As a mortgage broker, you deal with:

- constant lead calls

- document requests

- follow-ups

- rate questions

- pre-approvals

- application updates

- and communication with buyers, lenders, and referral partners.

Managing all of this manually can slow your business down and cause you to lose qualified borrowers simply because you couldn’t respond fast enough.

GoHighLevel for Mortgage Brokers gives you a complete system to manage your entire mortgage pipeline – from lead capture to loan approval – inside one powerful platform.

You can automate:

- follow-ups

- track borrower progress

- collect documents

- schedule consultations

- send updates

- and nurture long-term prospects without juggling multiple tools.

Whether you help first-time homebuyers, refinancers, or investors, GoHighLevel helps you stay organized, responsive, and consistent at every stage of the mortgage process.

This guide shows you exactly how to use GoHighLevel to streamline your workflow, convert more leads, and build a reliable mortgage pipeline that runs smoothly every day.

TL;DR

- GoHighLevel helps mortgage brokers automate lead follow-up, schedule consultations, manage loan pipelines, collect documents, and send timely updates.

- You can create clear pipelines for pre-approval, underwriting, conditions, and closing.

- Automated SMS + email follow-up dramatically increases conversions and borrower trust.

- The CRM keeps every borrower’s details, documents, and communication in one place.

- This guide walks you step-by-step through setting up GoHighLevel specifically for mortgage brokers so you can save time, increase closings, and serve clients better.

How to Set Up GoHighLevel for Mortgage Brokers

Let’s get straight to the point – first, we’ll set up your account, then I’ll walk you through all the strategies you can use.

This is how to set it up:

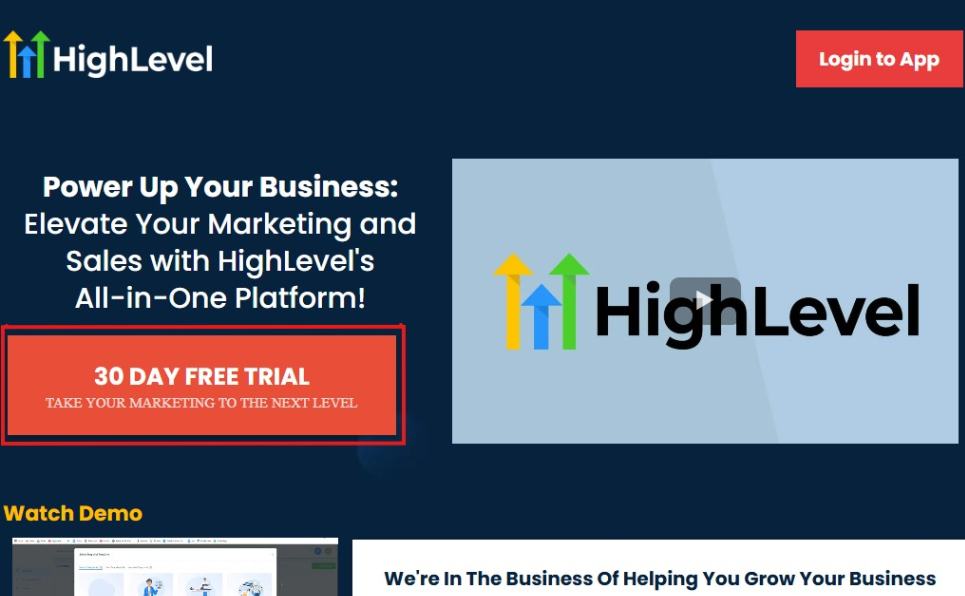

Step 1: Create HighLevel Account for 30 Days Free

Since you’re just starting with GoHighLevel, you would need to properly set up your account.

And you can do that for free through our exclusive 30-Day Free Trial link here.

In order to start, head over to gohighlevel.com/30-day-free-tial free trial and click on “30 DAY FREE TRIAL” as you can see below.

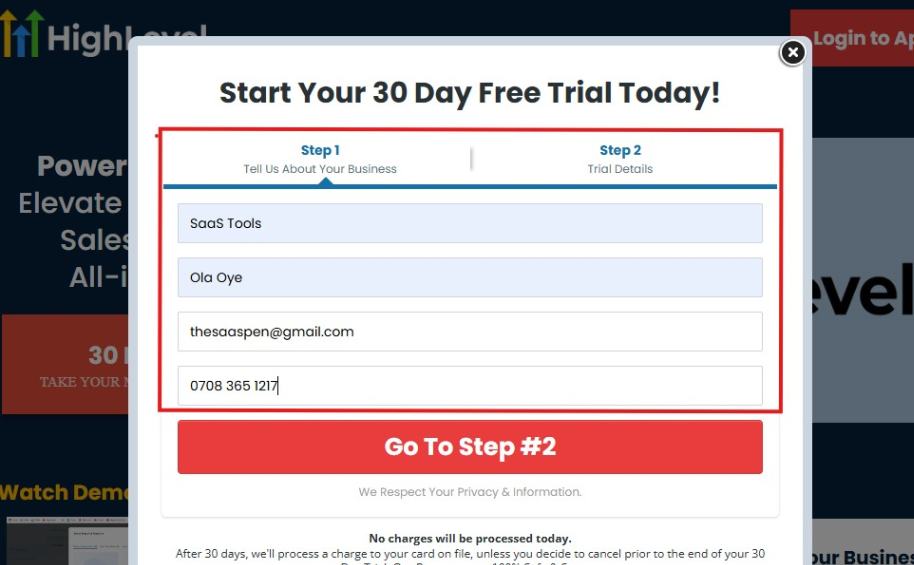

Upon clicking on “30 DAY FREE TRIAL“, a page will pop that looks exactly like the image below.

If you take a closer look at the image above, you will see that you need to supply your:

- Business name

- Company name

- Company email

- Phone number

Supply all the pieces of information and click on “Go To Step #2.”

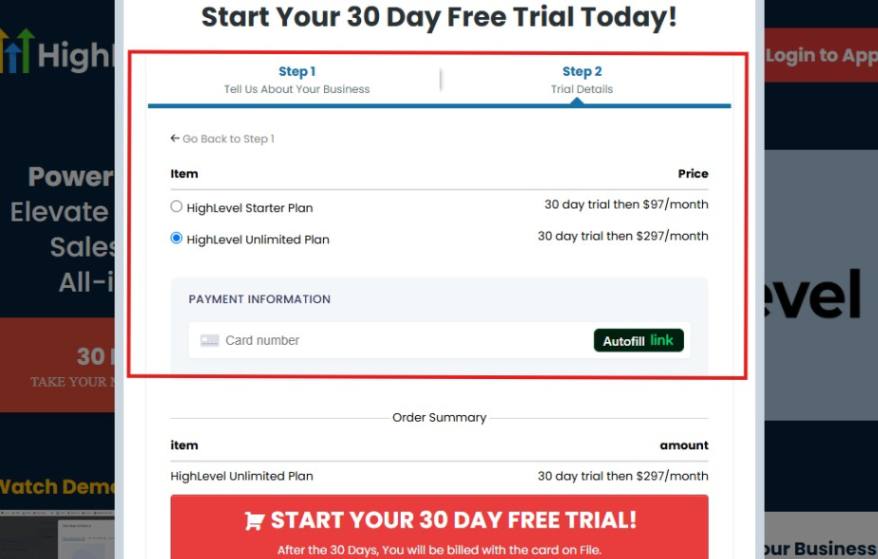

On the next page, you will be required to select the plan you want to opt in for.

As you can see from the image above, you can either choose from:

- HighLevel Starter Plan

- HighLevel Unlimited Plan

Select the HighLevel Unlimited Plan and continue – you can always upgrade to the SaaS Mode later if you want that or downgrade.

The next thing you want to do is supply your credit card information.

Note: You will not be debited anything today until the end of your trail that is if you don’t cancel. Keep in mind that $1 will be debited and refunded back instantly into your account just to test your card is working.

After you have supplied the information accordingly, click on “START YOUR 30 DAY FREE TRIAL” and you will be asked to confirm you’re not a robot.

After that, the page below will pop up.

The image above says, “Your Account has been created!” Now, you need to click on the blue button that says “Click Here to Get Started.“

Click on the blue button to start your onboarding process.

Step 2: GoHighLevel Onboarding Process

The onboarding questions help GoHighLevel understand why you have signed up for the platform so that it can tailor your experience accordingly.

