investment Guide yesterday. Would you like to schedule a quick 15-minute chat to explore your options?”

This kind of automation feels human, saves time, and ensures you never miss a lead – even while you sleep.

📞 Step 5: Internal Team Automations for Task Management

Automation isn’t just about client communication – it also improves your team’s workflow.

Inside GoHighLevel, you can:

- Automatically assign tasks to specific advisors based on pipeline stage.

- Notify team members via email or Slack when a new client is onboarded.

- Trigger internal checklists when clients hit specific milestones.

💡 Example:

When a client moves to “Proposal Sent,” assign a task to the admin team: “Prepare contract for signature.”

This keeps everyone in sync, prevents bottlenecks, and eliminates miscommunication.

📊 Step 6: Automation for Reports & Client Updates

Save hours of manual reporting with recurring, automated updates.

- Set GoHighLevel to send monthly performance summaries to clients.

- Include links to updated dashboards or financial reports.

- Automate internal performance reports every Friday to your team inbox.

📈 Result: Clients stay informed, and your team stays proactive – all without manual effort.

✅ In Short

Advanced automation in GoHighLevel transforms your financial advisory practice from organized to optimized.

With it, you can:

- Anticipate client needs and respond automatically.

- Follow up consistently with zero effort.

- Keep your team aligned with automated workflows.

- Engage clients through personalized drip campaigns.

- Use AI to enhance communication and save time.

When set up right, GoHighLevel becomes the invisible engine powering every interaction – letting you focus on what matters most: building wealth for your clients and growth for your firm.

Common Mistakes Financial Advisors Make in GoHighLevel

Even though GoHighLevel is built to simplify your entire workflow, many financial advisors still make small but costly mistakes that limit their results.

These errors often stem from skipping foundational setup steps or over-automating before mastering the basics.

Let’s go over the most common mistakes – and how you can avoid them – so your GoHighLevel setup runs smoothly and delivers consistent results.

🚫 Mistake 1: Not Segmenting Clients Properly

Many advisors dump all their contacts into one list without categorizing them, making it impossible to send targeted messages or track client progress.

Why it hurts:

You end up sending irrelevant content, missing renewal opportunities, and losing personal touch with high-value clients.

How to fix it:

- Use tags like “Retirement,” “Insurance,” “Tax Planning,” or “Wealth Management.”

- Create smart lists that segment clients based on goals, portfolio size, or service level.

- Build automation rules that trigger based on each tag (e.g., send different follow-ups to insurance clients than to investment clients).

💡 Pro tip: Personalization = trust. The more relevant your communication, the stronger your client retention.

⚠️ Mistake 2: Ignoring Compliance & Documentation Setup

Some advisors rush to automate emails or build funnels without setting up compliance disclaimers and consent collection – a big red flag in financial services.

Why it hurts:

You could violate data protection laws or appear unprofessional to regulators and clients.

How to fix it:

- Add disclaimer footers to every email and landing page.

- Use opt-in checkboxes for form submissions.

- Store client consent records inside GoHighLevel custom fields.

- Set up automated document requests to keep client files current and compliant.

📋 Remember: Automation is great, but compliance is non-negotiable.

🤖 Mistake 3: Over-Automating Without Personalization

Automation saves time, but when overused, it can make your communication feel cold and robotic.

Why it hurts:

Clients may feel disconnected, ignored, or unsure if they’re dealing with a real person.

How to fix it:

- Use personalized merge fields (e.g., first name, portfolio type, last meeting date).

- Balance automation with manual touchpoints – especially for high-value clients.

- Add personal voice notes or Loom videos inside automated follow-ups.

💡 Pro tip: Automation should enhance relationships, not replace them.

📉 Mistake 4: Failing to Review and Clean Up Data Regularly

Old contacts, incomplete records, or duplicate entries make your CRM messy and your reports unreliable.

Why it hurts:

It skews your analytics, inflates pipeline numbers, and makes it harder to track real performance.

How to fix it:

- Audit your CRM monthly.

- Merge duplicate contacts.

- Remove inactive or irrelevant leads.

- Update client statuses after each major meeting or milestone.

📈 Result: Clean data = accurate insights and better decision-making.

🔕 Mistake 5: Not Leveraging Reports & Analytics

Some advisors use GoHighLevel only for automation and ignore the powerful data it provides.

Why it hurts:

You can’t improve what you don’t measure. Without tracking, you miss out on optimization opportunities.

How to fix it:

- Check your Pipeline and Conversion Reports weekly.

- Use Revenue Forecasts to project monthly earnings.

- Track engagement metrics (email open rates, response times, etc.).

- Adjust your campaigns and workflows based on performance data.