This is all you need to do:

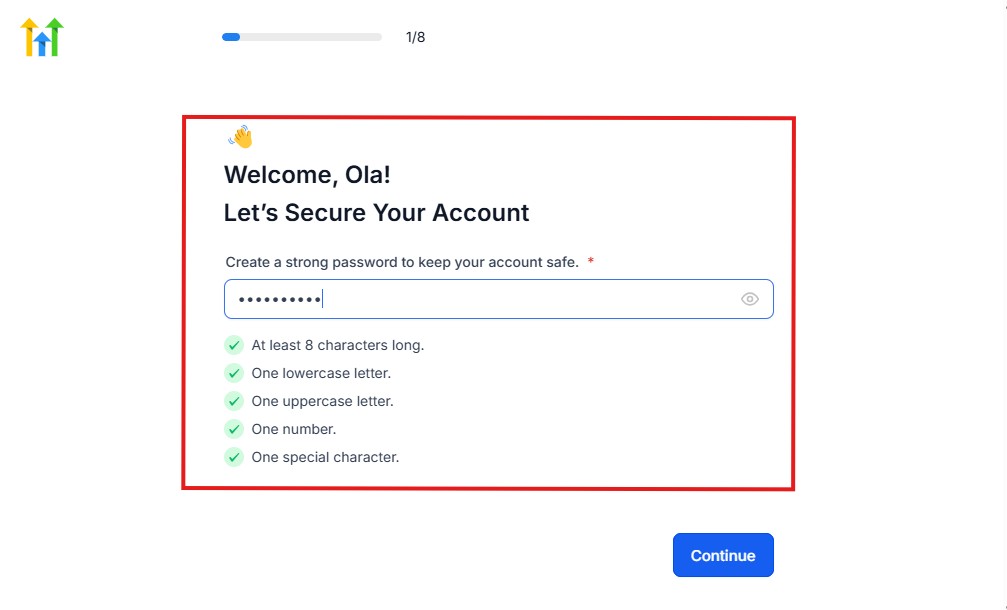

After you click on the blue button above, the page below will pop up.

As you can see above, you need to set up your password, and the password has to be:

- At least 8 characters long

- One lowercase letter

- One uppercase letter

- One number

- One special character

If you have input the password and it matches all the description above, everything will be green just the way it’s in the image.

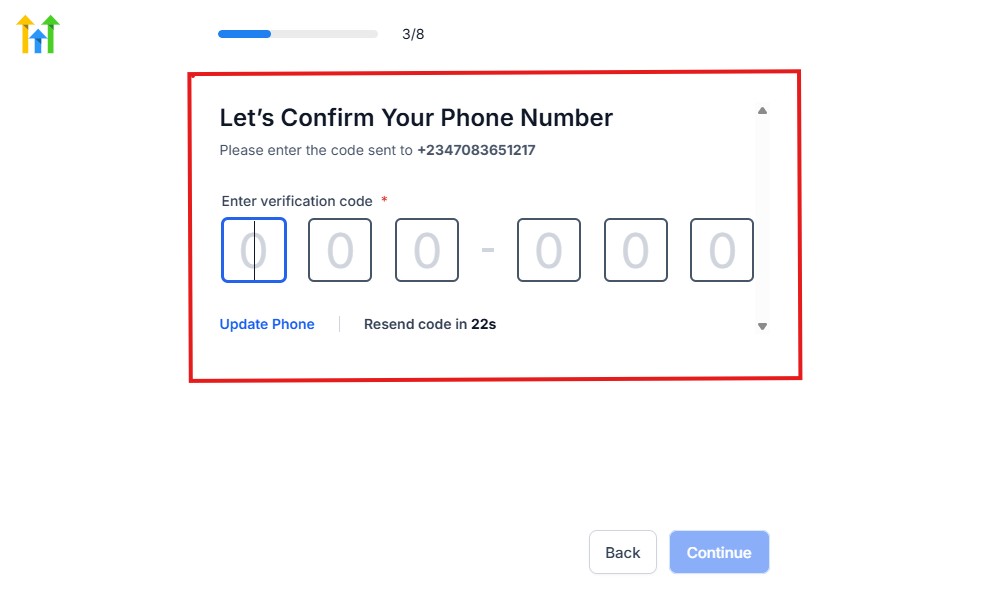

Click on “Continue” there after, and the image below will pop up.

As you can see, a code will be sent to you to confirm your email address and phone number. The process is the same for the 2.

The next thing you need to do is to select how you plan to use GoHighLevel, as you can see below.

Select what best matches why you have signed up and click on Continue.

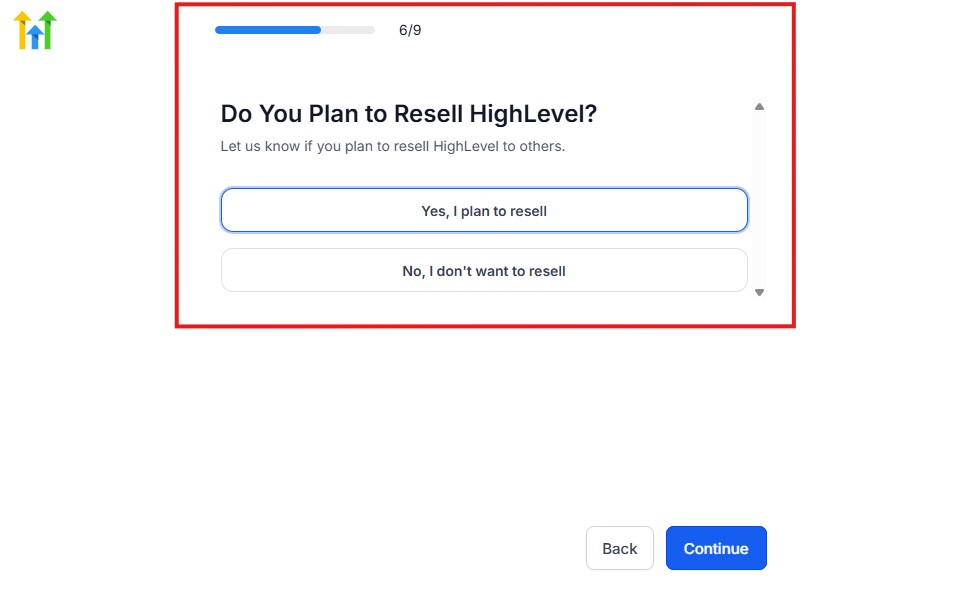

On the next page, you will be asked if you plan to resell GoHighLevel or not.

Select the answer based on the reason why you have signed up and click on “Continue”

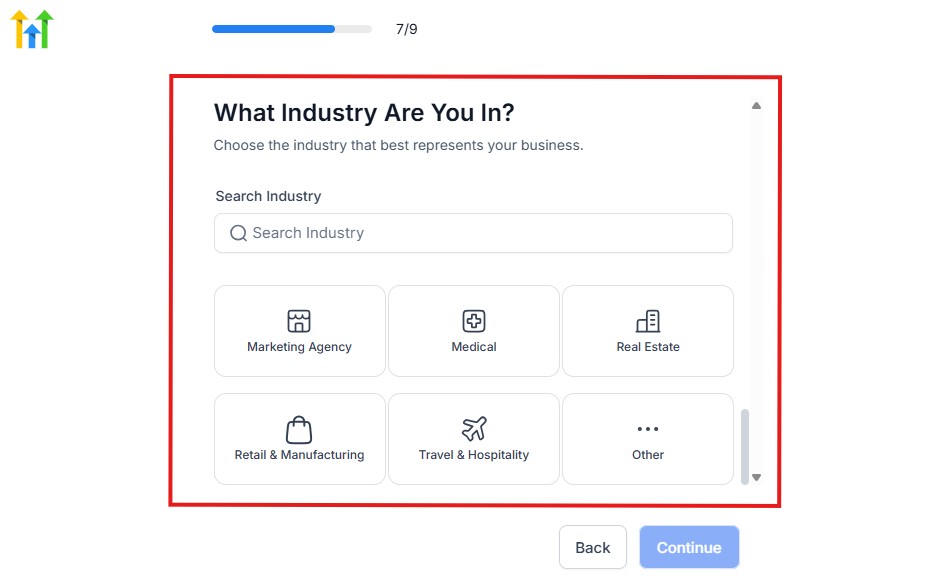

Then, the page below will pop up.

From the image above, you need to select the industry that you fall on. You can also make use of the search button if you can’t find it right away.

Then, click on continue after you select your industry.

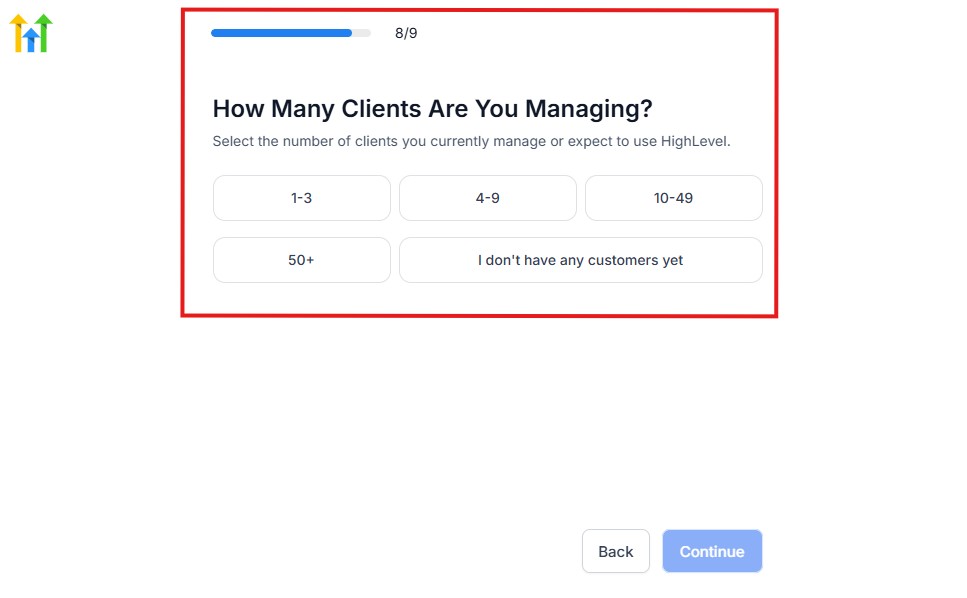

Then, the next thing you need to do is to select the number of clients that you currently have. Select “I don’t have any customers” yet if you currently don’t have one.

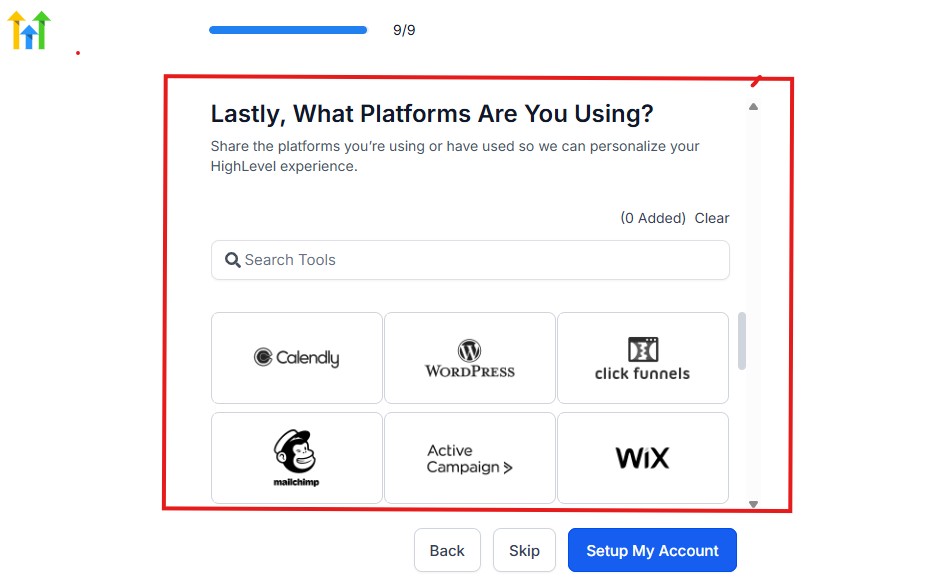

On the next page, you will be asked to select the platforms you currently use that you can integrate with GoHighLevel right away.

You can use the search button to search for any tools you want to add to your GoHighLevel account.

You can also skip this process and do it later if you want to.

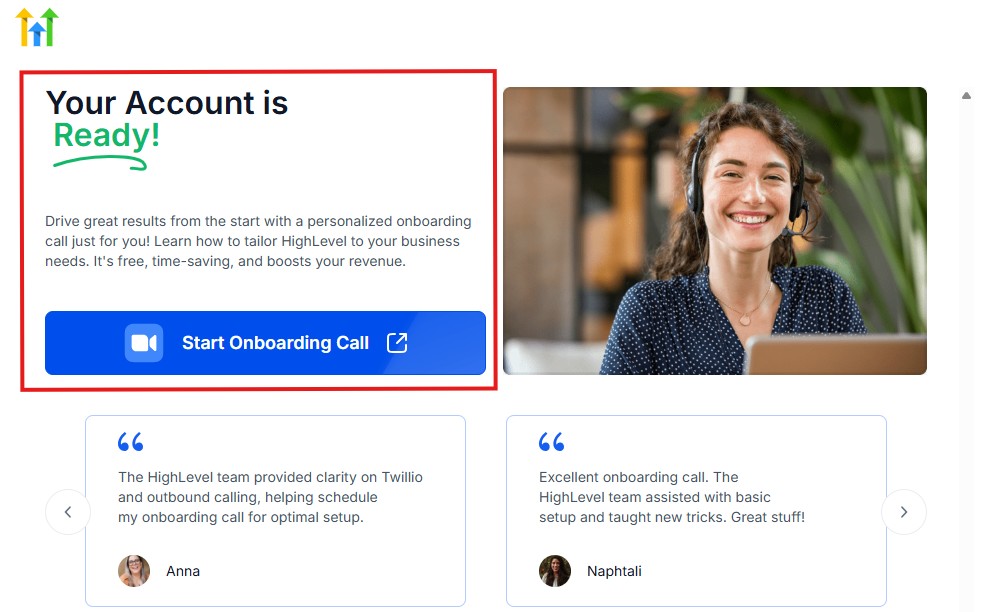

After that, the page below will pop up.

The page above says your account is ready and is asking you to “Start Onboarding Call.”

The “Onboarding Call” allows you to connect with the Go High Level team in order to discuss your account set-up process and everything regarding your plan in using HighLevel.

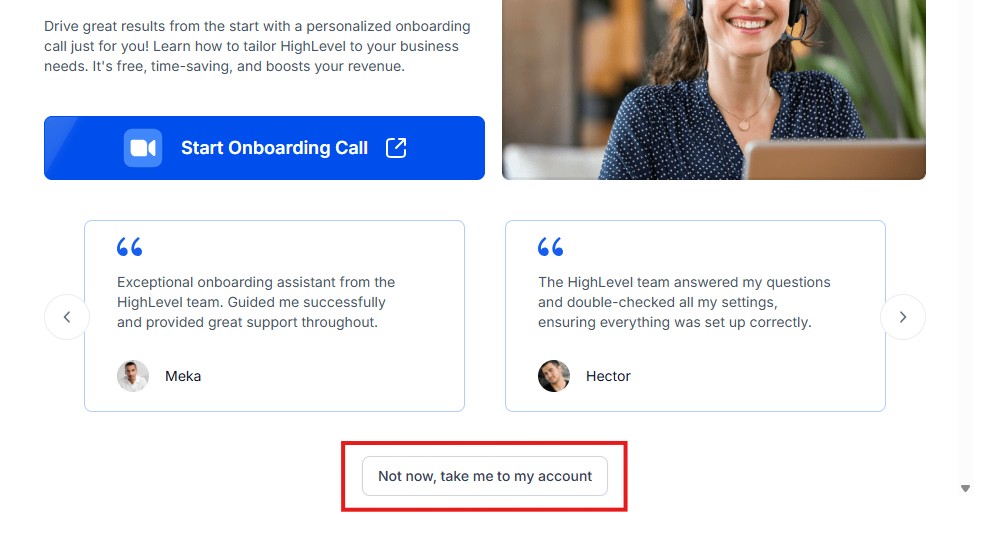

If you don’t want to start the “Onboarding Call” yet, just stroll down, and you will see the button in the image below.

Simply click on “Not now, take me to my account“, and you will have access to your dashboard.