💡 Pro tip: Data-driven advisors make smarter, faster business decisions.

✅ In Short

Avoiding these common mistakes keeps your GoHighLevel system efficient, compliant, and client-focused.

Here’s a quick recap of what to do instead:

- Segment clients with tags and smart lists.

- Prioritize compliance in every automation.

- Personalize communication beyond templates.

- Clean your CRM data regularly.

- Track KPIs and optimize based on insights.

When you treat GoHighLevel as a living system – one you review, refine, and personalize – it stops being “just a CRM” and becomes your most powerful business growth tool.

Tips to Maximize ROI with GoHighLevel for Financial Advisors

Once your GoHighLevel system is set up and running, the goal shifts from “getting it to work” to getting the most value out of it.

As a financial advisor, every minute saved and every process automated directly impacts your bottom line.

The following strategies will help you squeeze maximum ROI from your GoHighLevel setup – turning it into a profit-generating powerhouse.

💼 Tip 1: Use Snapshots for Repeatable Workflows

If you serve similar types of clients (e.g., retirement planning, insurance, or investment management), stop rebuilding automations from scratch.

Snapshots allow you to duplicate proven workflows, funnels, and campaigns into new accounts or sub-accounts in seconds.

✅ Use it to:

- Launch onboarding systems for new advisors on your team.

- Clone successful lead generation funnels.

- Standardize compliance templates across your business.

💡 Pro tip: Update your master snapshot regularly as your processes improve – it’ll save hours every time you onboard a new advisor or expand your operations.

🤖 Tip 2: Automate Your Most Time-Consuming Tasks

Identify tasks that eat up your day – then automate them using GoHighLevel’s workflow builder.

Examples include:

- Appointment confirmations and reminders.

- Client check-in messages.

- Renewal and review follow-ups.

- Feedback and review requests after meetings.

Every minute you save through automation adds up to more time for high-value work – like portfolio analysis or client strategy calls.

💡 Pro tip: Use “if/else” conditions in workflows to create dynamic automations that adapt based on client actions or responses.

📈 Tip 3: Review Analytics and Refine Campaigns Regularly

Set aside time each week or month to analyze your GoHighLevel performance data.

Pay attention to:

- Pipeline conversion rates: Are your consultations converting into clients?

- Campaign engagement: Which emails or messages perform best?

- Revenue growth trends: Which services or funnels bring in the most revenue?

Then make data-driven tweaks to optimize your workflows, messaging, and lead sources.

📊 Pro tip: Even small improvements in conversion (e.g., from 20% to 25%) can compound into thousands of dollars in extra revenue annually.

💬 Tip 4: Personalize Automation Without Losing Efficiency

Automation is powerful, but clients still crave the human touch. GoHighLevel lets you balance both beautifully.

Try this:

- Add your client’s first name and last review date in messages.

- Use custom fields to tailor recommendations based on client goals.

- Record a personalized video once, and reuse it in automated sequences.

💡 Pro tip: The more authentic your automation feels, the stronger your client retention and referrals will be.

🔁 Tip 5: Encourage Referrals Using Automated Post-Meeting Campaigns

Referrals are your highest-quality leads – and GoHighLevel can help you generate them consistently.

Set up a post-meeting automation that sends a thank-you message and politely asks for referrals.

Example:

“Hi John, it was great catching up today! If you know anyone who might benefit from a financial review like yours, I’d love to help them. You can share this link: [Referral Form Link]”

You can even reward referrals with incentives like free consultations or portfolio audits.

💡 Pro tip: Create a simple “Referral Funnel” using a form + thank-you page to track and reward new client introductions.

💎 Tip 6: Stay Updated with New Features & Integrations

GoHighLevel evolves fast -[ and each update usually brings new opportunities for efficiency and growth.

Keep an eye on:

- The GoHighLevel Marketplace for new financial service snapshots.

- Community webinars and updates inside your dashboard.

- New integrations (e.g., AI tools, reporting add-ons, or compliance apps).

Staying up to date ensures you’re always leveraging the platform’s full power while your competitors lag behind.

✅ In Short

Maximizing your ROI with GoHighLevel is about working smarter, not harder.

Here’s your quick action list:

- Reuse and refine your best systems with Snapshots.

- Automate repetitive, time-heavy tasks.

- Review analytics regularly and improve your numbers.

- Add a personal touch to every automated interaction.

- Turn every happy client into a source of new leads.

- Stay updated to keep your systems sharp and modern.

When used strategically, GoHighLevel doesn’t just save you time – it becomes a growth multiplier that helps your financial advisory firm scale efficiently, profitably, and sustainably.