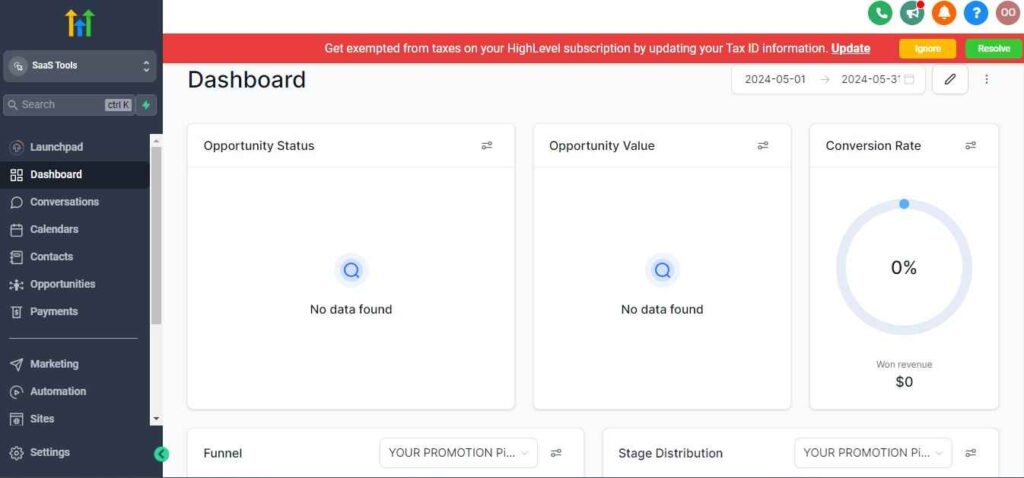

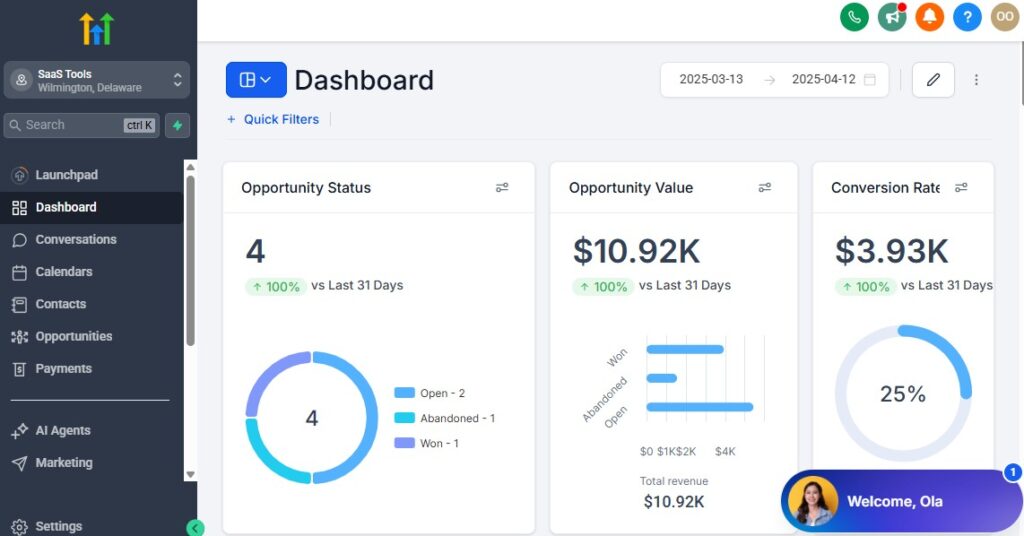

Note: If you have indicated that you want to resell HighLevel, you would have access to the agency dashboard by default, which looks like the image below.

But if you didn’t indicate interest in reselling GHL, your dashboard will look like the image below.

You can switch between these dashboards at any time.

The data you see on the dashboard above are not real data, they’re snapshots that you can use to kickstart your account setup process.

I want to say congratulations. You have successfully set up your Go High Level account.

✅ Tip: Use a professional logo and a branded email (like info@yourmortgagebrand.com) for a polished look.

Step 3: Connect Your Domain, Email & Phone

To make the most of GoHighLevel’s tools, connect your core communication channels:

- Domain – This is used for your landing pages and funnels (e.g., apply.yourmortgagebrand.com). Connecting your domain builds trust and supports custom branding.

- Email SMTP – Connect Gmail, Outlook, or another email service. This allows you to send automated follow-ups and newsletters from your email address.

- Phone Number – Buy or connect a number for SMS and call automation. You can have dedicated numbers for team members or departments if needed.

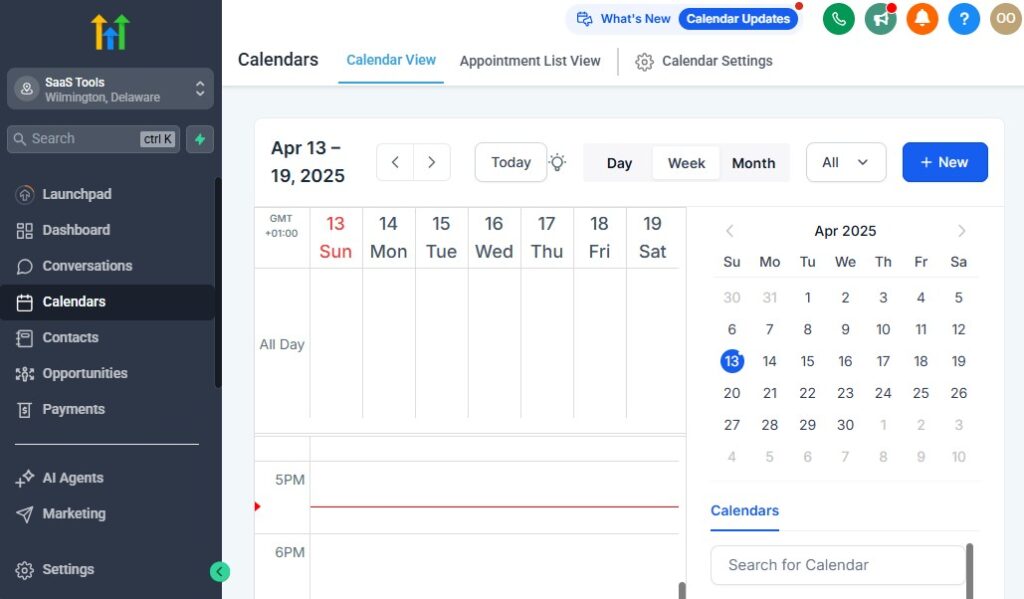

Step 4: Set Up Your Calendar

Calendar automation is essential for booking consultations and follow-ups.

- Create a calendar specifically for mortgage consultations, loan reviews, or pre-approval chats.

- Set availability, buffer times, and Zoom/Google Meet integrations.

- Embed your booking link on your website or funnels.

💡 Imagine a borrower booking a pre-approval call with you right after seeing your ad – without needing to speak to anyone first. That’s what this setup enables.

Step 5: Build Your Workspace Structure

Organize your account with pipelines, tags, and custom fields tailored to mortgage workflows:

Pipelines: Set up loan pipelines with stages like:

- New Lead → Pre-Approval Sent → Docs Collected → Underwriting → Approved → Closed

Tags: Use tags like “First-Time Buyer,” “Refinance,” “Investor,” or “Credit Repair” to segment contacts.

Custom Fields: Add fields such as loan amount, credit score, loan type, and estimated close date.

Step 6: Invite Your Team (If Applicable)

If you work with processors, assistants, or other brokers, you can add them to your GoHighLevel account.

- Assign roles and permissions (e.g., admin, user, restricted view).

- Create separate calendars or pipelines if different team members handle different loan types or regions.

- Use internal notes to keep team communication organized per client or deal.

Step 7: Import Existing Leads or Clients

If you’re switching CRMs or want to keep all your contacts in one place:

- Use the Contact Import tool to upload lists of borrowers, prospects, or partners.

- Apply tags during import to segment contacts (e.g., “Past Client,” “Pre-Approved,” or “Real Estate Partner”).

- Map all data fields properly during upload for clean records.

Step 8: Set Up Notifications & Reminders

Stay in the loop with real-time alerts for key actions:

- New lead added

- Appointment booked

- Loan stage moved

- Task completed

Customize notifications via email, SMS, or in-app alerts to stay informed without micromanaging.

✅ What You’ll Love:

- A branded, professional dashboard that reflects your mortgage business

- Full control over emails, texts, and appointments

- A CRM tailored specifically to your loan process and workflow

- The ability to grow your team and manage everyone in one place

- Simple setup with big long-term payoff

Once your setup is complete, you’ll be ready to start generating high-quality mortgage leads and nurturing them through to closing – all inside GoHighLevel.

Building a Mortgage-Focused CRM That Works

At the heart of every successful mortgage business is an organized CRM (Customer Relationship Management) system.

With GoHighLevel, you don’t just track contacts – you manage relationships, conversations, and loan progress all in one place.

Let’s build a CRM that works for your day-to-day mortgage operations. 👇

📌 Step 1: Define Your Contact Segments

Start by organizing your leads and clients into categories. This helps you filter, follow up, and automate with precision.

Common segments for mortgage brokers:

- New Leads

- Pre-Qualified Borrowers

- Realtor or Referral Partners

- Past Clients

- Refinance Prospects

- First-Time Buyers

- Credit Repair Needed

👉 Use tags in GoHighLevel to assign these identifiers to each contact.

🧩 Step 2: Customize CRM Fields for Mortgage Info

Go beyond basic name and email. You’ll want to capture details specific to lending.

Create custom fields for:

- Loan type (Purchase, Refi, FHA, VA, etc.)

- Desired loan amount

- Estimated credit score

- Down payment amount

- Employment status

- Lead source (Zillow, Realtor, Ad, Referral, etc.)

➡️ These fields allow for smarter filtering, automation, and follow-up tailored to each client’s needs.

🔄 Step 3: Use Pipelines to Track Loan Progress

Create a visual pipeline that mirrors your loan process from lead to close. This gives you a real-time view of where each client stands.

Example stages for a loan pipeline:

- New Lead

- Initial Contact Made

- Application Sent

- Docs Received

- In Underwriting

- Conditional Approval

- Clear to Close

- Funded / Closed

🧠 You can even create separate pipelines for different loan types or referral sources (e.g., purchase vs. refi, or internal vs. partner leads).

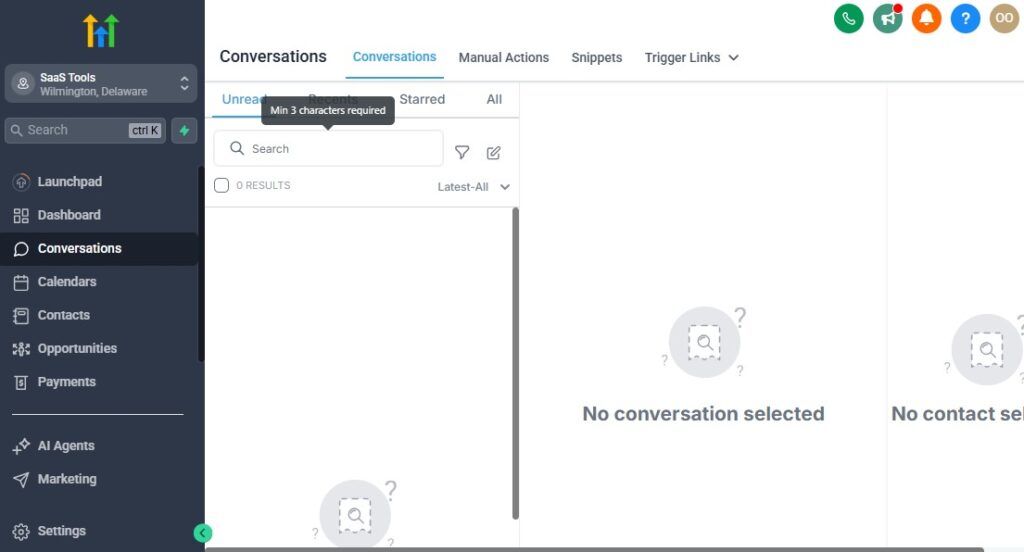

📬 Step 4: Centralize Communication

GoHighLevel automatically logs all communications – texts, emails, calls, and notes – right on the contact’s profile.

That means:

- You can easily pick up where you left off.

- Team members stay in sync on every deal.

- No more digging through email threads or apps.

💬 Plus, with two-way texting and email built in, you can message leads directly from the CRM.

⏱️ Step 5: Set Tasks & Reminders

Each lead and client can have custom tasks or follow-up reminders. This helps you stay on top of critical dates like:

- Sending a pre-approval letter

- Following up on missing documents

- Checking in post-close

- Asking for a review

You can assign these tasks to yourself or team members, and get notified so nothing slips through the cracks.

🧠 Step 6: Use Smart Lists to Stay Organized

Smart Lists in GoHighLevel let you filter contacts by any field or behavior.

Examples you’ll love:

- All “Application Sent” leads who haven’t submitted docs

- Everyone with “Credit Score < 600”

- Contacts tagged as “Referral Partner” with no communication in 30 days

- Past clients who closed 12 months ago (perfect for check-ins or refi offers)

This is where your CRM becomes a powerful tool for action, not just storage.

✅ What You’ll Love:

- A CRM that speaks your language as a mortgage professional

- No more spreadsheets or disconnected tools

- Every lead, loan, and message in one easy-to-use dashboard

- More time for closings, less time on busywork

When your CRM is set up right, everything else becomes easier – follow-ups, automations, partner management, and scaling your mortgage business.

Lead Generation Funnels for Loan Inquiries

To grow your mortgage business, you need a consistent flow of qualified leads.

That’s where GoHighLevel’s funnels come in – they let you create streamlined, conversion-focused landing pages that capture loan inquiries 24/7.

In this section, you’ll learn how to build simple, effective funnels that turn traffic into pre-qualified prospects. Let’s walk through it step-by-step.

🧲 Step 1: Understand the Funnel Strategy

A lead funnel is a mini website designed for one thing: getting someone to submit their info.

Your funnel typically includes:

- A landing page with a compelling headline and call to action

- A short form that collects key borrower details

- A thank-you page that confirms the submission and sets next steps

✅ Funnels work great for home buyers, refinancers, self-employed borrowers, or niche offers like “0% Down” or “First-Time Buyer Programs.”

🏗️ Step 2: Create a Simple Funnel in GoHighLevel

Go to Sites → Funnels in your GoHighLevel dashboard and start a new funnel. Use a pre-built template or start from scratch.

Page 1: Loan Program Landing Page

Headline: “Find Out What You Qualify For — In Under 60 Seconds”

Subheadline: “Get pre-qualified for your ideal home loan with no credit impact.”

Add a clear form asking for:

- Full Name

- Phone Number

- Email Address

- Loan Type (Purchase, Refi, etc.)

- Property Zip Code

- Credit Score Range

Page 2: Thank You Page

- Message: “Thanks! We’ve received your request. A licensed loan advisor will reach out shortly.”

- Add a calendar widget for scheduling a free consultation

📆 Pro Tip: Use the thank-you page to instantly convert a lead into a booked call.

🧪 Step 3: A/B Test Your Messaging

Small changes in your funnel’s messaging can lead to big results. Try running A/B tests with:

- Different headlines (e.g., “Find Your Best Loan Option” vs. “Get Pre-Qualified Now”)

- Button colors

- Form length (longer forms = more qualified leads, shorter = more volume)

Let your audience guide what works best.

📤 Step 4: Connect Your Funnel to Your CRM & Automations

Every submission should automatically:

- Be added as a new lead in your pipeline

- Trigger a welcome email or SMS

- Schedule a follow-up task or assign to a team member

- Start a follow-up sequence (which we’ll cover in the next section)

GoHighLevel makes this seamless with workflows and automations.

💡 Funnel Ideas Mortgage Brokers Will Love

- First-Time Buyer Quiz Funnel

→ Educate, qualify, and capture leads all in one place. - Free Mortgage Consultation Funnel

→ Great for running Facebook or Google Ads to generate warm conversations. - Refinance Savings Calculator Funnel

→ Attract homeowners looking to lower their monthly payments. - Credit Score Check Funnel

→ Capture early-stage buyers needing guidance before they qualify.

✅ What You’ll Love:

- High-converting, mobile-friendly lead pages

- Easy integration with your CRM and calendar

- Endless ways to generate leads for different loan programs

- Works whether you get traffic from ads, partners, or SEO

Now that you’re collecting leads 24/7, it’s time to automate the follow-up and convert more of them into closings.

Automating Follow-Ups & Lead Nurturing

Most mortgage leads don’t convert right away. Some are still shopping around, others need to fix their credit or wait for the right time.

The key? Stay top-of-mind without spending all day following up manually.

GoHighLevel makes it easy to automate your follow-ups so no lead slips through the cracks – and you stay in front of borrowers at every stage.

🕒 Step 1: Speed-to-Lead Follow-Up (First 5 Minutes)

When a new lead submits your funnel form, the first few minutes are critical. You want to:

- Acknowledge their request

- Set clear expectations

- Invite them to book a call or apply online

Use GoHighLevel Workflows to automate:

- 📧 A welcome email (“Thanks for reaching out!”)

- 📱 An SMS reply (“Hey [First Name], I got your request — want to book a quick call?”)

- 📆 A link to your calendar to book a consultation

This makes your business feel responsive and trustworthy right away.

💬 Step 2: Automated Nurture Sequences

Some leads need time. Create email/SMS nurture campaigns based on their situation or loan type.

Examples:

- 🏡 Homebuyer Sequence: Send educational tips on the buying process, pre-approval steps, and down payment options.

- 🔁 Refi Sequence: Share info on rates, how refi works, and common savings scenarios.

- 💳 Credit Repair Nurture: Provide helpful resources and invite them to check back when they’re ready.

✅ Send 2–3 emails per week for the first 2 weeks, then 1x/week after that. Keep it helpful, not salesy.

🎯 Step 3: Smart Follow-Up Based on Engagement

GoHighLevel lets you automate actions based on how your leads behave.

Examples:

- Opened your email but didn’t book? → Send reminder to schedule a call

- Clicked “Get Pre-Approved” but didn’t finish? → Send follow-up with a quick-start form

- Didn’t respond for 30 days? → Move them to a long-term nurture list

Use Workflows to set this up once and let GoHighLevel handle the rest.