Frequently Asked Questions

FAQs about GoHighLevel for Financial Advisors.

Is GoHighLevel compliant for financial services?

Yes, GoHighLevel can be used in a compliant manner – but compliance depends on how you configure it.

While GoHighLevel itself follows secure data practices and encryption standards, you must ensure your setup includes:

- Privacy disclaimers on every funnel and form.

- Clear opt-in consent for communication (email/SMS).

- Secure file uploads and restricted staff access.

- Proper data storage policies in line with local regulations.

💡 Pro tip: Always consult your compliance officer or licensing body to ensure your automations align with your region’s financial data regulations.

Can I manage multiple advisors under one GoHighLevel account?

Yes. If you operate a firm or multi-advisor agency, GoHighLevel’s Agency Dashboard lets you create separate sub-accounts for each advisor.

Each sub-account can have:

- Its own pipelines, funnels, and automations.

- Independent calendars and client databases.

- Role-based permissions for data privacy.

This setup ensures smooth collaboration while keeping every advisor’s data secure and distinct.

How secure is client data inside GoHighLevel?

GoHighLevel uses SSL encryption and advanced access controls to protect sensitive client information.

You can further enhance data security by:

- Limiting staff access using permission roles.

- Enabling two-factor authentication (2FA).

- Regularly backing up client documents.

- Using compliance-friendly integrations like Google Drive or DocuSign for document storage.

📋 Pro tip: Add your privacy policy link in every form and email footer to show clients you take data security seriously.

Can I connect GoHighLevel to my existing CRM or portfolio tools?

Yes. GoHighLevel integrates with most major CRMs and portfolio platforms through Zapier, Pabbly Connect, or webhooks.

You can sync data automatically between systems like:

- Redtail, Wealthbox, or Morningstar for portfolio tracking.

- QuickBooks or Xero for accounting.

- Google Sheets for reporting.

This way, GoHighLevel becomes the central hub for marketing, communication, and automation – while your existing CRM handles specialized financial functions.

Does GoHighLevel integrate with DocuSign or QuickBooks?

Yes – and it’s one of the most useful setups for financial advisors.

- DocuSign: Use automation to send agreements, collect digital signatures, and store them under the client’s contact record automatically.

- QuickBooks or Xero: Create invoices, track payments, and link completed transactions back to your GoHighLevel pipeline for visibility.

💡 Pro tip: Use Zapier or Pabbly to bridge these integrations seamlessly – they take just minutes to set up.

Can I run my marketing campaigns directly inside GoHighLevel?

Yes. GoHighLevel replaces separate tools like Mailchimp, ActiveCampaign, and HubSpot.

You can create and send:

- Email campaigns and newsletters.

- SMS drip sequences for follow-ups.

- Landing pages and funnels for lead capture.

- Social media messages or WhatsApp outreach via integrations.

Everything syncs with your CRM so you can track every lead from first contact to conversion.

Can clients schedule consultations automatically?

Yes – GoHighLevel includes a built-in calendar booking system.

You can:

- Add booking links to your website, emails, or funnels.

- Automate reminders and confirmations.

- Sync your calendar with Google or Outlook.

- Even allow recurring appointments for reviews or renewals.

📲 Result: No more scheduling back-and-forth – clients book themselves at their convenience, and your system handles the rest.

How does GoHighLevel help me grow my financial advisory business?

GoHighLevel helps you work smarter, not harder.

You’ll:

- Automate onboarding, reminders, and follow-ups.

- Track leads, deals, and revenue from one dashboard.

- Build personalized client experiences that foster trust.

- Generate more leads through automated funnels and campaigns.

- Improve retention with consistent, relationship-driven communication.

In short, it helps you scale efficiently while delivering a premium client experience.

Final Thoughts

In today’s fast-paced financial landscape, clients expect more than expertise – they expect responsiveness, personalization, and a seamless experience at every stage of their financial journey. GoHighLevel gives you all the tools to deliver exactly that.

By combining CRM, automation, marketing, scheduling, and communication under one roof, it transforms how you manage clients and grow your practice.

No more juggling multiple apps or worrying about missed follow-ups – GoHighLevel keeps your entire business running smoothly and intelligently.

With everything you’ve learned in this guide, you now have the blueprint to:

- Build a client management system that’s efficient and compliant.

- Automate onboarding, renewals, and follow-ups effortlessly.

- Generate and nurture leads using smart funnels and campaigns.

- Track performance with real-time analytics and reports.

- Scale your advisory business confidently – without losing your personal touch.

💡 Remember: The real power of GoHighLevel isn’t just in automation – it’s in what automation gives you back: time, focus, and freedom to serve your clients better and grow faster.