🔁 Step 4: Re-Engage Old Leads

Your CRM is probably full of cold or inactive leads. Reignite conversations with a win-back campaign.

Try:

- “Still in the market for a home?”

- “Rates have dropped — want to run the numbers again?”

- “Can I still help with your mortgage plans?”

✅ Add a CTA to book a quick call or get pre-qualified again.

🧠 Step 5: Use Workflows to Stay Consistent

Set up Workflows in GoHighLevel to:

- Automatically assign leads to the right pipeline or user

- Send timed emails and texts

- Trigger alerts when someone replies or books

- Move leads between stages based on activity

💡 Think of Workflows as your virtual assistant that follows up, educates, and books appointments 24/7.

✅ What You’ll Love:

- Instant follow-up with every lead – no manual effort

- Smart nurture campaigns that educate and build trust

- Reactivation of cold leads without cold calling

- More deals closed from leads you already paid to generate

Once your follow-up game is automated, you can focus on what matters most – closing deals.

Booking & Scheduling Property Tours

When a borrower is actively home shopping, speed and organization matter.

Whether you’re helping directly or coordinating with a realtor partner, GoHighLevel makes it easy to schedule tours, sync calendars, and keep communication flowing.

📍 Step 1: Use a Booking Calendar for Tour Requests

In GoHighLevel, you can create custom booking calendars for property tours or consultations.

Here’s how:

Go to Calendars → New Calendar

Set availability based on your (or your agent’s) schedule

Create booking form fields like:

- Preferred date & time

- Property address or MLS number

- Buyer’s loan status (Pre-approved, In Process, etc.)

Embed the calendar link in emails, texts, or a thank-you page

🧠 You can even create multiple calendars if you work with different agents or areas.

🔄 Step 2: Automate Confirmation & Reminders

Once a buyer schedules a tour:

- They’ll get an instant confirmation message via email and/or SMS

- You (or your partner agent) get notified automatically

- GoHighLevel logs the appointment in your contact’s activity timeline

Then set up automated reminder messages 24 hours and 1 hour before the tour to reduce no-shows.

✅ This keeps everyone aligned without back-and-forth emails or texts.

🤝 Step 3: Collaborate with Real Estate Partners

If you work with realtor partners:

- Give them access to specific pipelines or contacts

- Use shared calendars to manage showings

- Set up notifications so they’re looped in when a buyer schedules a tour

💡 Want to impress your partners? Set up a branded scheduling experience using GoHighLevel’s white-label features.

🧾 Step 4: Capture Tour Feedback

After the tour, follow up automatically with a feedback message:

Example SMS

“Hey [First Name], how did the tour go today? Ready to make an offer or still looking?”

Use the response to:

- Update the lead’s stage in your pipeline

- Trigger new follow-ups

- Keep the momentum going

This is a great way to stay connected and build trust with buyers during the house-hunting process.

✅ What You’ll Love:

- Seamless tour scheduling with real-time availability

- Fewer missed appointments thanks to automated reminders

- A smoother process for buyers, agents, and your lending team

- Stronger relationships with real estate partners

GoHighLevel makes it easy to manage appointments and communication, so your buyers feel taken care of and your deals stay on track.

Loan Process Automation – GoHighLevel for Mortgage Brokers

Once a lead is ready to move forward, your job shifts from attracting them to guiding them through the loan process efficiently.

This is where automation really shines.

From document requests to milestone updates, GoHighLevel helps you move borrowers through the pipeline with confidence – and without the constant follow-up.

🧭 Step 1: Build Your Loan Pipeline Stages

First, map out your core loan process stages inside your Opportunities Pipeline in GoHighLevel.

Example stages:

- Application Sent

- Application Submitted

- Pre-Approval In Review

- Pre-Approved

- Processing

- Underwriting

- Clear to Close

- Closed

You can customize this to match your workflow. Each stage lets you track progress at a glance and trigger automated actions when a deal moves forward.

🔄 Step 2: Automate Borrower Communication at Each Stage

For every pipeline stage, set up automated messages so your clients stay informed and confident.

Examples:

- ✅ “We received your application – thank you! We’ll begin reviewing and reach out within 24 hours.”

- 📁 “Next step: Please upload your income and ID documents using this secure link.”

- 🏡 “You’ve been pre-approved! 🎉 Let’s talk about next steps for your home search.”

Use Workflows to automatically send:

- Email and SMS updates

- Document request links

- Personalized messages based on loan type

💡 This keeps your pipeline moving without overwhelming your team.

📂 Step 3: Automate Document Collection & Reminders

Tired of chasing documents? Create a Document Upload Reminder Workflow for borrowers.

It could include:

- A secure upload link

- A checklist of required items (W-2s, pay stubs, IDs, etc.)

- Automatic reminders every 2 days until completed

You can stop the reminders once the contact tag changes (e.g., “Docs-Received”).

📌 Bonus Tip: Use GoHighLevel’s custom forms to pre-screen borrowers or collect missing info.

📅 Step 4: Internal Alerts & Team Notifications

As borrowers move through the loan process, GoHighLevel can also:

- Notify your loan processor when a file is ready

- Alert your underwriter when all docs are in

- Assign tasks or notes to different team members

This removes bottlenecks and ensures everyone stays in sync.

🎯 Step 5: Closing & Post-Close Follow-Up

Once the loan is funded:

- Move the deal to “Closed” in your pipeline

- Trigger a post-close thank-you email or text

- Start a referral and retention campaign automatically

Example:

“Congrats on your new home, [First Name]! 🎉 It was an honor helping you. Let us know if we can support any friends or family looking to buy.”

🧠 This builds long-term loyalty and drives future business.

✅ What You’ll Love:

- Less back-and-forth with borrowers

- No missed updates or dropped leads

- A more professional, organized loan process

- Happier clients (and less stress for you!)

When you automate the loan process, you don’t just save time – you create a better experience that turns clients into fans.

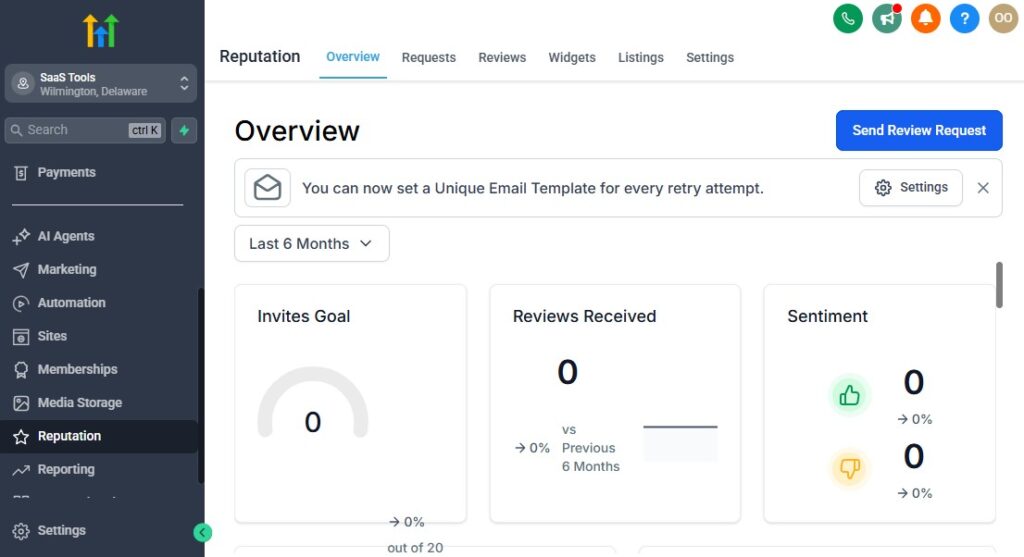

GoHighLevel for Mortgage Brokers – Reputation & Referral Automation

Referrals and reviews are the lifeblood of a successful mortgage business.

They build trust, boost conversion rates, and help you stand out in a competitive market.

But most brokers leave these to chance. Not you.

With GoHighLevel, you can automate the process of collecting 5-star reviews and asking for referrals at the right time, every time.

⭐ Step 1: Automate Review Requests Post-Closing

The best time to ask for a review? Right after the deal closes and your client is still feeling excited and grateful.

Set up a Workflow that triggers when an opportunity moves to “Closed.” Your automation should include:

- 🎉 A warm “Congrats on your new home!” message

- ⭐ A link to leave a Google or Zillow review

- 😊 A short message like: “It was a pleasure helping you with your mortgage, [First Name]. If you had a great experience, we’d truly appreciate a quick review here [link]. It really helps us grow!”

💡 Pro tip: Use GoHighLevel’s review funnel pages to direct clients to your preferred platforms and filter out negative reviews.

📣 Step 2: Ask for Referrals (Without Being Pushy)

Your clients likely know others who could use your help. So why not make it easy for them to refer?

After the review request, add a follow-up email or SMS a few days later:

“Know anyone else looking to buy or refinance? I’d love to help them too. You can share this link to get them started.”

This could link to:

- A simple referral form

- Your consultation booking page

- A dedicated landing page with a referral offer

✅ Make it feel helpful, not salesy. You’re just keeping the door open.

🔁 Step 3: Add Past Clients to a Referral & Nurture Campaign

Don’t let relationships go cold.

Stay top of mind with:

- Monthly mortgage tips or rate updates

- Homeownership resources

- Occasional referral reminders (“We love helping friends of clients like you!”)

This keeps your network active and more likely to send people your way.

📬 Use GoHighLevel’s Email Campaigns or a long-term Workflow for this.

🛠 Step 4: Track Referrals Inside Your CRM

When someone refers a new lead, tag that lead as Referral, and note the referring client in your CRM.

You can even automate:

- A thank-you note to the referrer

- A small gift or card (if that’s part of your strategy)

- Referral tracking for future follow-up

📌 Tracking helps you reward loyalty and spot your biggest promoters.

✅ What You’ll Love:

- A hands-free system to request reviews and referrals

- Higher response rates with perfectly timed messages

- Consistent visibility on Google, Zillow, Facebook, and more

- A growing list of happy clients who actively promote your business

When you automate reputation and referral requests, you build trust at scale – and grow your business with the best kind of leads: warm introductions.

Client Communication & Document Collection

Mortgage brokers often juggle many clients at once, and efficient communication is key to staying organized and ensuring nothing falls through the cracks.

GoHighLevel makes this process easier by automating your client communication and simplifying document collection.

💬 Step 1: Centralized Client Communication

Rather than using a mix of emails, texts, and phone calls, GoHighLevel gives you a single platform to communicate with clients across multiple channels.

Here’s how you can keep it all in one place:

SMS and Email Templates: Save and reuse frequently used messages. For example:

- “We received your application, here’s the next step”

- “Reminder: Please upload your documents by [Date]”

Unified Inbox: Manage all messages in one place, so you’re not bouncing between apps.

Automated Alerts: Set up notifications for missed messages or when a new message arrives.

This way, you can respond quickly and never miss an opportunity to provide helpful information.

📂 Step 2: Secure Document Upload and Collection

Clients will need to submit documents at various stages of the loan process, like proof of income, tax returns, IDs, etc.

GoHighLevel simplifies this by offering secure document upload links that you can send to clients at the right time.

How to set it up:

- Create a custom document request page (with GoHighLevel’s form builder)

- Add fields for each document you need (e.g., W-2, bank statements, etc.)

- Send clients a link to the page via SMS or email when you need those documents.

📌 Tip: You can even personalize the request with a friendly note. Example:

“Hey [First Name], to get your pre-approval finalized, I’ll need the following documents. Please upload them here: [link]. Thanks!”

🔔 Step 3: Automated Document Reminders

We’ve all been there – chasing clients for documents. With GoHighLevel, you can automate reminders to ensure clients submit everything on time.

Workflow Example:

- Day 1: Send an email with document request link

- Day 3: Reminder SMS: “Don’t forget to upload your documents to keep things moving!”

- Day 7: Final reminder with urgency: “Only [x] days left to submit your documents for processing!”

You can set the timing and content of these reminders based on client behavior (e.g., how many days since the initial request).

🔑 Step 4: Client Milestone Notifications

As clients move through the loan process, it’s crucial to keep them informed. Use GoHighLevel Workflows to send milestone updates automatically:

Examples of Milestone Updates:

- Application Received: “We’ve received your application, and we’re starting the review process.”

- Pre-Approval: “You’ve been pre-approved! 🎉 Here are your next steps.”

- Processing Complete: “We’ve completed processing, your file is now with underwriting.”

These updates help clients feel confident and informed every step of the way.

🧠 Step 5: Use Tasks for Internal Follow-Ups

While your clients get automated reminders, your internal team will also need to stay on track.

GoHighLevel’s task management system lets you assign tasks such as:

- Review client documents

- Call to discuss loan terms

- Confirm pre-approval status

This way, nothing falls through the cracks, and your team stays organized.

✅ What You’ll Love:

- No more juggling multiple communication channels

- Simplified document collection with secure links

- Less manual follow-up with automated reminders

- Clear, professional updates for your clients

GoHighLevel helps keep your communication and document collection process smooth, efficient, and professional. This not only saves you time but also enhances the client experience, making them feel cared for and confident in your services.

Learn More:

- What is GoHighLevel? (Features, Use Cases, Pricing & More)

- GoHighLevel Review: (My Experience After 5 Years)

- GoHighLevel Pricing: (+ Discount Codes)

- GoHighLevel Features: (Full List of Tools)

- GoHighLevel Onboarding Checklist: (Complete Tutorial)

- GoHighLevel for Property Management: (Detailed Tutorial)

- GoHighLevel for Real Estate Agents: (Detailed Tutorial)

- GoHighLevel for Realtors: (Detailed Tutorial)

- GoHighLevel for Real Estate Investors: (Detailed Tutorial)

- GoHighLevel for Small Businesses: (2026 Helpful Tutorial)

- GoHighLevel for Service Businesses: (2026 Helpful Tutorial)

- GoHighLevel for Local Businesses: (2026 Helpful Tutorial)

Reporting, Analytics & Conversion Tracking

To make data-driven decisions, you need to measure what matters.

GoHighLevel’s reporting and analytics tools allow you to track leads, conversions, and pipeline performance, giving you clarity on your business’s health and areas for growth.

📈 Step 1: Monitor Lead Source Performance

With GoHighLevel, you can track where your leads are coming from.

Whether they’re from your website, social media, paid ads, or referrals, this visibility allows you to allocate resources effectively.

Here’s how to set it up:

- Create custom tags for different lead sources (e.g., “Google Ads,” “Referrals,” “Facebook”)

- Track lead progression in your CRM by filtering leads by source

- Measure the conversion rate of each lead source

📌 This way, you’ll know which marketing efforts are bringing in the best leads.

📊 Step 2: Track Conversion Rates & Pipeline Progress

Use GoHighLevel’s pipeline analytics to monitor how your leads are progressing through your mortgage funnel. This lets you see where deals get stuck or fall off.

Here’s what to focus on:

- Conversion rate from lead to application

- Application to pre-approval conversion rate

- Pre-approval to closing rate

- The average time each deal spends in each stage of the pipeline

This helps you spot bottlenecks and understand where to optimize.

🧑💼 Step 3: Team Performance Tracking

It’s also important to know how well your team is doing. GoHighLevel allows you to:

- Set individual user goals for lead follow-ups, loan applications, and more

- Track the activity level of each team member (calls, emails, meetings)

- Evaluate the conversion rates associated with specific team members

This helps you optimize team performance and understand where additional training or support might be needed.

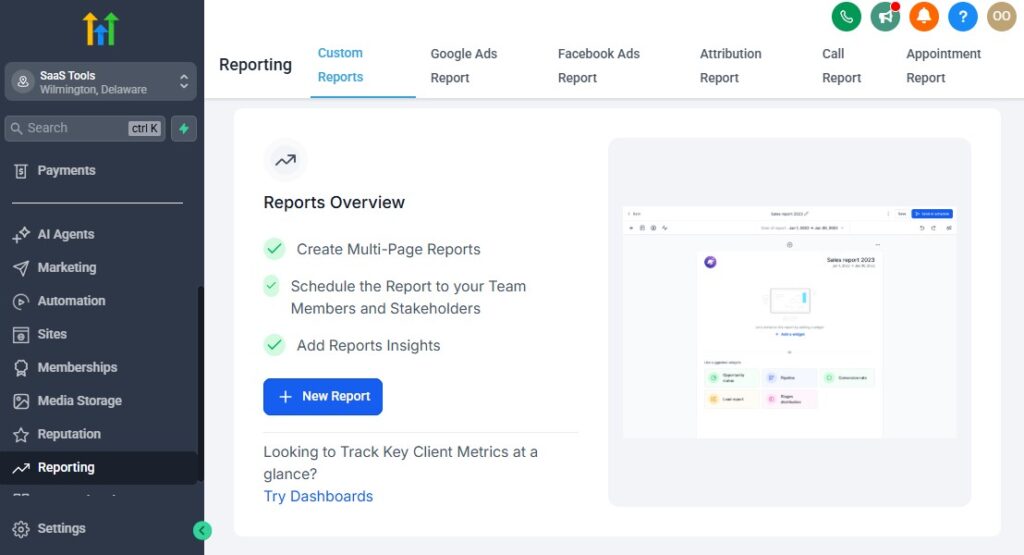

🎯 Step 4: Custom Reporting & KPI Dashboards

GoHighLevel’s reporting tools allow you to create custom dashboards and reports for deeper insights. For example:

- Lead-to-close ratio

- Monthly revenue generated from closed deals

- Lead response time

- Cost per lead (CPL)

These reports are fully customizable, so you can pull the exact data you need, whenever you need it.

📈 Pro Tip: Use GoHighLevel’s Custom Fields to track additional information specific to your business (e.g., loan amount, loan type, or client credit score).

🔄 Step 5: Track Marketing ROI – GoHighLevel for Mortgage Brokers

If you’re running paid ads (Google Ads, Facebook Ads, etc.), you’ll want to track your Return on Investment (ROI). GoHighLevel integrates with your ad platforms, letting you:

- Track conversions directly from your ads

- Measure Cost per Acquisition (CPA)

- Calculate Total ROI based on the leads generated and deals closed

This helps you understand which marketing channels are most profitable and worth your investment.

✅ What You’ll Love:

- Clear insights into where your leads come from and which marketing channels work

- Real-time data on pipeline health and deal progression

- Performance metrics for both your team and individual agents

- Customizable reporting that aligns with your business needs

- Easy tracking of marketing ROI and ad performance

By tracking key metrics and analyzing data in real time, you can continuously optimize your efforts, boost conversions, and ensure your mortgage business remains profitable and efficient.

White-Labeling & Scaling Your Mortgage Business

When you’re looking to scale your mortgage business, white-labeling can be a powerful way to establish your own brand identity while providing clients with top-notch service.

GoHighLevel makes it easy to offer a branded experience and streamline operations, even as your client base and team grow.

🌟 Step 1: White-Label Your GoHighLevel Account

First, let’s start with the basics: White-labeling GoHighLevel allows you to present a professional, custom-branded portal for your clients.

Here’s how:

- Branding Your Client Portal: You can upload your logo, choose your brand colors, and customize the interface so clients see your brand, not GoHighLevel’s.

- Custom Domains: Instead of using the default GoHighLevel domain, you can set up your own custom domain (e.g., yourmortgagecompany.com) for a more professional, branded experience.

- Email and SMS Branding: Ensure all communications from GoHighLevel, including email templates and SMS reminders, carry your business branding.

Why it matters: It enhances your professionalism and gives clients a seamless experience while using your services. Plus, you’re not relying on GoHighLevel’s brand, which boosts your authority.

📈 Step 2: Scaling Your Mortgage Business with Automation

Scaling your business means managing more clients, leads, and team members without overwhelming yourself.

GoHighLevel’s automation features allow you to grow without the growing pains.

Here’s how:

- Automated Workflows for Lead Handling: Set up workflows that automatically process new leads and move them through the stages of the loan pipeline.

- Task Automation for Your Team: Assign tasks and reminders automatically, making sure your team follows up with clients on time.

- Email & SMS Nurture Sequences: Keep clients engaged through drip campaigns that send timely follow-up messages, even if you’re managing hundreds of leads.

- Customer Onboarding Automation: Streamline your client onboarding with automated emails, document collection reminders, and welcome messages.

🏢 Step 3: Build a Scalable Team Structure

As your business grows, you’ll likely need a team to help manage the increasing client base.

GoHighLevel can help you scale your team effectively with these features:

- Multi-User Access: Assign specific roles and permissions to different team members (loan officers, underwriters, assistants), ensuring everyone has the tools they need and nothing more.

- Team Performance Tracking: Use GoHighLevel’s reporting to track individual and team performance, measuring important KPIs like lead conversion rate, response time, and closed deals.

- Automated Client Assignment: When a new lead enters the pipeline, GoHighLevel can automatically assign it to the appropriate team member based on predefined rules (e.g., location, loan type, etc.).

💡 Step 4: Expanding to Multiple Locations or Markets

If you plan to expand to multiple markets or locations, GoHighLevel can help you manage everything in one place. Here’s how to handle scaling across regions:

- Create Custom Pipelines for Each Location: You can create separate pipelines for each location or market, so each team is working with a focused lead group.

- Custom Campaigns for Specific Locations: Set up marketing campaigns tailored to the needs of each market, whether you’re running Facebook ads or email campaigns.

- Multi-Location Dashboards: View the performance of all your locations in a single, consolidated dashboard to track overall business growth.

📊 Step 5: White-Label Client Forms and Portals

To provide your clients with a branded experience throughout their journey, create white-labeled forms and client portals:

- Custom Application Forms: Use GoHighLevel’s form builder to create branded loan application forms that integrate directly with your CRM.

- Secure Document Upload Portals: Allow clients to upload necessary documents securely through a branded portal with your company’s logo and color scheme.

- Client Dashboards: Provide your clients with a personal dashboard where they can track their loan status, review documents, and communicate with your team.

✅ What You’ll Love:

- Professional, branded experience for clients

- Seamless scaling without the added workload

- Ability to expand to new locations and manage everything in one place

- Clear team management tools to track performance

- Fully white-labeled portals, forms, and communications for a custom experience

GoHighLevel helps you provide a top-tier service and makes it easier to scale your mortgage business effectively.

Frequently Asked Questions

FAQs about GoHighLevel for Mortgage Brokers.

Can GoHighLevel manage my entire mortgage pipeline?

Yes. You can build custom pipelines for:

- New lead

- Pre-qualification

- Pre-approval

- Application submitted

- Underwriting

- Conditions

- Clear to close

- Closed

Each stage is fully trackable, automated, and tied to communication workflows.

Does GoHighLevel integrate with mortgage tools like LOS platforms?

Yes. You can integrate LOS tools (e.g., Encompass, Calyx, LendingPad) through:

- Zapier

- Make (Integromat)

- Webhooks

- API connections

You can automate status updates and document transfers.

Can I automate document requests and reminders?

Absolutely. You can send:

- Document checklists

- Secure upload links

- Missing documentation reminders

- Automated follow-ups

- Deadline alerts

This ensures borrowers submit everything on time.

Does GoHighLevel support pre-approval or rate quote funnels?

Yes. You can build funnels for:

- Instant rate quotes

- Pre-approval consultations

- First-time homebuyer guides

- Refinance offers

- Mortgage calculators

These funnels increase lead quality and boost conversion.

Can GoHighLevel handle compliance-friendly communication?

Yes. You can automate and track all communication:

- SMS

- Calls

- Voicemail drops

- Internal notes

Every message is logged for compliance and auditing.

Does GoHighLevel help with referral partner management?

Yes. You can set up:

- Referral pipelines

- Automated updates for Realtors

- Joint marketing funnels

- Follow-up reminders

- Co-branded landing pages

This strengthens relationships and brings predictable leads.

Can I track where my mortgage leads come from?

Absolutely. GoHighLevel tracks:

- Facebook ads

- Google ads

- Realtors

- Email campaigns

- Landing pages

- Website forms

This tells you exactly which channels produce the most closings.

Does GoHighLevel reduce lead drop-off?

Yes. Automated SMS + email follow-up increases conversion from:

- Cold leads

- Rate shoppers

- Long-term prospects

- Old database contacts

Speed-to-lead improves dramatically with automation.

Can I use GoHighLevel if I work with a team of loan officers?

Yes. You can assign:

- Pipelines

- Calendars

- Workflows

- Tasks

- Permissions

- Team inboxes

Every team member can manage their borrowers efficiently.

Does GoHighLevel help with long-term nurturing?

Yes. You can run:

- 30-day sequences

- 90-day sequences

- 6-month nurture

- Annual refinance reminders

- Market rate update campaigns

This turns old leads into new loans consistently.

Can I automate milestone updates for borrowers?

Yes. You can create automated messages for:

- Loan submitted

- Underwriting started

- Conditions requested

- Appraisal ordered

- Clear to Close

- Closing day

- Post-closing follow-up

This gives your borrowers peace of mind and builds trust.

Is GoHighLevel suitable for both brokers and loan officers?

Yes. It works for:

- Independent brokers

- Mortgage teams

- Loan officers within a brokerage

- Multi-branch operations

You can customize it for any structure.

Final Thoughts

The mortgage business thrives on fast responses, clear communication, and consistent follow-up.

GoHighLevel gives you the tools to automate all of this, turning your mortgage workflow into a smooth, predictable system – from the moment a lead submits their information to the moment their loan closes.

By centralizing your CRM, automating lead qualification, improving borrower updates, scheduling consultations, managing documents, and nurturing long-term prospects, GoHighLevel becomes your entire mortgage operations engine.

It helps you close more loans, reduce bottlenecks, eliminate manual tasks, and provide a world-class borrower experience.

Whether you’re helping first-time homebuyers, investors, refinance clients, or working with real estate partners, GoHighLevel equips you with everything you need to scale your business confidently and deliver a service that keeps clients coming back.